Focus on solar photovoltaic modules and solar lamps

According to public information, recently, Zhejiang Gongyuan New Energy Technology Co., Ltd. (hereinafter referred to as “Gongyuan New Energy”) received a second round of review and inquiry documents for the public offering of shares and listing on the Beijing Stock Exchange. Among them, questions were raised about the stability and sustainability of business performance and the authenticity of overseas sales revenue.

According to reports, in response to the first round of inquiries, Gongyuan Xinneng already responded to questions such as the company's innovative characteristics and competitiveness, and the rationality and authenticity of the sharp increase in overseas sales. The sponsor was Zheshang Securities Co., Ltd.

Gelonghui learned that Gongyuan New Energy was founded in 2006 and its office is located in Taizhou City, Zhejiang Province. The company is mainly engaged in R&D, production and sales of solar photovoltaic series products and energy saving and environmental protection products in the field of new energy.

In terms of the shareholding structure, as of the date the prospectus was signed, Zhang Jianjun and Lu Caifen controlled a total of 71.86% of Gongyuan Xinneng's shares through their control of Gongyuan Shares and Gongyuan International Trade, and are the actual controllers of Gongyuan Xinneng.

According to the prospectus, Zhang Jianjun was born in 1961 and graduated as a graduate student. He was the director of Zhejiang Huangyan Jingjie Plastic Factory, also the chairman and general manager of Zhejiang Yonggao Plastics Industry Development Co., Ltd., and has been the chairman of Gongyuan Group since December 2002. Lu Caifen was born in 1970 and has a graduate degree. He worked as an assistant general manager at Zhejiang Yonggao Plastics Development Co., Ltd., and was also the deputy general manager of Shanghai Gongyuan Building Materials Development Co., Ltd., and has been the vice chairman and general manager of Gongyuan Group since August 2014.

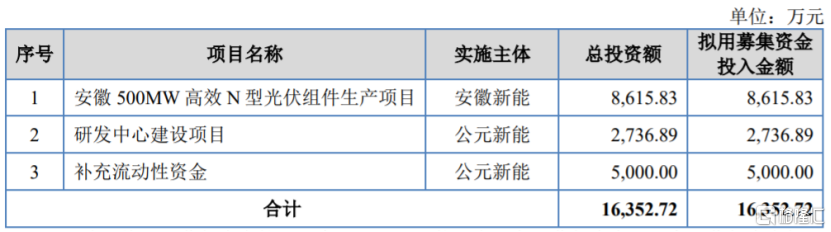

With this listing application, Gongyuan New Energy plans to raise capital for the 500MW high-efficiency N-type photovoltaic module production project in Anhui, R&D center construction projects, and supplementary liquidity.

Fundraising usage, image source: prospectus

1

Gross margin fluctuates greatly

Against the backdrop of global warming and the increasing depletion of fossil energy, vigorous development of renewable energy has become the consensus of countries around the world. Photovoltaic power generation is a technology that uses the photovoltaic effect of semiconductor interfaces to convert solar energy into electricity. In recent years, in the context of “carbon peak” and “carbon neutrality,” China's photovoltaic industry has continued to develop.

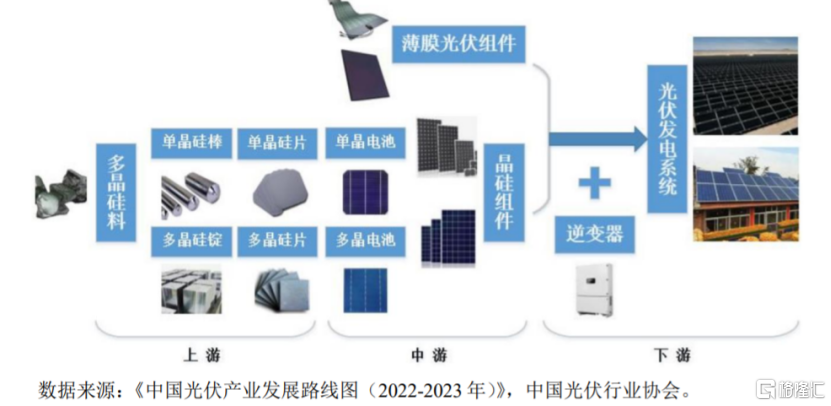

The upstream of the photovoltaic industry chain is the production of polysilicon materials, monocrystalline rods/polycrystalline ingots and slices, the midstream is the production of photovoltaic cells, packaging of photovoltaic modules, etc., and the downstream is the construction and operation of photovoltaic power generation systems such as centralized/distributed photovoltaic power plants. Gongyuan Xinneng's current business is mainly focused on the midstream photovoltaic module packaging process.

The composition of the photovoltaic industry chain, image source: prospectus

Specifically, Gongyuan New Energy's main products are solar photovoltaic modules and solar lamps. The products are mainly used in scenarios such as photovoltaic power generation, garden beautification, smart homes, road traffic, outdoor camping, and mobile energy storage.

According to responses from the first round of inquiries, from 2021 to 2023, solar photovoltaic modules with relatively low gross margin accounted for more than 60% of the revenue of the company's products, and their share showed an upward trend, and the overall revenue share of solar lamps with high gross margin declined.

Revenue amount, share and gross margin of the company's main products. Image source: Response to the first round of inquiries

From 2020 to 2022, Gongyuan Xinneng's gross margin was 11.68%, 9.41%, and 9.64%, respectively. There was some fluctuation, which was lower than the average gross margin of comparable companies.

It is worth noting that the gross margin of Gongyuan Xinneng rose sharply to 14.89% from January to June 2023, which is higher than the average gross margin of comparable companies. The company's recent gross margin rose sharply and was higher than that of comparable companies was questioned by the regulatory authorities.

Comparative analysis of gross margins of comparable companies. Image source: Prospectus

According to the prospectus, during the reporting period, Gongyuan Xinneng's material costs accounted for more than 85% of the main business costs, accounting for a relatively large share. In the future, if the prices of major raw materials such as batteries, glass, aluminum alloy frames, and batteries increase, it may raise the company's procurement costs, thereby affecting the company's gross margin and profitability.

In terms of performance, according to responses to the first round of inquiries, in 2021, 2022, and 2023, Gongyuan New Energy's operating income was about 612 million yuan, 1,029 million yuan, and 964 million yuan respectively, with corresponding net profit of about 127.777 million yuan, 33.284 million yuan, and 49.0208 million yuan, respectively.

Changes in the company's performance during the reporting period. Image source: Response to the first round of inquiries

The photovoltaic industry where Gongyuan New Energy is located is greatly affected by subsidy policy adjustments, trade frictions, and phased overcapacity. Although due to full competition and elimination in the market, backward production capacity has gradually been cleared, and the conflict between supply and demand in the market has improved, if the future is affected by industry sentiment, market competition, etc., or if vicious competition or price wars due to overcapacity occur, it may affect the company's operating performance.

2

The R&D cost rate is lower than the peer average

The photovoltaic industry is a technology-intensive and capital-intensive industry. Although the entry threshold is high, after years of rapid development, competition in the industry has become more intense. At the same time, the photovoltaic industry also has the characteristics of rapid development and rapid technology updates and iterations. If the company is unable to accurately determine technology and product development trends and grasp major alternative technologies in a timely manner, it may affect the market competitiveness of the company's products.

According to the prospectus, from 2020 to January to June 2023, Gongyuan New Energy's R&D expenses were 4.5631 million yuan, 5.6331 million yuan, 5.4412 million yuan, and 1.8435 million yuan respectively. The R&D cost rates were 1.1%, 0.92%, 0.53%, and 0.34%, respectively. The company's R&D cost ratio was significantly lower than the average of comparable companies.

The ratio of R&D investment to revenue compared to comparable companies. Image source: Prospectus

Gongyuan Xinneng's orders mainly come from overseas customers. According to the prospectus, from 2020 to January to June 2023, the company's revenue from overseas accounts for more than 90%, accounting for a relatively large share. The company's overseas customers are mainly concentrated in South America, North America, Europe and other countries and regions. Overseas business is mainly settled in US dollars and euros, and the company faces the risk of exchange rate fluctuations.

The company's main business revenue is classified according to the specific situation of sales regions. Image source: Prospectus

According to responses to the first round of inquiries, Gongyuan Xinneng's accounts receivable book balance soared from 447.08 million yuan in 2021 to 188 million yuan in 2022. The company's accounts receivable book balance in 2023 was about 158 million yuan. If the company's accounts receivable are not managed properly, there may be a risk of bad debts.

Company accounts receivable book balance, amount of overdue accounts receivable, and corresponding repayment status. Image source: Response to the first round of inquiries

3

epilogue

In recent years, although Gongyuan Xinneng's net profit has shown an upward trend, the company's revenue is more dependent on overseas customers, and gross margin has fluctuated to a certain extent. Being in the technology-intensive industry of photovoltaics, in the face of rapid technological updates and fierce competition in the industry, the company still has to continue to increase investment in R&D to enhance its competitiveness.