Aadi Bioscience, Inc. (NASDAQ:AADI) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. For any long-term shareholders, the last month ends a year to forget by locking in a 77% share price decline.

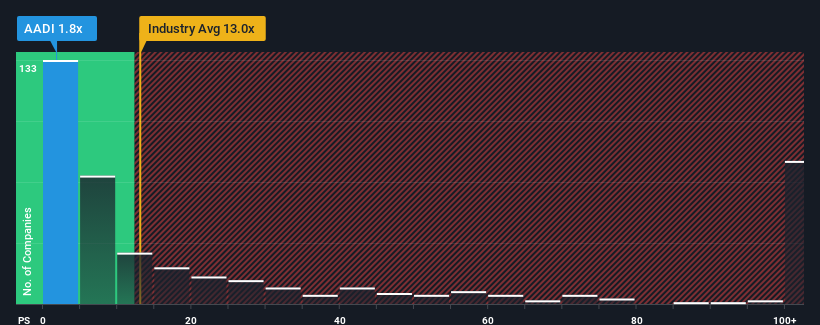

Since its price has dipped substantially, Aadi Bioscience may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.8x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 13x and even P/S higher than 59x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

How Has Aadi Bioscience Performed Recently?

Aadi Bioscience could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Aadi Bioscience's future stacks up against the industry? In that case, our free report is a great place to start.How Is Aadi Bioscience's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Aadi Bioscience's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 60% gain to the company's top line. The latest three year period has also seen an excellent 67% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 55% per annum during the coming three years according to the three analysts following the company. With the industry predicted to deliver 163% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Aadi Bioscience's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Aadi Bioscience's P/S

Having almost fallen off a cliff, Aadi Bioscience's share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Aadi Bioscience maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Aadi Bioscience that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.