Shareholders might have noticed that Citic Pacific Special Steel Group Co., Ltd (SZSE:000708) filed its quarterly result this time last week. The early response was not positive, with shares down 6.2% to CN¥15.66 in the past week. Results were roughly in line with estimates, with revenues of CN¥28b and statutory earnings per share of CN¥1.11. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

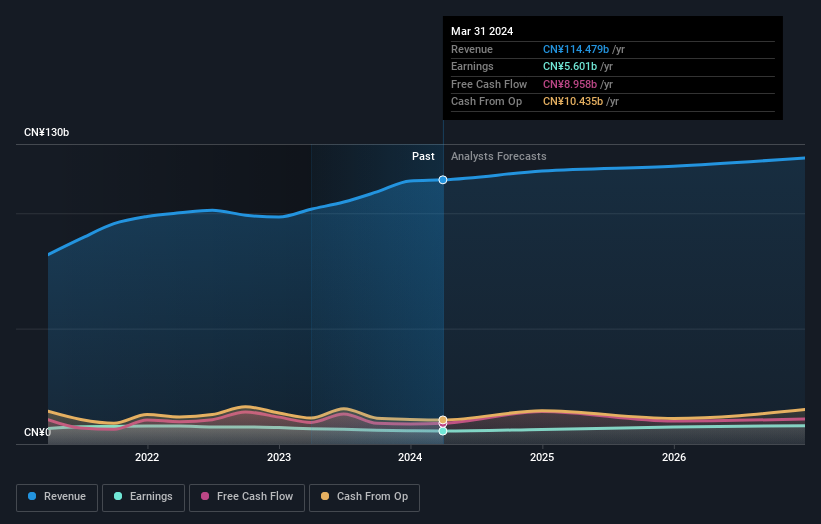

Taking into account the latest results, the most recent consensus for Citic Pacific Special Steel Group from five analysts is for revenues of CN¥118.3b in 2024. If met, it would imply a satisfactory 3.3% increase on its revenue over the past 12 months. Per-share earnings are expected to step up 13% to CN¥1.25. Yet prior to the latest earnings, the analysts had been anticipated revenues of CN¥117.2b and earnings per share (EPS) of CN¥1.26 in 2024. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

The analysts reconfirmed their price target of CN¥19.05, showing that the business is executing well and in line with expectations. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Citic Pacific Special Steel Group, with the most bullish analyst valuing it at CN¥19.46 and the most bearish at CN¥18.63 per share. This is a very narrow spread of estimates, implying either that Citic Pacific Special Steel Group is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that Citic Pacific Special Steel Group's revenue growth is expected to slow, with the forecast 4.5% annualised growth rate until the end of 2024 being well below the historical 9.6% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 9.7% per year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Citic Pacific Special Steel Group.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Citic Pacific Special Steel Group analysts - going out to 2026, and you can see them free on our platform here.

However, before you get too enthused, we've discovered 2 warning signs for Citic Pacific Special Steel Group that you should be aware of.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.