Jiuding Investment Response: Unrelated

A change in the top ten shareholders of Jiuding Investment's 2023 annual report sparked heated debate.

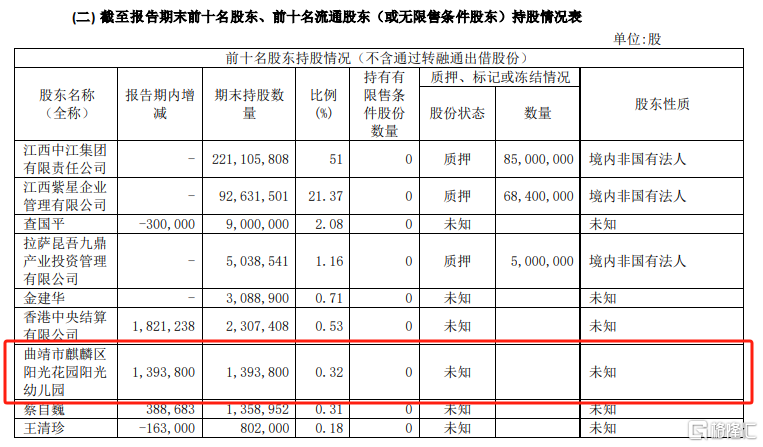

According to the 2023 annual report recently disclosed by Jiuding Investment, Sunshine Garden Sunshine Kindergarten (hereinafter referred to as “Sunshine Garden Sunshine Kindergarten”) in Kirin District of Qujing City has become the seventh largest shareholder of the company with 1.3938 million shares.

It is worth noting that in the 2023 three-quarter report disclosed by Jiuding Investment, Sunshine Garden Sunshine Kindergarten in Qilin District of Qujing City did not appear in the top ten shareholders of the company. This also means that the kindergarten probably bought shares in the fourth quarter of last year.

On April 25, a staff member of Jiuding Investment and Securities Department said that the company's subsidiary was indeed a partner of Yunnan World Expo Jiuding, but it had completely retired in 2023. The staff member also said that currently Sunshine Kindergarten is indeed a shareholder of the company, but the company does not understand the shareholder's situation and reason for the purchase. “It (referring to kindergarten) has nothing to do with us before or after the purchase.”

According to Times Weekly, Wind data shows that the highest price of Jiuding Investment in the fourth quarter of 2023 was 20.90 yuan, the lowest price was 11.74 yuan, and the average transaction price was about 15.77 yuan/share. Based on the average transaction price of 15.77 yuan/share, Sunshine Garden Sunshine Kindergarten would need to spend 21.98 million yuan to buy 1.393,800 shares of Jiuding Investment; even if Sunshine Garden Sunshine Kindergarten bought 1.393,800 shares of Jiuding Investment at the lowest price of 11.74 yuan, it would need to use 16.36 million yuan in capital.

A private kindergarten, with Jiuding in the background

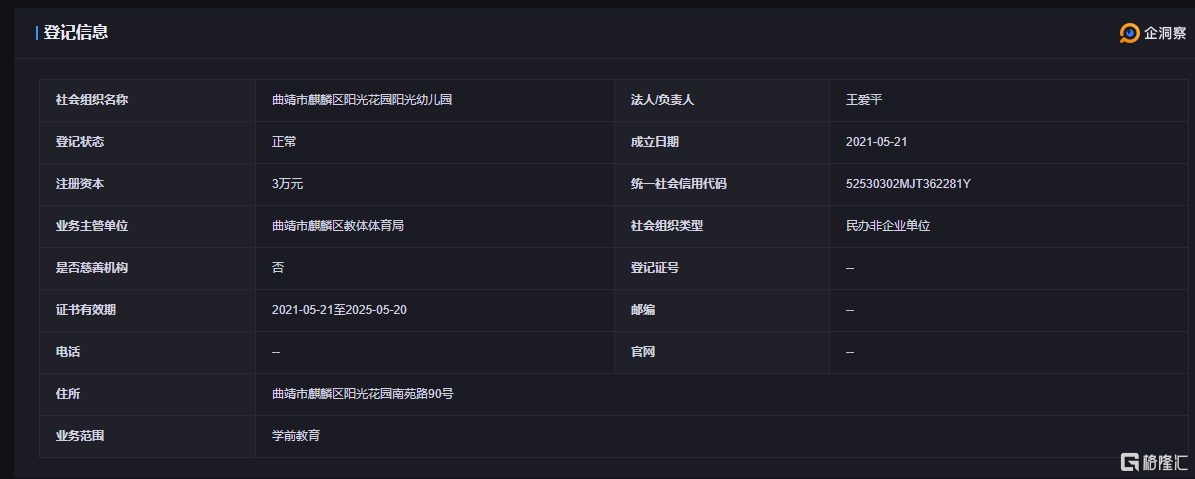

Enterprise insight shows that Sunshine Kindergarten was established on May 21, 2021, with a start-up capital of only 30,000 yuan. The legal representative is Wang Aiping. It is a private kindergarten.

Through equity penetration, kindergarten investors seem to be linked to education companies invested by tourism and cultural enterprises set up by a subsidiary of Jiuding Investment.

According to public information, Sunshine Garden Sunshine Kindergarten is one of many kindergartens invested by Yunnan World Expo Sunshine Education Investment Co., Ltd. (hereinafter referred to as “Yunnan World Expo Sunshine”). Wang Aiping is not only the director of Sunshine Garden Sunshine Kindergarten, but also the director of Yunnan World Expo Sunshine.

According to Tianyan survey, Yunnan World Expo Education was founded in March 2010 with a registered capital of 204.801,000 yuan. The legal representative is Zhang Ying. The company currently has two major shareholders, namely Yunnan World Expo Jiuding Tourism and Culture Partnership (limited partnership) (“Yunnan World Expo Jiuding”) and Yunnan Changtian Real Estate Co., Ltd., with shareholding ratios of 50.9998% and 49.0002%.

Among them, the “related products/institutions” of Yunnan World Expo Jiuding are shown as Jiuding Investment. Yunnan Tianchang Real Estate is 100% owned by Wang Aiping, but the company was cancelled on September 26, 2023.

Last year's performance fell by more than 90%

Real estate business losses increased by 114.6%

In terms of financial data, in 2023, Jiuding Investment achieved operating income of 281 million yuan, a year-on-year decrease of 35.07%; realized net profit attributable to shareholders of listed companies of 0.15 million yuan, a year-on-year decrease of 91.19%.

Among them, the private equity investment management business achieved operating income of 270 million yuan, a year-on-year decrease of 32.22%, and realized net profit attributable to shareholders of listed companies of 50 million yuan, a year-on-year decrease of 73.66%.

In addition, the real estate business achieved operating income of 0.1 billion yuan, a year-on-year decrease of 68.84%; realized net profit attributable to shareholders of listed companies of 35 million yuan, an increase of 114.62% year-on-year losses.

As for the reason for the decline in performance, Jiuding Investment's explanation is that “the company's private equity investment management business stock fund entered the exit period, leading to a decrease in management fee revenue. At the same time, the number of project exits and return on project investment decreased compared to the same period of the previous year, leading to a decrease in management remuneration income collected by the company and investment income from the company's own capital. The decline in fair value changes in the current period was higher than in the same period last year.”