Lin Yuan invests in buying a ceramics company

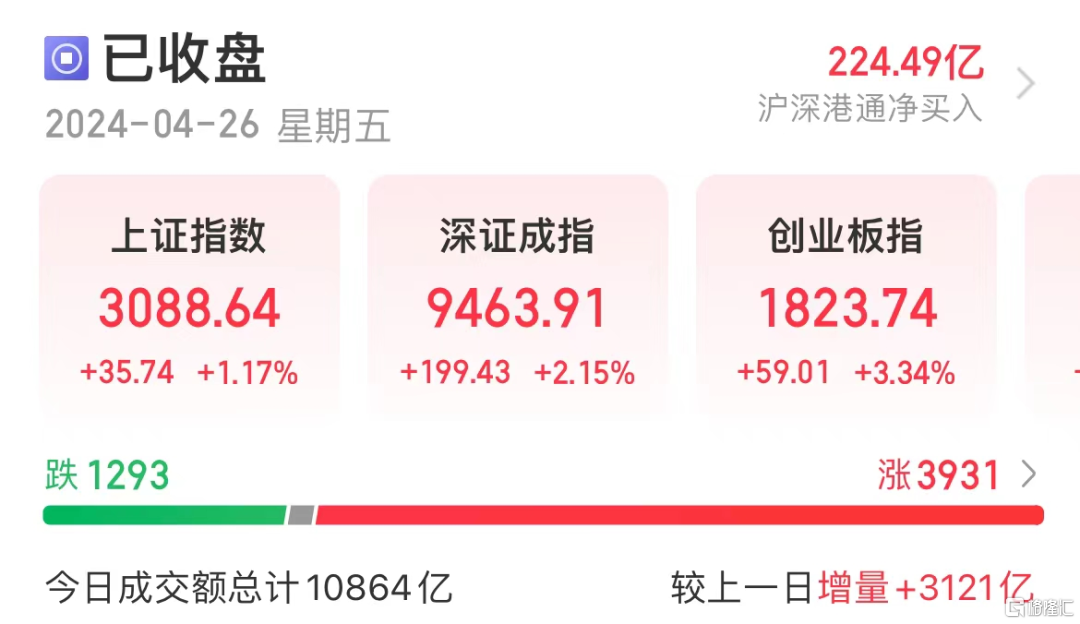

A-shares are booming. Northbound capital made net purchases of 22.449 billion dollars, the highest net purchase amount in history.

As of yesterday, the companies with the most net foreign purchases since the beginning of the year were Ningde Times, Wuliangye, Kweichow Moutai, Midea Group, and China Merchants Bank, all with net purchases of over 4 billion dollars.

The securities sector, known as the “flag bearer of the bull market,” rose sharply, and securities ETFs rose more than 6%.

According to the news, the State Council issued a report on the research, processing and rectification of the opinions on the review of the special report on the management of state-owned assets of financial enterprises. The report shows that efforts are being concentrated to build a “national team” for the financial industry. Promote leading securities companies to become stronger and better, and support the Shanghai and Shenzhen stock exchanges to build world-class exchanges. Additionally, Guolian Securities announced that the company is planning to acquire control of Minsheng Securities Co., Ltd. and raise supporting capital by issuing A-shares.

1

The big guys are starting to reduce their holdings of this star stock

Purchased in 2018, held for 6 years, the stock price increased more than 10 times, and the 6-year dividend exceeded 61.4 billion dollars. The boss began to reduce his holdings in this star company.

The Shaanxi coal industry achieved operating income of 17.872 billion yuan in 2023, an increase of 2.41% year on year; net profit of 21.239 billion yuan, a year-on-year decrease of 39.67%. Net profit declined year on year, but they still chose large dividends and introduced a dividend plan of 12.749 billion yuan.

The Shaanxi coal industry released its report for the first quarter of 2024 yesterday. Net profit returned to mother for the first quarter was 4.652 billion yuan, down 32.69% from the previous year.

The list of the top ten shareholders in the first quarterly report revealed key information. Boss Zhang Yao reduced his holdings of the Shaanxi coal industry by 4.010,900 shares in the first quarter.

Zhang Yao appeared on the list of the top ten tradable shareholders in the Shaanxi coal industry in 2018. In mid-2018, Zhang Yao first appeared on the list of the top ten shareholders of the Shaanxi coal industry, holding 68 million shares. In the 2019 annual report, Zhang Yao held 85.46 million shares in the Shaanxi coal industry. Subsequently, the 2019 quarterly report and 2022 semi-annual report showed that its holdings reduction report for the 2023 quarterly report showed that Zhang Yao held 87.12 million shares.

Who is Zhang Yao? Most investors are probably unfamiliar with it.

Zhang Yao is a “big man among the bosses” in the Shenzhen investment community. He doesn't manage money for anyone else and has a net worth of 10 billion dollars. He is an extremely legendary figure. According to the Securities Times, Zhang Yao earned 2,000 times the profit from A-shares and Hong Kong stocks from 1999 to 2018. Since 2018, Zhang Yao's heavy coal stocks have increased by more than 1 times, and the profit in 25 years has been about 4,000 times.

Regarding the logic of buying the coal industry in Shaanxi, Zhang Yao said, “At the end of 2018, there were 13.1 billion dollars in monetary capital on the account, earning 10 billion dollars in profits every year. The net cash flow from operating activities was nearly 20 billion yuan, while the minimum market value of the Shaanxi coal industry back then was 70 billion yuan. This means that the Shaanxi coal industry can get investors back their costs in five or six years.

Some people have calculated an account. The dividend plan for the Shaanxi coal industry in 2023 is 2.18 yuan per share, while the dividend per share from 2018 to 2022 has reached 5.68 yuan, which means that the dividends of the Shaanxi coal industry in the last 6 years have covered the average purchase cost in mid-2018.

In other words, Zhang Yao recovered most of the principal amount of the investment through dividends, compounded by a 10-fold increase over the past 6 years. The return on this investment is quite impressive.

Zhang Yao shared his investment philosophy: using the number of shares held by multiplying the profit per share as his profit, and using the dividends received as his own cash flow to form his own profit and cash flow system. By focusing on one's total profit and total cash flow, this core is to return to focusing on the number of shares owned by the company. This is a kind of cognitive sublimation. This perception can mitigate the psychological impact of short-term stock price fluctuations on oneself. Back to the essence of investing, buying stocks means buying a company. Since you are buying a company, of course you want to own more shares of the company for the same amount of money.

Zhang Yao once said, “My personal experience can be used as an example to show that value investing is effective in China, and that it is possible to continue to obtain good returns through value investment and even achieve a leap in wealth levels.”

2

Lin Yuan invests in buying a ceramics company

Linyuan Investment, a well-known investment institution, became the fourth largest tradable shareholder of Huaci Co., Ltd., with a holding volume of 322,000 shares. Based on 15.24 yuan/share at the end of the first quarter, the market value of the position was 4.879,800.

(The content of this article is a list of objective data and information and does not constitute any investment advice)

(The content of this article is a list of objective data and information and does not constitute any investment advice)

Linyuan's investment management scale exceeds 10 billion dollars. Judging from the market value of its holdings, it is less than 5 million, accounting for a very small share of positions.

Huaci Co., Ltd. is a company engaged in the design, R&D, production and sales of ceramic products. In the first quarter of 2024, the company achieved operating income of 280 million yuan, an increase of 7.95%; achieved net profit attributable to shareholders of listed companies of 0.46 million yuan, an increase of 10.24% year on year; realized net profit of 38 million yuan, an increase of 44.43% year on year; achieved basic income per share of 0.18 yuan, an increase of 10.21% year on year.

Investment boss Lin Yuan previously achieved significant wealth growth through heavy warehousing of companies such as Kweichow Moutai and Pien Tsai. In recent years, he has repeatedly emphasized his optimism for the aging circuit.

At the Glonghui Carnival, Mr. Lin Yuan said that now we have all the conditions at the beginning of the bull market, and this is another big opportunity to take care of the elderly and aging. The pharmaceutical industry has gone through some ups and downs in the past few years, and the pharmaceutical industry is unfavorable in terms of public opinion. This is the crisis we are talking about. We're never wrong with buying a crisis. When you buy melamine, you can buy milk; if you buy financial stocks during the US financial crisis, you can't go wrong with your eyes closed. This is common sense. However, behind common sense is that there is a big consumer market that will not change in the future; this is also common sense. If the future consumer market we're studying shrinks, then it's not common sense. Therefore, if we look at the aging pharmaceutical market in 30 years, today's consumption is relatively zero.

3

reversal? Analysts who were initially bearish on Evergrande have a new opinion

The reversal has come. Analysts who first warned Evergrande Thunderstorm expressed their latest views and are optimistic about Chinese real estate stocks.

In 2021, John Lin, a real estate analyst at UBS Greater China, rarely gave China Evergrande Group a sales rating. At the time, the move caused an uproar in the market. At the time, John Lam lowered the target price from HK$14.50 to HK$6, becoming the only analyst among 19 analysts who follow Evergrande to give the company a sales rating.

The market later validated his predictions. Evergrande's stock price began to plummet by more than 90% in April of that year. There was a thunderstorm in the second half of that year, and trading was suspended 14 months later.

Now that the real estate industry chief analyst is back on his feet, John Lin predicts that China's real estate market will gradually recover, yet most analysts believe that the market has not yet bottomed out.

In an interview in Hong Kong, he said, “After three years of bearishness, we are more optimistic about the Chinese real estate industry for the first time due to government aid.”

He predicts that housing demand and supply will return to historic averages sometime next year, and the stocks of developers with large portfolios in 21 major cities may rebound.

John Lin predicts that although sales and prices in China's real estate industry will not rise this year, the decline will ease somewhat. He believes that once housing prices stabilize, suppressed demand will return because the cycle of falling real estate prices over the past three years has caused people to delay purchases.

With this round of real estate adjustments, people are generally worried about whether Japan and the US will experience the bursting crisis of the real estate bubble.

Regarding this issue, John Lin believes that the real estate market in mainland China is healthier than Japan and Hong Kong, China, and the extent of the crisis is not as serious as the latter two. He pointed out that the reason for this is China's low urbanization rate and the implementation of strict foreign exchange controls. The combination of these factors has enabled China to manage the real estate bubble better than Japan.