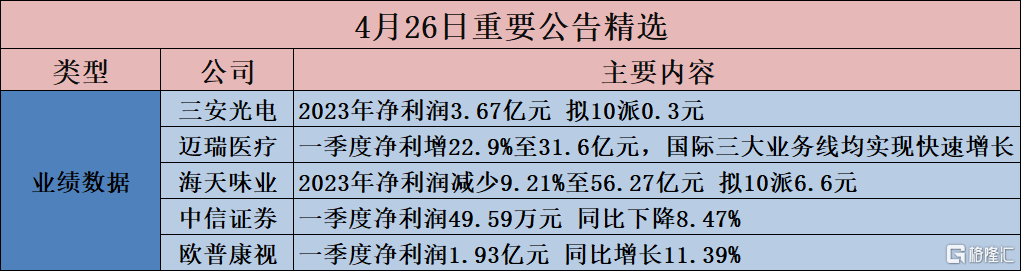

[Performance data]

San'an Optoelectronics (600703.SH): Net profit of 367 million yuan in 2023, plans to distribute 0.3 yuan

San'an Optoelectronics (600703.SH) released its 2023 annual report, achieving operating income of 14.53 billion yuan, an increase of 6.28%; net profit attributable to shareholders of listed companies of 367 million yuan, a year-on-year decrease of 46.50%; and net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss - 1,088 billion yuan, with basic earnings per share of 0.07 yuan. It is proposed to distribute a cash dividend of 0.30 yuan (tax included) for every 10 shares to all shareholders.

Bank of Changsha (601577.SH): Net profit increased 9.57% year-on-year in 2023, and plans to pay 3.8 yuan

Bank of Changsha (601577.SH) released its 2023 annual report. During the reporting period, the company achieved operating income of 24.803 billion yuan, up 8.46% year on year; net profit attributable to shareholders of listed companies was 7.463 billion yuan, up 9.57% year on year; net profit attributable to shareholders of listed companies deducted non-recurring profit and loss of 7.506 billion yuan, an increase of 10.29% year on year; basic income per share was 1.78 yuan/share. The company plans to pay a cash dividend of 3.80 yuan (tax included) for every 10 shares.

BAIC Blue Valley (600733.SH): Net loss of 5.4 billion yuan in 2023

BAIC Blue Valley (600733.SH) released its 2023 annual report. During the reporting period, the company's revenue was 14.319 billion yuan, up 50.50% year on year; net loss attributable to shareholders of listed companies was 5.4 billion yuan; net loss attributable to shareholders of listed companies after deducting non-recurring profit and loss was 6.018 billion yuan; and basic loss per share was 1.0719 yuan/share.

Opcom TV (300595.SZ)'s net profit of 193 million yuan in the first quarter increased 11.39% year-on-year

Opcon TV (300595.SZ) released its report for the first quarter of 2024. The company achieved operating income of 465 million yuan in the first quarter of 2024, an increase of 15.71% over the same period of the previous year, achieved net profit attributable to shareholders of listed companies of 193 million yuan, an increase of 11.39% over the same period last year, and achieved net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses of 167 million yuan, an increase of 11.59% over the same period last year.

CITIC Securities (600030.SH): Net profit of 495,900 yuan in the first quarter decreased 8.47% year over year

CITIC Securities (600030.SH) released its first quarter report. Operating revenue was 13.75 billion yuan, down 10.38% year on year, net profit was 495,900 yuan, down 8.47% year on year, after deducting non-net profit of 4.9 billion yuan, down 7.97% year on year, with basic earnings per share of 0.32 yuan.

Wangfujing (600859.SH): Net profit for the first quarter was 202 million yuan, down 10.86% year on year

Wangfujing (600859.SH) released its report for the first quarter of 2024. During the reporting period, it achieved operating income of 3.308 billion yuan, a year-on-year decrease of 1.74%; net profit attributable to shareholders of listed companies of 202 million yuan, a year-on-year decrease of 10.86%; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 193 million yuan, a year-on-year decrease of 13.72%; and basic earnings per share of 0.178 yuan.

Mindray Healthcare (300760.SZ)'s net profit increased 22.9% to 3.16 billion yuan in the first quarter, and all three major international business lines achieved rapid growth

Mindray Healthcare (300760.SZ) released its report for the first quarter of 2024. Operating revenue for the reporting period was 9.373 billion yuan, up 12.06% year on year; net profit attributable to shareholders of listed companies was 3.160 billion yuan, up 22.90% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 3,037 billion yuan, up 20.08% year on year; net cash flow from operating activities was 2,865 billion yuan, up 114.85% year on year, with basic earnings per share of 2.6107 yuan. The company continues to guarantee high R&D investment. In the first quarter of 2024, it invested 1,030 billion yuan in R&D, accounting for 10.99% of revenue. It continues to enrich its products, continuously innovate and iterate, and achieve breakthroughs, especially in the high-end field.

Yunnan Baiyao (000538.SZ): Net profit of 1.702 billion yuan in the first quarter increased 12.12% year-on-year

Yunnan Baiyao (000538.SZ) released its report for the first quarter of 2024. Operating revenue for the reporting period was 10.774 billion yuan, up 2.49% year on year; net profit attributable to shareholders of listed companies was 1,702 billion yuan, up 12.12% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 1,690 billion yuan, up 20.51% year on year; basic earnings per share were 0.95 yuan.

Haitian Flavors (603288.SH): Net profit reduced by 9.21% to 5.627 billion yuan in 2023, plans to distribute 10 to 6.6 yuan

Haitian Flavors (603288.SH) released its 2023 annual report, achieving operating income of 24.559 billion yuan, a year-on-year decrease of 4.10%; net profit attributable to shareholders of listed companies of 5.627 billion yuan, a year-on-year decrease of 9.21%; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 5.395 billion yuan, a year-on-year decrease of 9.57%; and basic earnings per share of 1.01 yuan. It is proposed to distribute a cash dividend of 6.60 yuan (tax included) for every 10 shares to all shareholders.

Makiyuan Co., Ltd. (002714.SZ) 2023 revenue of RMB 110.861 billion, net loss of RMB 4.168 billion

Muyuan Co., Ltd. (002714.SZ) announced its 2023 annual report. In 2023, the company sold 63.816 million pigs, including 62.267 million commercial pigs (including total sales of 13.266 million heads to the wholly-owned subsidiary Makihara Meat and its subsidiaries), 1.367 million piglets, and 181,000 breeding pigs; in 2023, the company slaughtered 13.26 million pigs and sold 1.455 million tons of fresh and frozen pork products. In 2023, the company achieved revenue of 110.861 billion yuan, a decrease of 11.19% over the same period last year. Among them, the slaughter and meat business achieved operating income of 21,862 billion yuan, an increase of 48.54% over the same period last year; realized net profit of -4168 billion yuan, a decrease of 127.91% year on year.

Marumi Co., Ltd. (603983.SH): Net profit increased by 48.93% to 259 million yuan in 2023, plans to distribute 10 to 5.2 yuan

Marumi Co., Ltd. (603983.SH) released its 2023 annual report, achieving operating income of 2,226 billion yuan, an increase of 28.52%; net profit attributable to shareholders of listed companies of 259 million yuan, an increase of 48.93% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 188 million yuan, an increase of 38.16% year on year; and basic earnings per share of 0.65 yuan. It is proposed that all shareholders receive a cash dividend of 5.20 yuan (tax included) for every 10 shares.

China Pharmaceutical (600056.SH): Net profit increased 42.47% year-on-year to 1,048 billion yuan in 2023

China Pharmaceutical (600056.SH) released its 2023 annual report. During the reporting period, the company's revenue was 38.824 billion yuan, up 3.28% year on year; net profit attributable to shareholders of listed companies was 1,048 million yuan, up 42.47% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 614 million yuan, up 2.35% year on year; basic earnings per share were 0.7006 yuan/share. It is proposed to distribute a cash dividend of RMB 2.1019 (tax included) for every 10 shares to all shareholders.

Lin Yang Energy (601222.SH): Net profit increased by 20.48% to 1,031 million yuan in 2023, plans to distribute 10 to 3.03 billion yuan

Lin Yang Energy (601222.SH) released its 2023 annual report, achieving operating income of 6.872 billion yuan, an increase of 39.00%; net profit attributable to shareholders of listed companies of 1,031 million yuan, an increase of 20.48% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 867 million yuan, an increase of 23.61% year on year; and basic earnings per share of 0.51 yuan. It is proposed to distribute a cash dividend of 0.303 yuan (tax included) per share to all shareholders.

Sunong Bank (603323.SH): Net profit increased 16.04% year-on-year to $1,743 billion in 2023

Sunong Bank (603323.SH) released its 2023 annual report. During the reporting period, the company's revenue was 4,046 billion yuan, up 0.21% year on year; net profit attributable to shareholders of listed companies was 1,743 billion yuan, up 16.04% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 1,658 billion yuan, up 16.60% year on year; basic earnings per share were 0.97 yuan/share. It is proposed to distribute a cash dividend of 1.8 yuan (tax included) for every 10 shares (RMB 1 per share) to all shareholders.

Vail Co., Ltd. (603501.SH): Net profit of 558 million yuan in the first quarter increased by 180.50% year-on-year

Vail Co., Ltd. (603501.SH) released its report for the first quarter of 2024. During the reporting period, the company achieved operating income of 5.644 billion yuan, an increase of 30.18%; net profit attributable to shareholders of listed companies was 558 million yuan, an increase of 180.50% year on year; net profit attributable to shareholders of listed companies deducted 566 million yuan from non-recurring profit and loss, an increase of 2,476.81% year on year; basic earnings per share were 0.46 yuan/share.

Kaizhong Co., Ltd. (603037.SH): Net profit increased 17.66% in 2023 to 91.826,700 yuan, plans to convert 10 to 4 to 5 yuan

Kaizhong Co., Ltd. (603037.SH) released its 2023 annual report. The company achieved operating income of 739 million yuan in 2023, an increase of 15.17% over the same period of the previous year. The company achieved a net sales interest rate of 12.42% in the same year, and realized net profit attributable to shareholders of listed companies of 91.8267 million yuan, an increase of 17.66% over the same period of the previous year, with a basic income of 0.69 yuan per share. It is proposed to distribute a cash dividend of 5.0 yuan (tax included) to all shareholders for every 10 shares, and 4.0 shares will be converted to a capital reserve fund for every 10 shares.