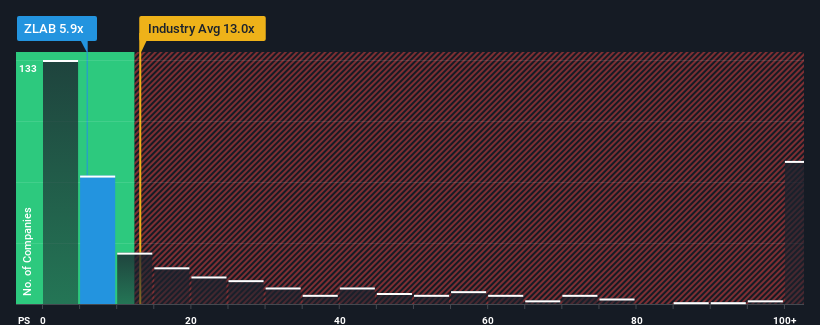

With a price-to-sales (or "P/S") ratio of 5.9x Zai Lab Limited (NASDAQ:ZLAB) may be sending very bullish signals at the moment, given that almost half of all the Biotechs companies in the United States have P/S ratios greater than 13x and even P/S higher than 59x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Has Zai Lab Performed Recently?

Recent times haven't been great for Zai Lab as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Zai Lab's future stacks up against the industry? In that case, our free report is a great place to start.How Is Zai Lab's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Zai Lab's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 53% each year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 163% each year growth forecast for the broader industry.

In light of this, it's understandable that Zai Lab's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Zai Lab's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Zai Lab's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Zai Lab with six simple checks.

If these risks are making you reconsider your opinion on Zai Lab, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.