Investors with a lot of money to spend have taken a bullish stance on $ZIM Integrated Shipping (ZIM.US)$.

Today, Benzinga's options scanner spotted 11 options trades for ZIM Integrated Shipping. The overall sentiment of these big-money traders is split between 72% bullish and 18%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $48,024, and 10, calls, for a total amount of $393,270.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $10.0 to $17.5 for ZIM Integrated Shipping during the past quarter.

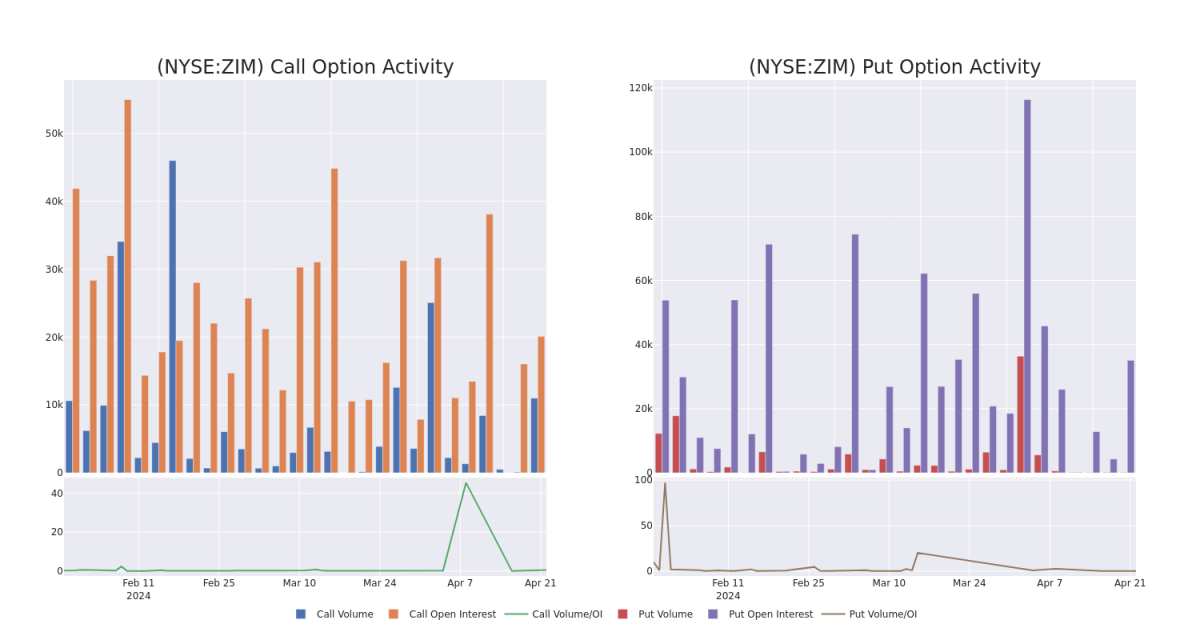

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in ZIM Integrated Shipping's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to ZIM Integrated Shipping's substantial trades, within a strike price spectrum from $10.0 to $17.5 over the preceding 30 days.

ZIM Integrated Shipping Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

ZIM | CALL | SWEEP | BULLISH | 05/24/24 | $1.14 | $1.13 | $1.14 | $13.50 | $66.0K | 232 | 155 |

ZIM | CALL | SWEEP | BULLISH | 07/19/24 | $3.5 | $3.3 | $3.5 | $10.00 | $49.3K | 4.8K | 161 |

ZIM | PUT | SWEEP | BEARISH | 05/31/24 | $1.38 | $1.37 | $1.38 | $13.00 | $48.0K | 10 | 0 |

ZIM | CALL | SWEEP | BULLISH | 07/19/24 | $0.95 | $0.77 | $0.85 | $15.00 | $42.5K | 17.5K | 142 |

ZIM | CALL | SWEEP | BULLISH | 05/17/24 | $1.34 | $1.26 | $1.34 | $12.50 | $40.2K | 6.7K | 881 |

ZIM Integrated Shipping Services Ltd is an asset-light container liner shipping company. It offers tailored services, including land transportation and logistical services, specialized shipping solutions, including the transportation of out-of-gauge cargo, refrigerated cargo, and dangerous and hazardous cargo. Its services include Cargo Services, Digital Services, Schedules, and Shipping Trades and Lines. Geographically, it derives a majority of its revenue from the Pacific trade region.

After a thorough review of the options trading surrounding ZIM Integrated Shipping, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of ZIM Integrated Shipping

With a trading volume of 3,338,548, the price of ZIM is up by 15.32%, reaching $13.13.

Current RSI values indicate that the stock is may be approaching overbought.

Next earnings report is scheduled for 24 days from now.