Century-old mining giant Anglo American Plc (Anglo American Plc), the parent company of De Beers, the world's largest diamond supplier, is facing the biggest crisis in history.

The company's Pearl in the Pocket - Diamond business is underperforming under the impact of a sharp drop in natural diamond prices. Although demand and sales prices are now showing signs of a rebound, De Beers diamond production target has been cut to 26 million to 29 million carats, lower than the previous target of 32 million carats.

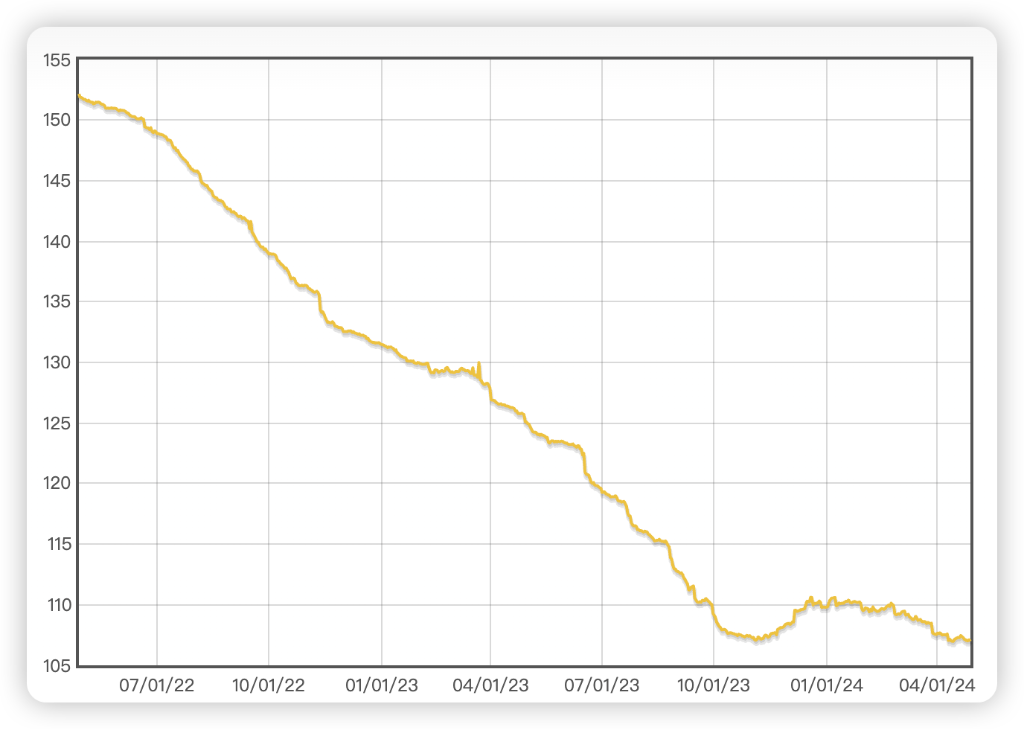

Due to setbacks in businesses such as diamonds, the stock price of Anglo-American Resources has been falling since April 2022. Rival BHP Billiton announced plans to humiliate its acquisition last week — to dismember British and American resources and select its best assets.

The takeover proposal was ultimately rejected, but the trouble with British and American resources was not over.

Cultivating diamonds from their hometown in Henan defeated international diamond giants

As shown in the chart below, the DEX diamond price index began to decline during the pandemic. Since July 2022, the decline has exceeded 30%.

Laboratory-grown diamonds are a key factor in the sharp drop in natural diamond prices. The physical and chemical properties of the two are completely consistent. Measured using the 4C standards (color, clarity, cut, carat), cultivated drills can fully meet the standards. With the naked eye alone, the difference between natural and cultured drills cannot be completely distinguished, and it is difficult for ordinary instruments to detect the difference. Generally, the price of a one-carat natural diamond is around 200,000 yuan, while the retail value of a one-carat cultured diamond is only 1/10 of that of a natural diamond.

The advent of cultivating diamonds has essentially changed the previous situation where natural diamonds were dominated by a single family, and the consumerist fantasy of “diamonds last forever, one lasts forever” has now added a cost-effective option.

The global economic downturn and high inflation after the pandemic also made consumers more cautious. Against the backdrop of a slump in the inlay jewelry market, cultured diamonds have rapidly risen in consumer markets such as the US, China, India, and Europe, and have already occupied 50% of the wedding market's sales share.

According to the “Diamond Watch” analysis, the rise of cultivating diamonds has been verified by the market in recent years, and has greatly affected the size of the consumer base of natural diamonds, and will greatly limit the potential scale in the future.

China, on the other hand, occupies a very important position in the global diamond industry chain. More specifically, it's Henan.

According to data compiled by “Eleven People in Finance”, in 2022, China contributed half of the production to the global diamond industry chain, 80% of which came from Henan. Over the past few decades, places such as Zhengzhou, Xuchang, Nanyang, and Shangqiu in Henan Province have formed an artificial diamond industry cluster integrating R&D, production and sales.

In Zhecheng County, Henan, the annual production of cultivated diamonds has reached 6 million carats; in 2021, the world produced 9 million carats of cultivated diamonds, and Zhecheng alone produced 4 million carats, making it the “capital of artificial diamonds”. Statistics from Zhengzhou Customs show that in 2023, the export value of cultivated diamonds supervised by Zhengzhou Customs reached 2.112 billion yuan, ranking first in the country.

De Beers could be sold

As the diamond mining group with the highest production value in the world, De Beers has always been a true pearl in the pocket of Anglo-American Resources Group, and has always been a key source of profit for it.

However, the sharp drop in diamond prices after the pandemic caused De Beers, which is almost the only company in the field of natural diamonds, to lose a lot. According to the Anglo-American Group's financial report, in 2023, De Beers lost 314 million US dollars, compared to a profit of 552 million US dollars in the previous year.

The sharp decline in De Beers' performance, compounded by the company's own difficulties in dealing with fluctuations in the commodity market, gave British and American Resources the idea of selling De Beers.

According to media reports, Anglo-American Resources has had conversations with potential buyers in recent weeks, including luxury goods companies and the Gulf Sovereign Wealth Fund. According to the above sources, Anglo-American Resources Group has signaled to potential acquirers that they are open to the takeover proposal.

The report said that discussions are still in the early stages, and valuation issues have not yet been discussed. The final buyer may be a combination of luxury goods companies and financial investors.