Deep-pocketed investors have adopted a bullish approach towards Palo Alto Networks (NASDAQ:PANW), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PANW usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 26 extraordinary options activities for Palo Alto Networks. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 38% bearish. Among these notable options, 4 are puts, totaling $182,210, and 22 are calls, amounting to $864,907.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $253.33 and $650.0 for Palo Alto Networks, spanning the last three months.

Insights into Volume & Open Interest

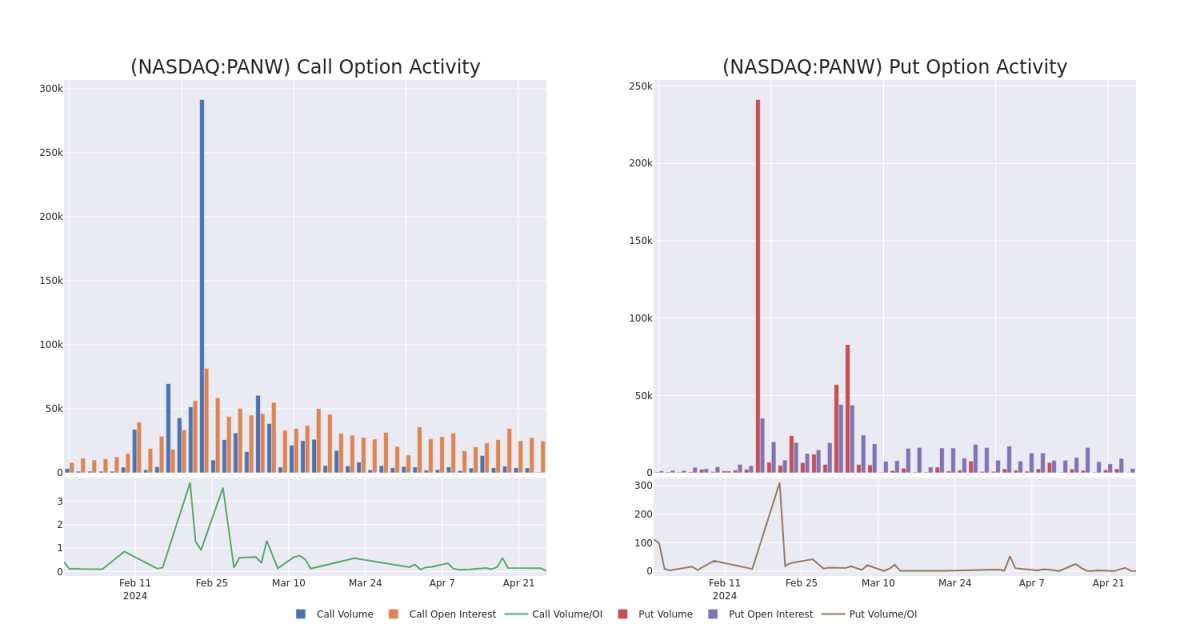

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Palo Alto Networks's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Palo Alto Networks's whale activity within a strike price range from $253.33 to $650.0 in the last 30 days.

Palo Alto Networks Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | CALL | TRADE | BULLISH | 08/16/24 | $25.6 | $25.45 | $25.6 | $300.00 | $89.6K | 411 | 40 |

| PANW | CALL | SWEEP | BULLISH | 01/17/25 | $10.85 | $10.8 | $10.85 | $410.00 | $70.5K | 444 | 76 |

| PANW | CALL | TRADE | BEARISH | 01/17/25 | $63.4 | $61.75 | $61.75 | $260.00 | $61.7K | 999 | 0 |

| PANW | PUT | SWEEP | BULLISH | 09/20/24 | $27.2 | $26.9 | $26.95 | $290.00 | $51.2K | 474 | 22 |

| PANW | PUT | SWEEP | BEARISH | 09/20/24 | $18.2 | $17.9 | $18.1 | $270.00 | $50.7K | 1.6K | 111 |

About Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 85,000 customers across the world, including more than three fourths of the Global 2000.

Following our analysis of the options activities associated with Palo Alto Networks, we pivot to a closer look at the company's own performance.

Current Position of Palo Alto Networks

- With a volume of 898,397, the price of PANW is up 1.3% at $292.55.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 25 days.

Professional Analyst Ratings for Palo Alto Networks

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $345.0.

- Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Palo Alto Networks, targeting a price of $330.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $350.

- An analyst from Keybanc has decided to maintain their Overweight rating on Palo Alto Networks, which currently sits at a price target of $355.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.