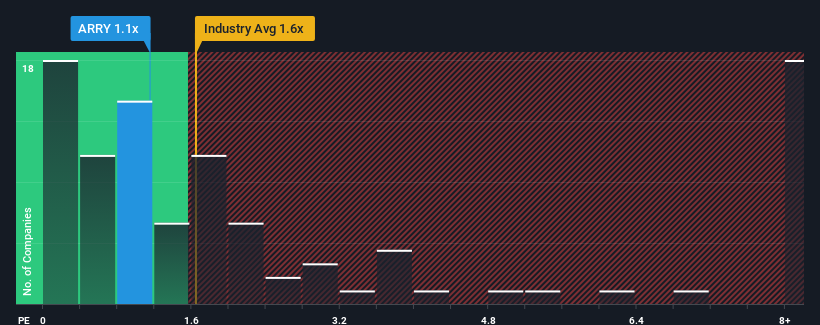

With a median price-to-sales (or "P/S") ratio of close to 1.6x in the Electrical industry in the United States, you could be forgiven for feeling indifferent about Array Technologies, Inc.'s (NASDAQ:ARRY) P/S ratio of 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Array Technologies' P/S Mean For Shareholders?

Array Technologies could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Array Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Array Technologies?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Array Technologies' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 3.7% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 81% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 4.9% each year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 34% per annum, which is noticeably more attractive.

With this information, we find it interesting that Array Technologies is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Array Technologies' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Array Technologies' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Having said that, be aware Array Technologies is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.