Investors with a lot of money to spend have taken a bullish stance on Deere (NYSE:DE).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DE, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 9 uncommon options trades for Deere.

This isn't normal.

The overall sentiment of these big-money traders is split between 44% bullish and 44%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $244,794, and 3 are calls, for a total amount of $251,580.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $370.0 to $420.0 for Deere over the last 3 months.

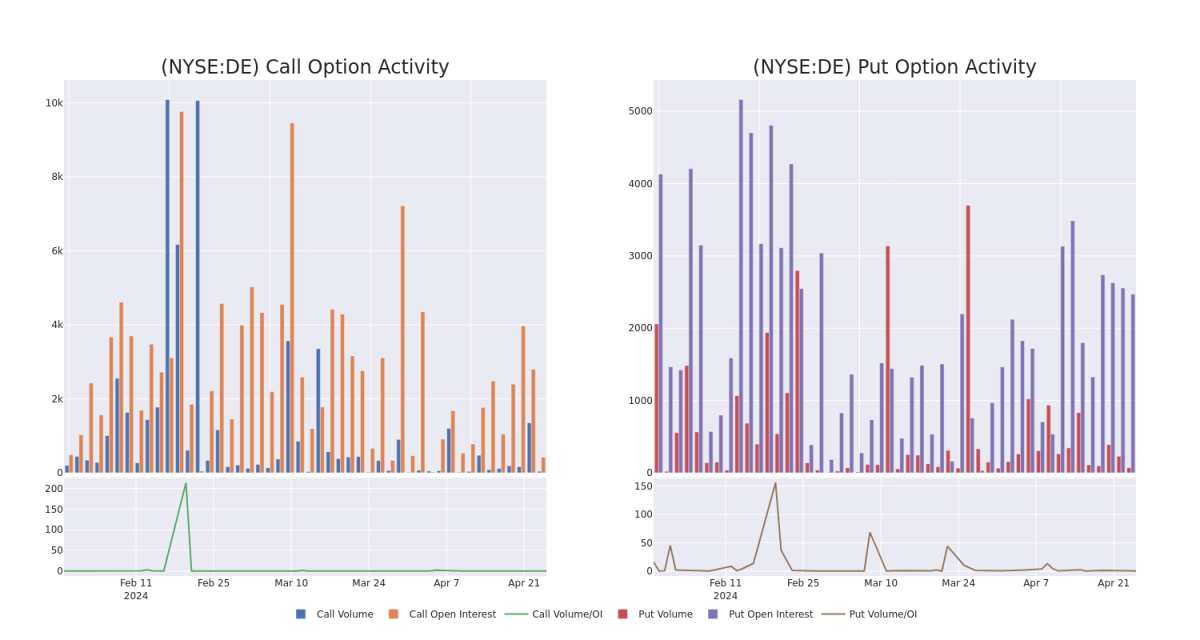

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Deere's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Deere's substantial trades, within a strike price spectrum from $370.0 to $420.0 over the preceding 30 days.

Deere 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | CALL | SWEEP | BEARISH | 06/21/24 | $31.5 | $31.5 | $31.5 | $370.00 | $126.0K | 389 | 0 |

| DE | CALL | TRADE | NEUTRAL | 06/20/25 | $59.8 | $58.55 | $59.22 | $380.00 | $88.8K | 33 | 15 |

| DE | PUT | SWEEP | BEARISH | 01/17/25 | $34.9 | $33.4 | $34.9 | $400.00 | $80.2K | 730 | 0 |

| DE | PUT | TRADE | BULLISH | 09/20/24 | $41.15 | $40.3 | $40.3 | $420.00 | $40.3K | 70 | 11 |

| DE | PUT | SWEEP | BULLISH | 01/17/25 | $30.9 | $28.35 | $30.9 | $390.00 | $37.0K | 569 | 0 |

About Deere

Deere is the world's leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

Present Market Standing of Deere

- With a volume of 594,513, the price of DE is down -0.95% at $390.86.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 22 days.

Professional Analyst Ratings for Deere

1 market experts have recently issued ratings for this stock, with a consensus target price of $425.0.

- An analyst from JP Morgan has decided to maintain their Neutral rating on Deere, which currently sits at a price target of $425.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Deere options trades with real-time alerts from Benzinga Pro.