In early Asian trading on Friday (April 26), spot gold fluctuated in a narrow range near the 2330 key. The US GDP growth rate for the first quarter, which was released on Thursday, fell short of market expectations, dragging down the US dollar index to a low level of nearly two weeks, helping the price of gold stay above the key support in the middle of the Bollinger Line. Although US Treasury yields rose after economic data showed signs of stubborn inflation, it dampened hopes that the Federal Reserve would cut interest rates soon.

(Daily chart of spot gold, source: Easy Huitong)

Spot gold rose 0.7% to $2332.30 per ounce on Thursday. After hitting a record high of $2431.29 on April 12 due to geopolitical turmoil, the price of gold has dropped by nearly $100. US futures closed 0.2% higher, and the settlement price was $2342.5.

The US dollar index fell 0.23% on Thursday to close at 105.57. The intraday low hit 105.46, a new low since April 12. Earlier data showed that US economic growth slowed more than expected in the first quarter, but rising inflation suggests that the Federal Reserve will not cut interest rates until September. If this trend continues, it will leave the Federal Reserve in a dilemma.

For most of the time fighting the sharp rise in inflation caused by the COVID-19 pandemic, Federal Reserve officials said that it would take a period of time for economic growth to fall below the trend level to push price pressure back to the target, and the 1.6% month-on-month expansion rate in the first quarter reached this standard. Previously, the economic growth rate was above 1.8% for a period of time. This is the median value of the trend level estimated by the Federal Reserve without increasing inflationary pressure.

However, price pressure is still sticky.Data released on Thursday also showed that the personal consumption expenditure (PCE) price index for the first quarter grew at an annual rate of 3.4% month-on-month, while the Federal Reserve's inflation target was 2%.

Investors and analysts initially paid more attention to high inflation data, and the economy may have finally shown signs of cooling as expected by the Federal Reserve.

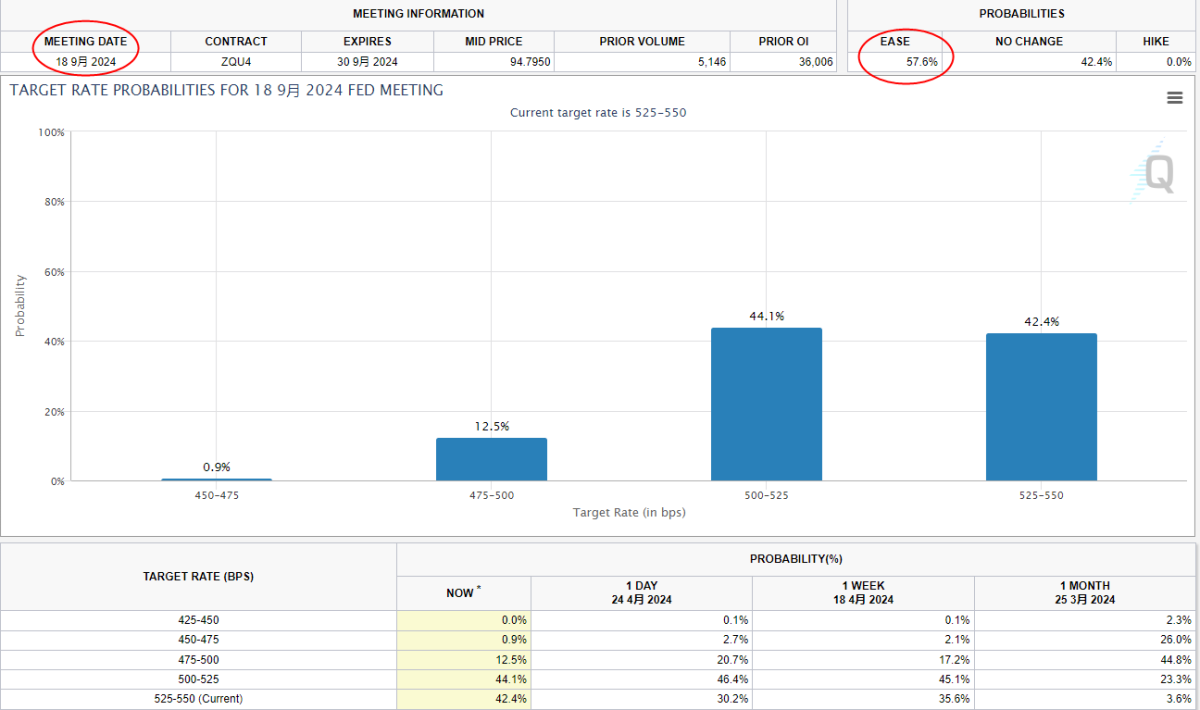

According to CME's FedWatch tool, the probability that the Fed will cut interest rates for the first time has declined across the board. The chance of cutting interest rates in June is now less than 10%, the chance of cutting interest rates in September is below 58%, and the chance of cutting interest rates for the second time in December is less than 50%.

Nationwide Financial market economist Oren Klachkin said that there is reason to believe that the 1.6% growth rate in the first quarter exaggerated the extent of economic weakness, and the huge drag caused by imports and inventories is unlikely to continue this year.

At the same time, “the current level of inflation does not give the Fed confidence that it will soon reach the 2% target,” he said. “A higher and longer interest rate environment is likely to prevail.”

The year-on-month GDP growth rate in the first quarter was lower than economists' expectations, and the growth rate of 3.4% at the end of 2023 was significantly slower. The impact of imports and inventories on economic growth is actually the same as in early 2022, when US GDP growth declined throughout the first half of the year, triggering warnings that the economy was about to fall into recession. Both of these factors in GDP are unstable. As far as inventories are concerned, weakness in one quarter often drives strength in the later stages, and companies sell products first and then replenish inventories.

In 2022, after people predicted a recession, the US economy grew above trend levels for six quarters. The Federal Reserve must now determine whether the economy is actually weakening from other aspects - such as employment data and upcoming monthly inflation data - and whether price pressure can begin to ease again after growing faster than expected in the past few months

Bob Haberkorn, senior market strategist at RJO Futures, said, “More data shows that the Federal Reserve will not cut interest rates soon; gold is trading accordingly.”

After the data was released, US Treasury yields hit their highest level in more than five months. This limited the increase in the price of gold.

“Federal Reserve microphone” Nick Timiraos's latest article pointed out that Thursday's economic activity report sounded the latest wake-up call for investors and Fed policymakers. They have been holding their breath and are hoping that falling inflation will allow interest rate cuts to officially begin this summer. The data shows that after cooling off perfectly in the second half of last year, US inflation has been more stubborn than expected for the third month in a row. So far this year, individual economic growth and price data alone are not enough to significantly change the Fed's outlook. But the cumulative impact of these continuously disappointing data is significant. In particular, the inflation data has always been stronger than expected. In follow-up reports in recent months, the revision of the inflation data has increased. This trend has prompted investors and Federal Reserve officials to reconsider whether it is appropriate to cut interest rates this year.

People will carefully study Friday's March monthly inflation data (PCE) to determine whether the higher-than-expected quarterly GDP data will translate into an acceleration of month-on-month price increases in March, or revise the January and February data. The April employment report will be released next Friday.

Until employment and wage growth becomes more clear, and more price data is seen, the Federal Reserve may have no incentive to adjust the information that will maintain current interest rate levels.

“GDP growth in the first quarter was lower than expected, but inflation was stronger than expected, making the US Federal Reserve officials who are considering when to cut interest rates this year very uncomfortable,” Citigroup economists wrote, predicting that “cracks in economic activity and labor market data” may still leave room for summer interest rate cuts.

David Meger, head of metals trading at High Ridge Futures, said: “After a sharp rise over the past few weeks, gold is currently in the process of consolidation. Of course, if we see very moderate inflation data and a significant drop in the inflation rate, this situation may change in the short term.”

At 07:57 Beijing time, the current price of spot gold was 2330.54 US dollars/ounce.