Hong Kong equity-related ETFs rose more than 17%

1.Market Overview Review

From April 22 to April 26, A-shares fluctuated upward and returned to a high in mid-April. Risk aversion in the market further subsided, and all three indices performed well. The Shanghai Composite Index rose 0.76%, the Shenzhen Index rose 1.99%, and the GEM Index rose 3.86%.

Among the major indices, Hong Kong stocks rebounded strongly, and the Hang Seng Technology Index surged at an impressive rate of 13.43%. The Hang Seng Index also rose 8.80%. Among the A-share indices, the GEM index, which has more growth attributes, had the highest increase, reaching 3.86%. The three major US stock indexes all rebounded. The German, British, Japanese, and South Korean market indices rose, while emerging markets performed well, with MSCI rising by more than 2%.

In terms of other assets, gold and the US dollar both declined to varying degrees. Crude oil, iron ore, and coking coal continued to rise, and treasury bond futures prices were under heavy pressure.

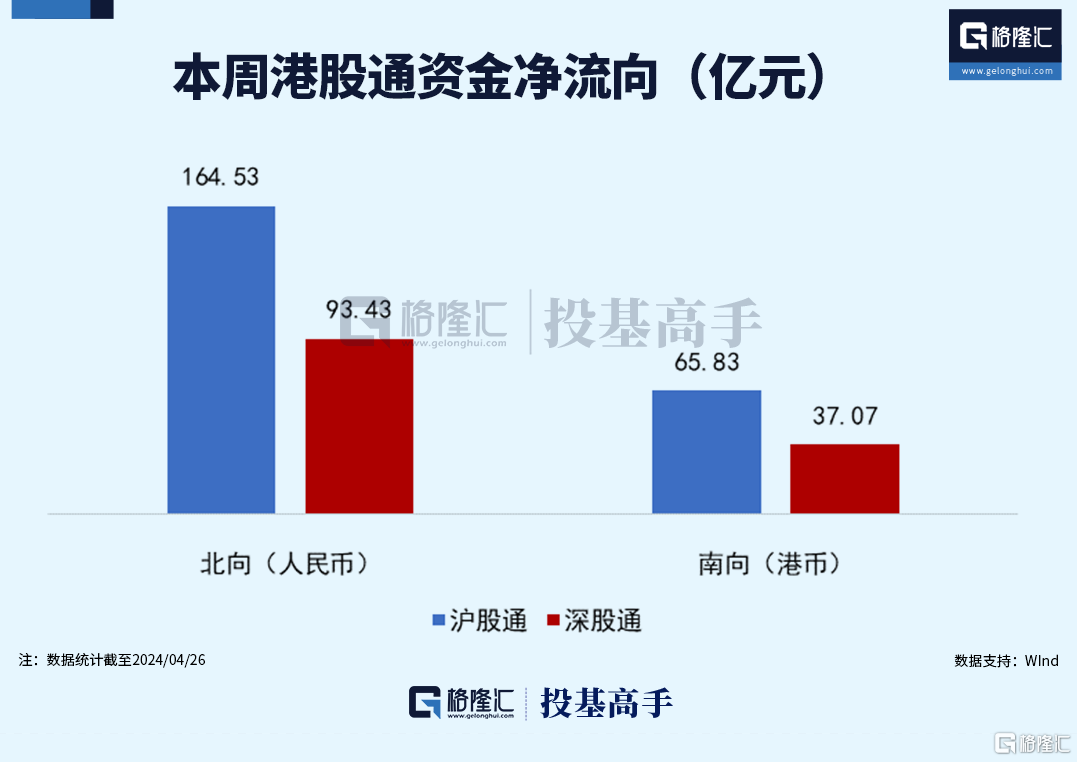

Northbound capital actively entered A-shares this week. The northbound capital inflows from Hong Kong Stock Connect and Shenzhen Stock Connect were $16.453 billion and $9.343 billion respectively. On Friday alone, the net purchase of A-shares by Beijing Capital reached 22.4 billion yuan. The net purchase amount in a single day hit a new high since the launch of Land Port Connect.

On the industry side, the average increase in Wind Level 1 was 1.01%, and the Wind 100 Concept Index increased by 81%. 68% of the sector received positive returns, with computer, non-bank finance, beauty care, electronics and communications ranking in the top five with the computer industry rising 5.78%. Traditional cyclical industries such as coal, petroleum and petrochemicals, and steel declined by 7.00%, 3.57%, and 2.64%, respectively.

2

II. Fund market performance

This week, the 2024 quarterly reports of public funds were revealed one after another. The total management scale of active equity funds reached 3.63 trillion yuan, a slight decrease compared with the end of the previous year.

Equity fund positions have declined, while partial hybrid fund positions have risen slightly. The latest share holding ratio of ordinary equity funds was 81.07%, down 4.25% from last week. The share holding ratio of partial hybrid funds was 77.03%, up 1.48% from last week.

Judging from the overall performance of the fund, Wind data shows that the Wande China Total Fund Index has a weekly return of 1.14%. The Wande Equity Fund Total Index was the highest in the overall index, at 2.23%; the Wande Hybrid Fund Total Index rose by 1.73%; and the Wande Bond Fund Index achieved negative returns this week.

From an industry perspective, among equity and hybrid funds, most of the funds with the highest yield focus on the pharmaceutical industry and the direction of innovative drugs. Specific products include Harvest Fusion Select Stock A, BOC Health A, Nuoan Select Value, BOCHK Pharma, etc.

Index funds were mainly led by Hong Kong stock funds. The weekly gains of Huaxia Fund Hang Seng Internet ETF and Wells Fargo Fund Hong Kong Stock Connect Internet ETF were 17.35% and 17.05% respectively.

In terms of fund issuance, a total of 34 funds were issued throughout the week, including 15 equity funds, 7 hybrid funds, 9 bond funds, 1 QDII fund, and 2 FOF funds, with a total issuance share of 34.197 billion shares.