Financial giants have made a conspicuous bearish move on MercadoLibre. Our analysis of options history for MercadoLibre (NASDAQ:MELI) revealed 12 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 58% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $404,540, and 5 were calls, valued at $182,404.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $1300.0 to $2600.0 for MercadoLibre over the last 3 months.

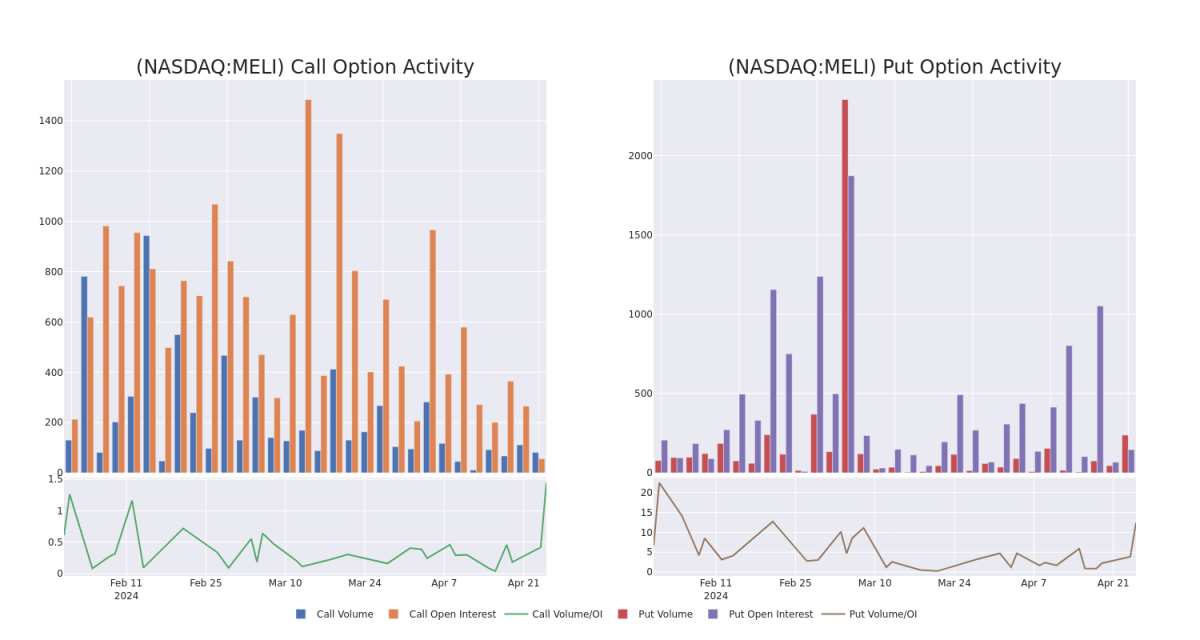

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for MercadoLibre's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MercadoLibre's whale activity within a strike price range from $1300.0 to $2600.0 in the last 30 days.

MercadoLibre Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | PUT | SWEEP | BULLISH | 05/03/24 | $26.7 | $21.4 | $21.4 | $1300.00 | $107.0K | 14 | 64 |

| MELI | PUT | SWEEP | BEARISH | 05/03/24 | $22.0 | $20.1 | $22.0 | $1300.00 | $99.0K | 14 | 54 |

| MELI | PUT | SWEEP | BULLISH | 05/10/24 | $37.5 | $34.0 | $34.0 | $1300.00 | $85.0K | 42 | 75 |

| MELI | CALL | TRADE | BEARISH | 05/17/24 | $59.5 | $57.0 | $57.0 | $1370.00 | $57.0K | 5 | 80 |

| MELI | CALL | TRADE | NEUTRAL | 01/16/26 | $368.0 | $351.1 | $361.0 | $1310.00 | $36.1K | 1 | 0 |

About MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

After a thorough review of the options trading surrounding MercadoLibre, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of MercadoLibre

- Trading volume stands at 88,368, with MELI's price down by -0.77%, positioned at $1359.49.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 11 days.

Professional Analyst Ratings for MercadoLibre

In the last month, 4 experts released ratings on this stock with an average target price of $1835.0.

- An analyst from Citigroup persists with their Buy rating on MercadoLibre, maintaining a target price of $1940.

- Maintaining their stance, an analyst from UBS continues to hold a Buy rating for MercadoLibre, targeting a price of $1800.

- An analyst from Wedbush persists with their Outperform rating on MercadoLibre, maintaining a target price of $1800.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for MercadoLibre, targeting a price of $1800.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest MercadoLibre options trades with real-time alerts from Benzinga Pro.