The first quarter results of coal stocks were poor, and China's Shenhua, the “leading coal and electricity company,” was no exception. Profits fell 14% in the first quarter.

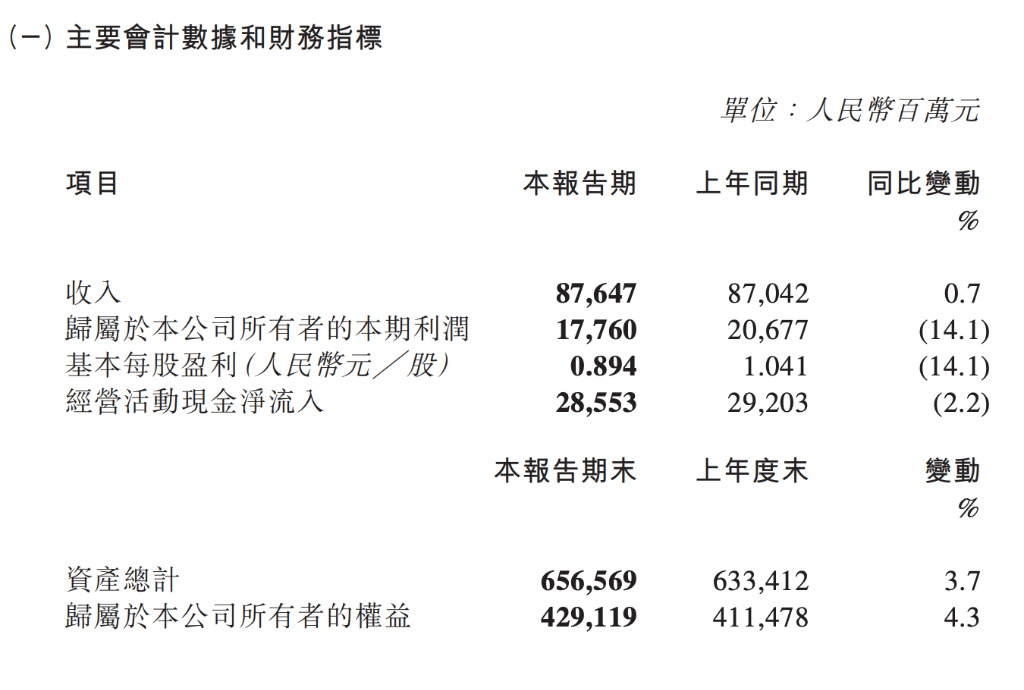

On Friday, China's Shenhua released its financial report for the first quarter of 2024. The financial report showed that China Shenhua achieved revenue of 87.647 billion yuan, a slight increase of 0.7% year on year; current profit attributable to the company's owners was 17.760 billion yuan, down 14.1% year on year, mainly due to falling coal prices; and net cash inflow from operating activities was 28.553 billion yuan, a slight year-on-year decline.

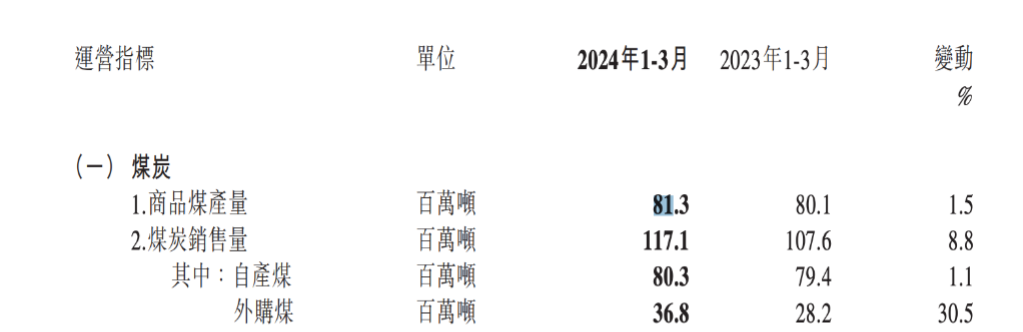

Judging from the main operating indicators, in the first quarter of 2024, China's Shenhua commercial coal production was 81.3 million tons, up 1.5% year on year; coal sales volume was 117.1 million tons, up 8.8% year on year. Affected by changes in market supply and demand, the average sales price of the company's commercial coal fell 7.7% year on year to 573 yuan/ton, leading to a decline in coal business profits.

Thanks to the recovery in domestic demand for electricity, China's Shenhua Power Generation business has bucked the trend. The company's total electricity sales volume was 52.16 billion kilowatt-hours, an increase of 7.0% over the previous year. The average number of hours used by coal-fired units reached 1,254 hours, a record high for the same period. The gross margin of the power generation business reached 16.9%, an increase of 1.1 percentage points over the previous year. The company actively promoted new energy projects, increasing the installed capacity of photovoltaic power generation to 482 megawatts.

The balance ratio remained low. As of the end of March, China Shenhua's assets totaled 656.569 billion yuan, and the equity attributable to the company's owners was 429.119 billion yuan. The balance ratio was 22.6%, and the financial situation was relatively stable. In terms of expenses, the company's financial expenses declined year over year.

The coal sector is a high-dividend stock for cash dairy cows. Last year, China Shenhua had a net profit of 59.694 billion yuan and used 75% of net profit for dividends, with a total dividend of 44.9 billion yuan.

However, the performance of many industry companies declined in the first quarter of this year. Some analysts pointed out that demand for coal in the power industry gradually weakened in the first quarter. In particular, after the heating season ended, the power industry's daily coal consumption dropped markedly, and Changxie coal shipments were guaranteed, and power plant electricity and coal stocks remained high.