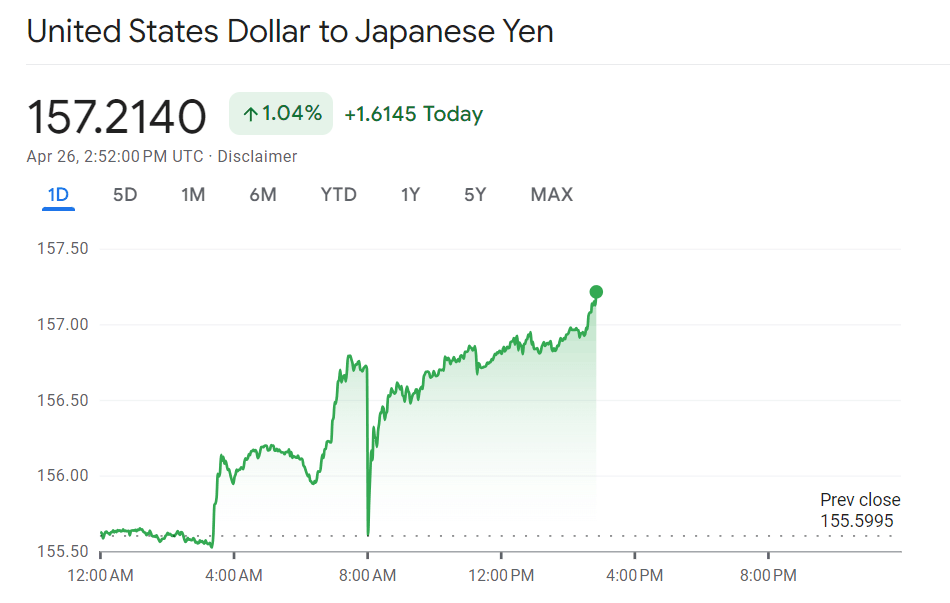

USD/JPY broke through 157 intraday, reaching the 157.40 line, and surged 1.1% during the day. This was the first time since May 10, 1990, and has risen more than 11% so far this year. The yen fell below the 156 mark against the US dollar as the Bank of Japan showed little to boost the yen. Since then, as PCE prices, the core of the US inflation data, rose 2.8% year on year in March, slightly exceeding expectations, the decline of the yen against the US dollar further increased.

On Friday night, Beijing time, the US dollar broke through 157 against the yen, reaching the 157.40 line. It surged 1.1% during the day, the first time since May 10, 1990.

EUR/JPY maintained gains of more than 0.5% and fluctuated below 168. Bank of Japan Governor Kazuo Ueda once rose to 168.35 after the press conference, approaching the phased peak of 169.96 on July 23, 2008.

The pound maintained a gain of around 0.7% against the yen, hovering above 196. The US PCE inflation index rose to 196.597 when it was released, approaching the phased peak of 200.373 on August 29, 2008, and reached 223.770 on January 1 of that year.

The yen has fallen 10% so far this year, making it the worst performer of the G10 currencies. The huge difference in interest rates caused by the monetary policies of the US and Japan is the most fundamental reason for the sharp depreciation of the yen.

During the day of Friday local time, the Bank of Japan kept interest rates unchanged as scheduled during the April interest rate meeting. It is expected that the current relaxed financial environment will continue, and the phrase “buy the same amount of bonds as before” was removed. The central bank said that it is necessary to pay attention to foreign exchange and its impact on inflation. The 2024 fiscal year price risk is trending upward. If the price trend rises, the degree of monetary easing will be adjusted.

With the Bank of Japan showing little to boost the yen, the yen fell below the 156 mark against the US dollar, hitting a 34-year low.

Since then, on Friday evening Beijing time, due to PCE prices, the core of US inflation data, rising to 2.8% year on year in March, slightly exceeding expectations, the yen's decline against the US dollar further increased, falling below the 157 mark and falling below the important mark for a day.

Recently, Japanese policy makers have repeatedly warned that if the yen depreciates too much too quickly, it will not be tolerated. Japan's Finance Minister Shunichi Suzuki reiterated after the Bank of Japan meeting that the Japanese government will respond appropriately to changes in foreign exchange.

According to an analysis of the speech to Masato Kanda, the chief monetary officer of Japan's Ministry of Finance, the market believes that the 157.60 line is a key level worth watching. The Japanese department will release intervention data for the period from March 28 to April 25 on April 30, and data including Friday will be released on May 31.

In a trilateral statement last week, the US, Japan, and South Korea said they will continue to closely discuss developments in the foreign exchange market, while acknowledging Japan and South Korea's serious concerns about the recent sharp devaluation of their currencies.

On Thursday, when asked about her views on Japan's possible measures to respond to the depreciation of the yen against the US dollar, US Treasury Secretary Yellen said that for large countries where the exchange rate is determined by the market, intervention should only occur in extremely rare cases. Judging from the mentality of the Group of Seven (G7) member countries, exchange rate adjustment in the market is one of the foundations for countries to have different policies. “We would hope this is rare, and we think this kind of intervention is only rare, only in the midst of excessive fluctuations, and they will negotiate ahead of time.”

Some analysts say that the yen is unbelievably weak; the yen has fallen too much. This level of decline is sure to raise concerns.

Charu Chanana, market strategist at Saxo Capital, said that the Bank of Japan has proven once again that its dovish attitude can surprise even Wall Street's most dovish expectations. The market is once again returning to the pattern of waiting for intervention measures to stop the yen from plummeting. But any intervention, if not coordinated and supported by hawkish policy messages, will still be futile.