Analysts say former US President Donald Trump was right: a strong dollar is causing US consumption to increasingly shift to foreign suppliers. But another analyst said the politicization of the dollar could limit its upside. /p >

The official US growth data released this week fell far short of economists' expectations. The first-quarter gross domestic product (GDP) report showed that international trade dynamics were the main culprit.

In the first quarter of 2024, the US economy grew at an annualized quarterly rate of 1.6%, while in the fourth quarter of 2023 it grew by 3.4%; analysts expected 2.5%. “The US economy slowed sharply in the first quarter,” said Berenberg Bank economist Felix Schmidt (Felix Schmidt). “Net exports dragged down overall growth by 0.9 percentage points.”

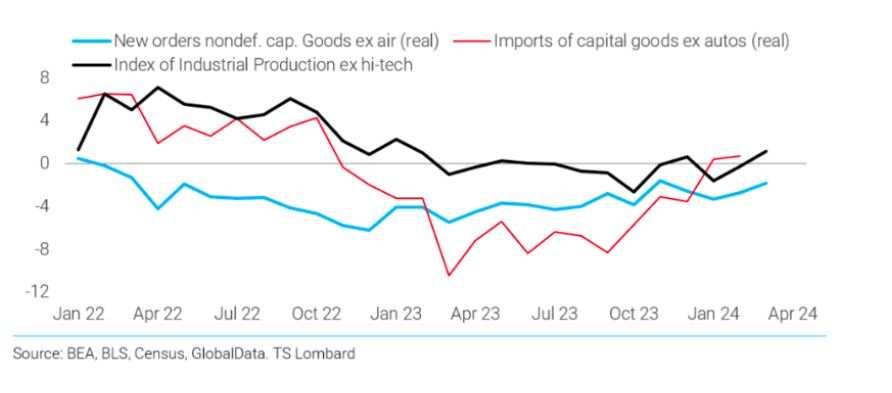

“The problem is that a strong dollar transfers capital equipment from domestic and foreign producers — this is contrary to the best efforts of government policy (taxes, tariffs, and expenses),” said Steven Blitz (Steven Blitz), chief US economist at TS Lombard.

(Photo credit: poundsterlinglive)

Presidential candidate Donald Trump said this week that the dollar is too strong and has had a “disastrous impact” on our manufacturers and others. The company will be “forced to either lose a lot of business or build factories in other countries,” he said.

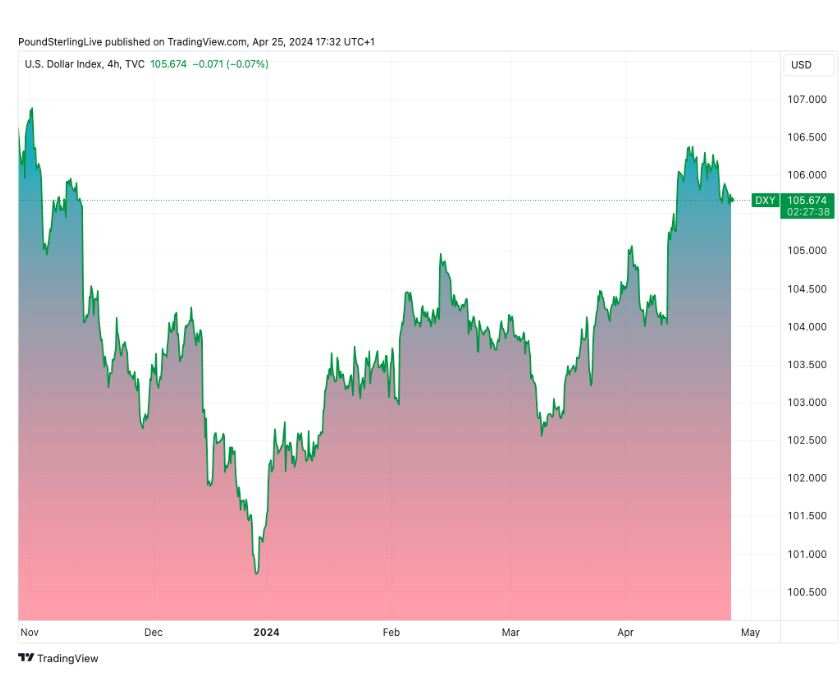

Since 2024, the US dollar has risen 4.25% overall, making it cheaper for US businesses and consumers to buy foreign goods and services and motivating them to switch to domestic suppliers. The dollar rose 18% compared to 2021.

“Weak export growth can be attributed to weak global demand and a strong dollar. Even if the impact of quarterly fluctuations in the data is abstracted, import growth looks strong,” Schmidt said.

The data shows that despite an increase in exports, new consumption is increasingly benefiting foreign suppliers, depriving domestic suppliers of demand.

“Why is the primary data so bad? This is partly due to a significant drag on trade. Net exports dragged down the main data by 0.86 percentage points. Without this drag, the main data would fully meet consensus expectations,” said Tim Quinlan (Tim Quinlan), senior economist at Wells Fargo Economics.

Strong dollar

The US dollar was the best-performing currency in 2024, rising as expectations of the Federal Reserve's interest rate cut weakened. Higher long-term interest rates make interest-paying US bonds more attractive to foreign investors, and their capital injections increase the value of the currency.

(Photo credit: poundsterlinglive)

Hopes for the Federal Reserve to cut interest rates gradually faded, triggering a sell-off in the stock market, which further increased demand for the US dollar because of its “safe-haven” nature.

Fundamentals clearly dominate the dollar's appreciation, but Trump sees a strong dollar as a political issue.

“Of course it exists here (very big?) Political in nature, Trump's goal is to criticize Biden's policies and blame Biden for the level of the dollar. If Trump were president, maybe he would use it as an example of America's strength.” Derek Halpenny (Derek Halpenny), head of global market research at Mitsubishi UFJ Bank, said.

Halpeni said there are other reports that Trump's economic advisers are carefully studying some measures to encourage other major countries to strengthen their currencies or face tariffs.

Politico quoted some of Trump's economic advisers as saying they are carefully studying ways to encourage other major countries to strengthen their currencies or face tariffs.

“Currency revaluation may be a priority for some members of the second Trump administration, mainly due to trade deficits (rising dollar),” a former Trump administration official told Politico.

According to Halpeni, political factors have entered the dollar debate, which may limit the dollar's room to rise. “As the dollar reaches these higher levels, speculative purchases of the dollar's purchasing power will definitely decrease.”