The CSP Inc. (NASDAQ:CSPI) share price has softened a substantial 33% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 117% in the last twelve months.

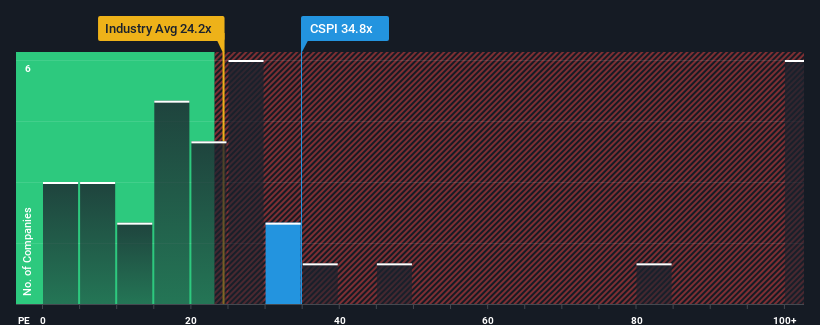

In spite of the heavy fall in price, CSP may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 34.8x, since almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

The earnings growth achieved at CSP over the last year would be more than acceptable for most companies. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Is There Enough Growth For CSP?

There's an inherent assumption that a company should far outperform the market for P/E ratios like CSP's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 24% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 1,607% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 12% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why CSP is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On CSP's P/E

CSP's shares may have retreated, but its P/E is still flying high. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that CSP maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for CSP (of which 1 is a bit unpleasant!) you should know about.

Of course, you might also be able to find a better stock than CSP. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.