The core price index favored by the Federal Reserve rose at a brisk pace in March, heightening concerns that stubborn price pressure might delay interest rate cuts.

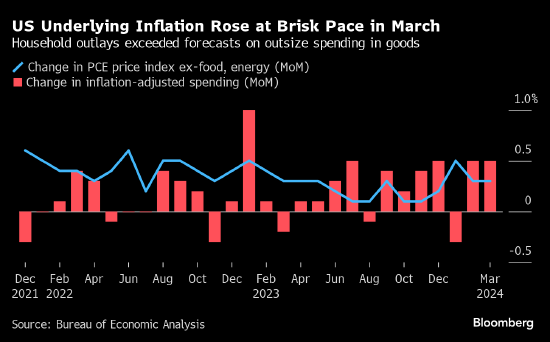

According to data released on Friday, the so-called core personal consumption expenditure price index, which excludes highly volatile food and energy, rose 0.3% month-on-month and 2.8% year-on-year.

The overall PCE price index rose 0.3% month-on-month and 2.7% year-on-year.

Inflation-adjusted consumer spending increased 0.5% month-on-month, higher than expected, and the biggest increase this year.

| metrics | actual | reckoned |

| PCE price index month-on-month | +0.3% | +0.3% |

| Core PCE price index month-on-month | +0.3% | +0.3% |

| PCE Price Index YoY | +2.7% | +2.6% |

| Core PCE Price Index YoY | +2.8% | +2.7% |

| Actual consumer spending month-on-month | +0.5% | +0.3% |

Accelerated inflation in the first quarter, combined with stable household spending, may persuade Fed policymakers to postpone interest rate cuts — if any — until later this year. Federal Reserve officials are expected to keep the benchmark interest rate unchanged at a 20-year high when they meet next week.

“Both the economy remains in good shape with high interest rates, and inflationary pressure continues,” said Bruce Kasman, chief economist at J.P. Morgan Chase. “Although I don't think it's appropriate to talk about it from the perspective of the Federal Reserve's austerity policy, it is very unlikely that the Fed will relax its policy in the short term.”

Traders mostly reacted positively, as Thursday's quarterly data suggested there was an upward risk in the March inflation data, so investors were relieved that the month-on-month inflation data was in line with expectations.

The Federal Reserve is closely watching inflation in services that do not include housing and energy, as it is often more stubborn. According to the US Bureau of Economic Analysis, the indicator rose 0.4% from February, and the growth rate was higher than the previous month.

A strong labor market is the main reason why American residents are still not putting the brakes on in the face of high interest rates and high commodity prices.

Consumer spending

Inflation-adjusted spending on personal goods rose 1.1% in March, reflecting the steady performance of durable goods spending for the second month in a row. Meanwhile, service spending increased by 0.2%.

Demand for labor remains healthy, supporting wage growth. Overall income increased by 0.5%, and wages and salaries increased by 0.7% for the second month in a row.

The savings rate fell to 3.2%, the lowest since October 2022.