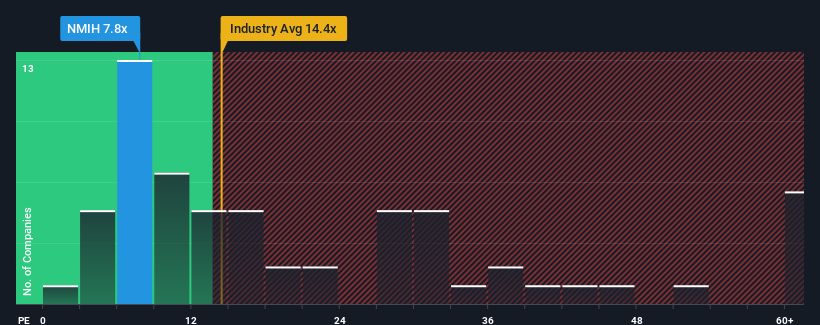

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider NMI Holdings, Inc. (NASDAQ:NMIH) as a highly attractive investment with its 7.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been pleasing for NMI Holdings as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

How Is NMI Holdings' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as NMI Holdings' is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 13%. This was backed up an excellent period prior to see EPS up by 82% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 9.3% per year as estimated by the seven analysts watching the company. With the market predicted to deliver 11% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that NMI Holdings' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On NMI Holdings' P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of NMI Holdings' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for NMI Holdings you should know about.

Of course, you might also be able to find a better stock than NMI Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.