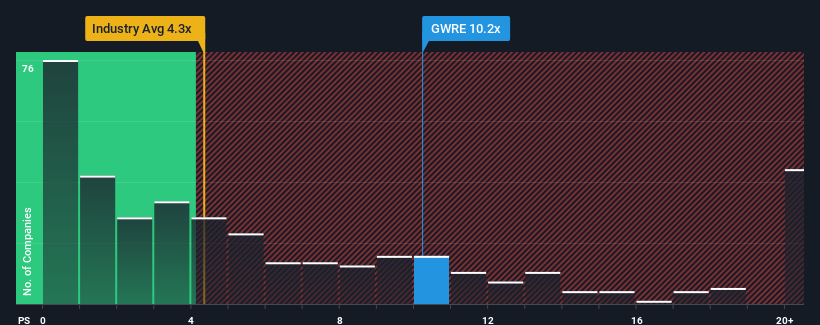

With a price-to-sales (or "P/S") ratio of 10.2x Guidewire Software, Inc. (NYSE:GWRE) may be sending very bearish signals at the moment, given that almost half of all the Software companies in the United States have P/S ratios under 4.3x and even P/S lower than 1.6x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has Guidewire Software Performed Recently?

With revenue growth that's inferior to most other companies of late, Guidewire Software has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Guidewire Software will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Guidewire Software's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.4% last year. The solid recent performance means it was also able to grow revenue by 22% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 13% per annum over the next three years. That's shaping up to be similar to the 15% per year growth forecast for the broader industry.

With this information, we find it interesting that Guidewire Software is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Guidewire Software's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Analysts are forecasting Guidewire Software's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Guidewire Software you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.