“Roll up your sleeves and work hard”!

Under the AI carnival, South Korean chip giant SK Hynix will usher in a record year.

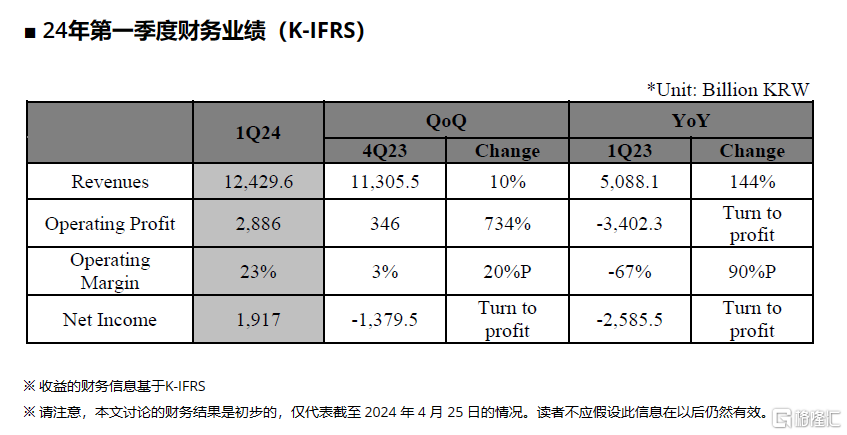

On April 25, SK Hynix announced the latest quarterly earnings report. Due to a sharp increase in sales volume in the flash memory (NAND) division, advanced DRAM chips are boomingQ1 revenue reached a record high, and operating profit reached the second highest.

As a chip manufacturing supplier for tech giants such as Nvidia, SK Hynix's stock price has nearly doubled in the past 12 months, and the cumulative increase so far this year has exceeded 20%, making it the second-largest chip manufacturer in the world after Samsung Electronics.

HoweverDespite strong performance, the company's stock price did not rise but fell today.As of press release, SK Hynix fell more than 4% to 171,300 won in the Korean stock market.

Big explosion in Q1 performance

Financial reports show that SK Hynix's first quarterrevenuesIt was 12.43 trillion won (approximately US$9 billion), a year-on-year increase of 144%, a record high.

Operating profitAt 2.886 trillion won (approximately US$2,098 billion), the operating profit margin was 23%, turning a year-on-year loss into a profit, and setting the second highest record for the same period of the previous year.

net profitThe net profit margin was 1.92 trillion won (US$1.39 billion), and the net profit margin was 15%. Previously, there was a net loss for five consecutive quarters.

SK Hynix attributes this strong performance to “increased sales of AI server products and efforts to drive profits.”

With the advantages of artificial intelligence (AI) chip technology such as high-bandwidth memory (HBM), it is committed to increasing sales of AI server chips and maintaining a profit-based management model, thus obtainingExcellent results with operating profit surging 734% month-on-month.

In terms of flash memory, the NAND business successfully turned a loss into a profit as the share of sales volume and average selling price of enterprise solid-state drives (eSSDs), which are high-end products, increased.

SK Hynix believesAfter a long period of downturn, the company has entered a phase of clear rebound.

The company also predicts that as demand for AI memory continues to grow, the overall memory market will grow steadily in the next few months, and the traditional DRAM market will also recover from the second half of the year.

Chief Operating Officer Kim Woo Hyun said during the earnings call that demand for enterprise-grade solid-state drives helped SK Hynix's NAND business return to profit in the first quarter.

He said the 2024 investment will be slightly higher than planned at the beginning of the year, and most of the spending will be focused on high-margin products and infrastructure to achieve medium term growth.

“Roll up your sleeves and work hard”!

As demand for artificial intelligence chips surged, SK Hynix became the biggest beneficiary of the explosive growth in AI adoption.

In the chip market, Nvidia accounts for 80% of the market share of AI chips, and as Nvidia's sole supplier of HBM3, SK Hynix is certainly ready to “take off”.

In order to meet AI memory requirements, SK Hynix is now preparing to “roll up your sleeves and work hard”.

DRAM field,The company plans to increase the supply of HBM3E. Mass production of HBM3E began in March. This is the first time in the industry, while expanding the customer base.

The company will also launch a 32GB DDR5 product based on the 1bNM process, which is the fifth generation of 10nm technology to reinforce its leading position in the high-capacity server DRAM market during the year.

For the NAND business,SK Hynix will seek product optimization to maintain the trend of profit recovery.

SK Hynix will actively add its US subsidiary Solidigm's high-performance 16-channel ESSD and QLC-based1Sale of high-capacity eSSDs. Also, launch the 5th generation PCIe csSD for AI PCs as soon as possible to optimize the product lineup to respond to market demand.

Earlier this week, SK Hynix said it plans to invest about 15 billion US dollars in South Korea.To meet HBM chip production capacity.

A few days ago,SK Hynix announced that it will invest 5.3 trillion won (US$3.86 billion) to produce DRAM chips in South Korea.

The company plans to begin construction of a chip factory called the M15X at the end of April, and plans to achieve mass production by November 2025 to meet the surge in demand for AI chips.

The new production site aims to increase DRAM production capacity, with an emphasis on HBM.SK Hynix said that in the long run, the total investment will exceed 20 trillion won (about 14.6 billion US dollars).

In response, Counterpoint Research director Tom Kang said that SK Hynix's high-end memory production capacity for this year has been fully booked and a new factory is needed to meet demand.

He said that SK Hynix expects revenue to reach nearly 61 trillion won this year, with a profit margin of more than 20%.

“This is a clear shift for SK Hynix and the beginning of a record breaking year.”

In addition, SK Hynix is also advancing an investment plan for the Yongin semiconductor cluster in South Korea, which will eventually inject about 120 trillion won into the cluster. Construction of the first fab is scheduled to begin next year in Yongin City and be completed in 2027.

The company also plans to invest 3.9 billion US dollars to establish a high-end packaging factory and AI product research center in Indiana, USA.

At the same time, SK Hynix is also preparing to cooperate with TSMC to create 4 high-bandwidth memory chips and next-generation packaging technology. Mass production of HBM4 chips is expected to begin in 2026.

In an earnings conference call, Chief Financial Officer Kim Woo-hyun said that with the industry's best technology in the field of artificial intelligence storage led by HBM, SK Hynix has entered a clear recovery phase.

“We will continue to work to improve our financial performance by delivering the best-performing products in the industry at the right time and maintaining our profit-first commitment.”