Oil States International, Inc. (NYSE:OIS) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

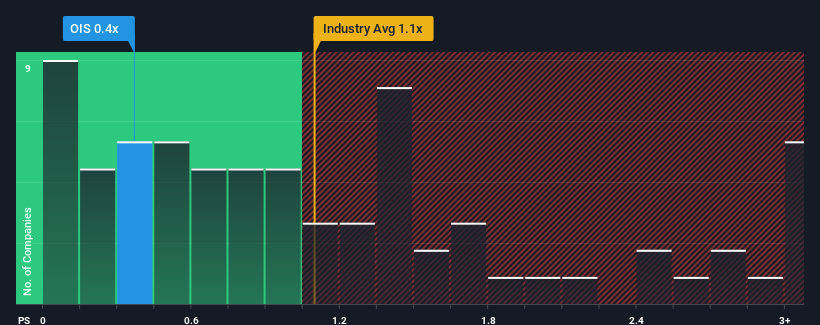

Following the heavy fall in price, considering around half the companies operating in the United States' Energy Services industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider Oil States International as an solid investment opportunity with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Oil States International's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Oil States International's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Oil States International.How Is Oil States International's Revenue Growth Trending?

In order to justify its P/S ratio, Oil States International would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 2.1% decrease to the company's top line. Even so, admirably revenue has lifted 38% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 4.7% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 8.8% per annum, which is noticeably more attractive.

In light of this, it's understandable that Oil States International's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Oil States International's P/S?

Oil States International's recently weak share price has pulled its P/S back below other Energy Services companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Oil States International maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Oil States International with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.