Financial giants have made a conspicuous bullish move on Viking Therapeutics. Our analysis of options history for $Viking Therapeutics (VKTX.US)$ revealed 27 unusual trades.

Delving into the details, we found 48% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $142,317, and 24 were calls, valued at $1,477,692.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $115.0 for Viking Therapeutics, spanning the last three months.

Analyzing Volume & Open Interest

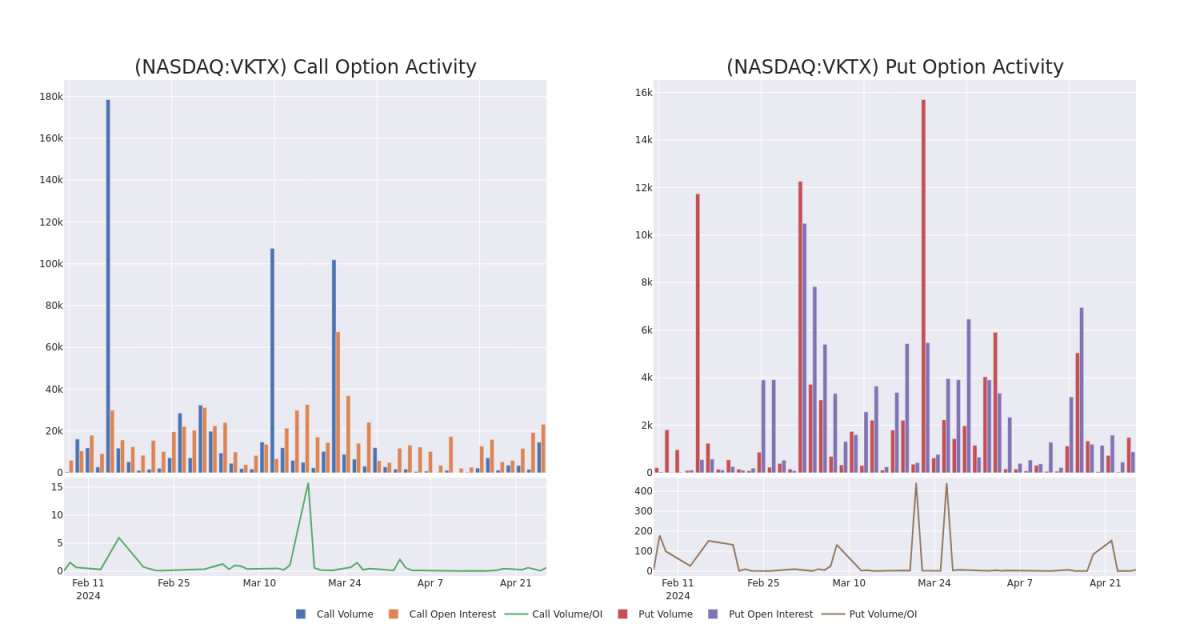

In terms of liquidity and interest, the mean open interest for Viking Therapeutics options trades today is 1418.18 with a total volume of 16,148.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Viking Therapeutics's big money trades within a strike price range of $20.0 to $115.0 over the last 30 days.

Viking Therapeutics Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

VKTX | CALL | SWEEP | BULLISH | 06/21/24 | $6.6 | $6.5 | $6.6 | $75.00 | $209.2K | 1.5K | 601 |

VKTX | CALL | SWEEP | BEARISH | 05/17/24 | $10.0 | $8.7 | $8.7 | $65.00 | $132.2K | 2.8K | 330 |

VKTX | CALL | SWEEP | BEARISH | 09/20/24 | $6.3 | $6.1 | $6.2 | $100.00 | $124.0K | 381 | 201 |

VKTX | CALL | SWEEP | BULLISH | 06/21/24 | $6.6 | $6.5 | $6.6 | $75.00 | $110.2K | 1.5K | 117 |

VKTX | CALL | SWEEP | BEARISH | 01/17/25 | $21.3 | $19.7 | $20.12 | $70.00 | $100.9K | 742 | 0 |

About Viking Therapeutics

Viking Therapeutics Inc is a healthcare service provider. The company specializes in the area of biopharmaceutical development focused on metabolic and endocrine disorders. The company's clinical program pipeline consists of VK2809, VK5211, VK0214 products. VK2809 and VK0214 are orally available, tissue and receptor-subtype selective agonists of the thyroid hormone receptor beta. VK5211 is an orally available, non-steroidal selective androgen receptor modulator.

Following our analysis of the options activities associated with Viking Therapeutics, we pivot to a closer look at the company's own performance.

Viking Therapeutics's Current Market Status

Currently trading with a volume of 2,266,930, the VKTX's price is up by 4.23%, now at $71.77.

RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

Anticipated earnings release is in 89 days.

Professional Analyst Ratings for Viking Therapeutics

In the last month, 1 experts released ratings on this stock with an average target price of $90.0.

An analyst from HC Wainwright & Co. has revised its rating downward to Buy, adjusting the price target to $90.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.