Deep-pocketed investors have adopted a bullish approach towards PDD Holdings (NASDAQ:PDD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PDD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 47 extraordinary options activities for PDD Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 59% leaning bullish and 31% bearish. Among these notable options, 16 are puts, totaling $961,520, and 31 are calls, amounting to $1,696,034.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $70.0 and $190.0 for PDD Holdings, spanning the last three months.

Analyzing Volume & Open Interest

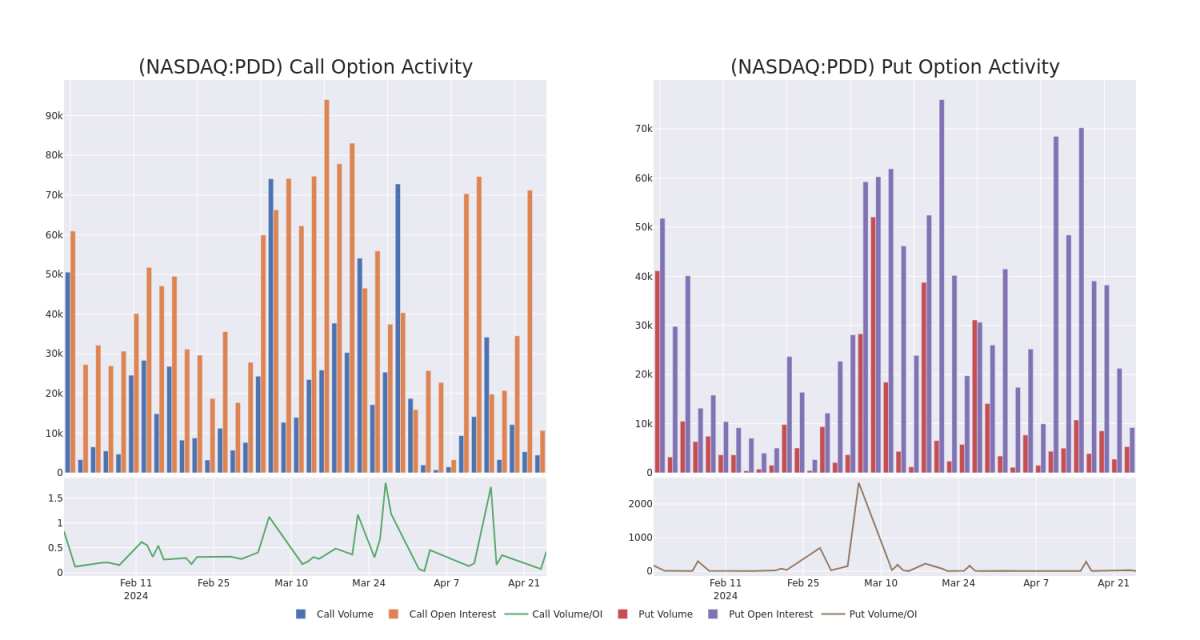

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in PDD Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to PDD Holdings's substantial trades, within a strike price spectrum from $70.0 to $190.0 over the preceding 30 days.

PDD Holdings Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | CALL | TRADE | BULLISH | 05/03/24 | $6.45 | $6.3 | $6.55 | $120.00 | $393.0K | 1.7K | 611 |

| PDD | PUT | TRADE | BEARISH | 05/17/24 | $65.0 | $64.15 | $65.0 | $190.00 | $260.0K | 25 | 40 |

| PDD | PUT | SWEEP | BEARISH | 03/21/25 | $11.0 | $10.95 | $11.0 | $105.00 | $156.1K | 2.2K | 129 |

| PDD | CALL | SWEEP | BULLISH | 03/21/25 | $17.2 | $17.1 | $17.19 | $145.00 | $120.4K | 19 | 63 |

| PDD | CALL | SWEEP | BEARISH | 05/24/24 | $16.6 | $15.5 | $15.6 | $111.00 | $113.8K | 15 | 100 |

About PDD Holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

Having examined the options trading patterns of PDD Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of PDD Holdings

- With a trading volume of 3,708,069, the price of PDD is down by -1.58%, reaching $125.53.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 29 days from now.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PDD Holdings with Benzinga Pro for real-time alerts.