Whales with a lot of money to spend have taken a noticeably bullish stance on McDonald's.

Looking at options history for $McDonald's (MCD.US)$ we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 30% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $111,612 and 8, calls, for a total amount of $344,592.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $140.0 and $370.0 for McDonald's, spanning the last three months.

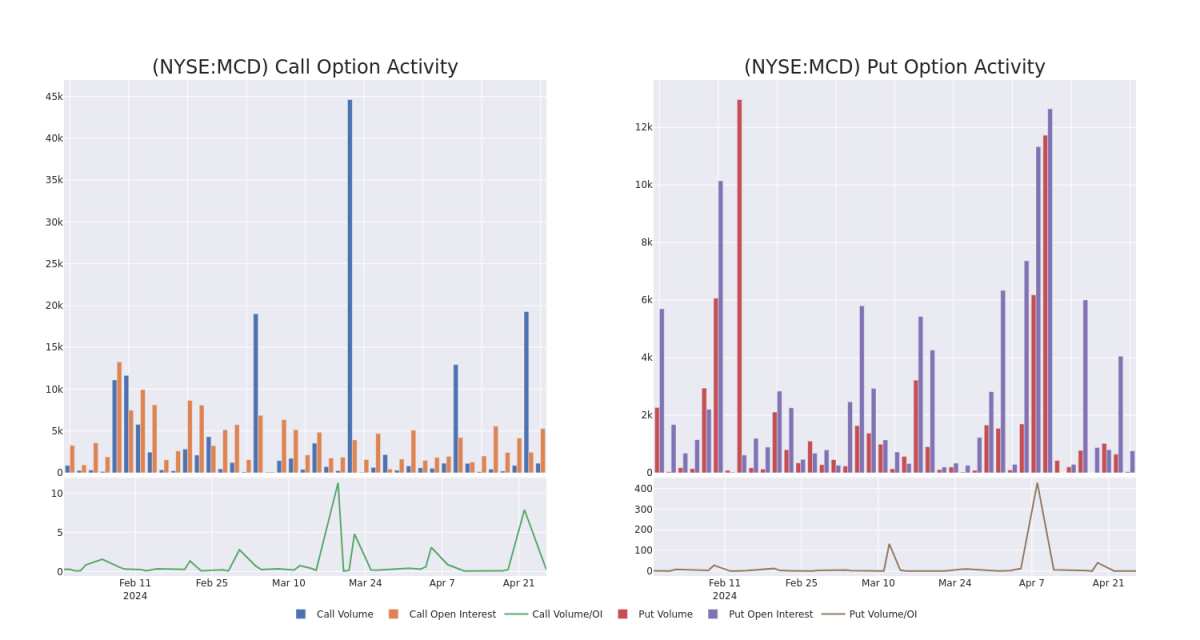

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for McDonald's's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of McDonald's's whale trades within a strike price range from $140.0 to $370.0 in the last 30 days.

McDonald's 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

MCD | CALL | SWEEP | BULLISH | 05/17/24 | $1.6 | $1.5 | $1.6 | $285.00 | $76.3K | 1.9K | 543 |

MCD | PUT | TRADE | NEUTRAL | 06/20/25 | $18.6 | $17.75 | $18.25 | $275.00 | $73.0K | 101 | 0 |

MCD | CALL | SWEEP | BEARISH | 01/16/26 | $138.5 | $134.3 | $136.0 | $140.00 | $68.0K | 8 | 0 |

MCD | CALL | SWEEP | BULLISH | 05/17/24 | $9.15 | $9.15 | $9.15 | $270.00 | $41.1K | 1.4K | 51 |

MCD | PUT | SWEEP | BEARISH | 05/17/24 | $2.96 | $2.75 | $2.75 | $270.00 | $38.6K | 663 | 39 |

About McDonald's

McDonald's is the largest restaurant owner-operator in the world, with 2023 system sales of $130 billion across nearly than 42,000 stores and 115 markets. McDonald's pioneered the franchise model, building its footprint through partnerships with independent restaurant franchisees and master franchise partners around the globe. The firm earns roughly 60% of its revenue from franchise royalty fees and lease payments, with most of the remainder coming from company-operated stores across its three core segments: the United States, internationally operated markets, and international developmental/licensed markets.

In light of the recent options history for McDonald's, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is McDonald's Standing Right Now?

Trading volume stands at 2,520,286, with MCD's price down by -1.76%, positioned at $270.75.

RSI indicators show the stock to be is currently neutral between overbought and oversold.

Earnings announcement expected in 4 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest McDonald's options trades with real-time alerts from Benzinga Pro.