Despite an already strong run, Grand Ocean Advanced Resources Company Limited (HKG:65) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 87%.

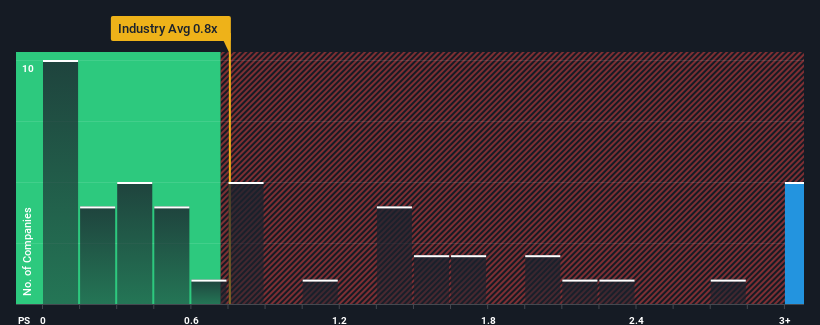

Since its price has surged higher, when almost half of the companies in Hong Kong's Oil and Gas industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider Grand Ocean Advanced Resources as a stock not worth researching with its 6.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has Grand Ocean Advanced Resources Performed Recently?

For instance, Grand Ocean Advanced Resources' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Grand Ocean Advanced Resources, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Grand Ocean Advanced Resources' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Grand Ocean Advanced Resources' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.7%. Even so, admirably revenue has lifted 41% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 2.2% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's understandable that Grand Ocean Advanced Resources' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Grand Ocean Advanced Resources' P/S

The strong share price surge has lead to Grand Ocean Advanced Resources' P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Grand Ocean Advanced Resources revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Grand Ocean Advanced Resources you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.