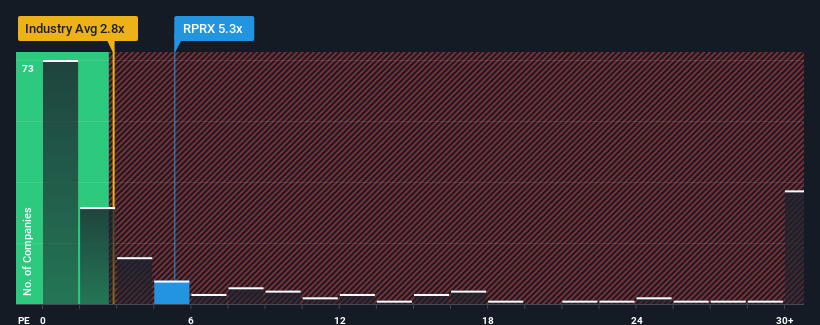

You may think that with a price-to-sales (or "P/S") ratio of 5.3x Royalty Pharma plc (NASDAQ:RPRX) is a stock to avoid completely, seeing as almost half of all the Pharmaceuticals companies in the United States have P/S ratios under 2.8x and even P/S lower than 0.8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Royalty Pharma's Recent Performance Look Like?

Recent revenue growth for Royalty Pharma has been in line with the industry. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Royalty Pharma's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Royalty Pharma would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 5.2% gain to the company's revenues. The latest three year period has also seen a 11% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 11% per annum as estimated by the seven analysts watching the company. That's shaping up to be materially lower than the 17% per year growth forecast for the broader industry.

In light of this, it's alarming that Royalty Pharma's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Royalty Pharma's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that Royalty Pharma currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Royalty Pharma, and understanding them should be part of your investment process.

If you're unsure about the strength of Royalty Pharma's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.