Rio de Janeiro, Brazil, April 24, 2024 — “Thanks to our commitment to operational excellence, we are off to a good start to 2024. In the iron ore solutions business, iron ore sales increased 15% year over year, thanks to strong production — this quarter's production was the highest in the first quarter since 2019. Our growth projects are also being promoted, which will help improve the quality and flexibility of our product portfolio. In terms of the energy transition metals business, improved performance in the Salobo Integrated Operations Area and production completion at the Salobo Plant 3 contributed to an increase in copper production and sales. The Canadian nickel mine also achieved encouraging results, increasing the supply of its own ore. We are proud that we have fulfilled our commitment to society and achieved 100% renewable electricity in Brazil two years ahead of schedule. We're moving forward and will continue to work to make Vale a better place.” Vale CEO Eduardo Bartolomeo (Eduardo Bartolomeo) said.

Performance highlights

Operating performance

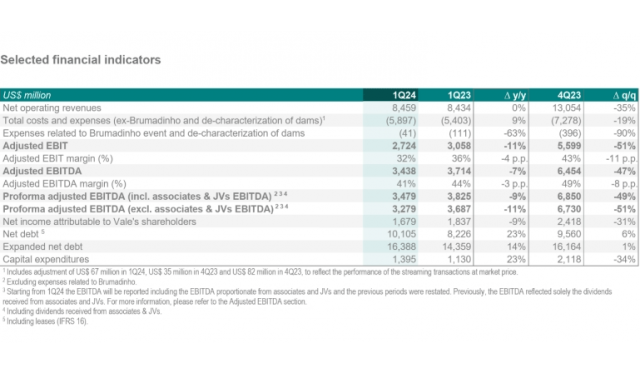

? In the first quarter of 2024, formally adjusted EBITDA (profit before interest, tax, depreciation and amortization, including the EBITDA share of US$203 million in associated companies and joint ventures) was US$3.5 billion, down 9% and 49% year over month, respectively, mainly due to weakening actual prices of iron ore powder. The month-on-month change was also affected by seasonal sales declines.

? In the first quarter of 2024, sales of iron ore and copper increased by 8.2 million tons and 141,000 tons, respectively, reaching 15% and 22% year-on-year increases, respectively, thanks to continued improvements in operating performance.

? In the first quarter of 2024, despite being adversely affected by the appreciation of the Brazilian real, the C1 cash cost for iron ore powder (excluding third-party procurement) declined slightly year over year to $23.5 per ton.

? Free cash flow reached $2 billion in the first quarter of 2024, or the EBITDA cash conversion rate of 57%, which was positively impacted by strong receipts from sales in the fourth quarter of 2023.

Disciplined capital allocation

? In the first quarter of 2024, capital expenditure was $1.4 billion, up $300 million year over year, in line with expectations. Capital expenditure for the Serra Sul 120 Mtpy (Serra Sul 120 Mtpy) project is expected to rise to 2.8 billion US dollars, mainly due to the inflationary economic situation since project approval and the nearly 18-month delay in issuing project installation permits, which have led to an increase in input and service procurement costs. The project is expected to commence in the second half of 2026, and Vale's 2024 capital expenditure guidance target remains unchanged at $6.5 billion.

? Total liabilities and lease liabilities as of March 31, 2024 were $14.7 billion, an increase of $800 million over the previous month, mainly due to Vale and Vale Base Metals receiving new loans under the debt management plan.

? Total net liabilities as of March 31, 2024 were US$16.4 billion, an increase of US$200 million over the previous month, mainly due to an increase in net liabilities. Vale's total net debt target remains between $10 billion and $20 billion.

Value creation and distribution

? A total of $275 million was disbursed during the quarter for the fourth share repurchase program. As of the date of publication of this report, the fourth share repurchase plan has been completed by 17% 1, and 29.9 million shares have been repurchased.

Recent developments

? Vale has reached an agreement to acquire Cemig Gera for R $2.7 billion?? O e Transmiss? Alian held by o S.A.? a Gera?? O de Energia S.A. (“Alian? a Energia”) 45% equity. Will Vale hold Alian after the deal is completed? 100% equity in a Energia. Alian? a Energia's power generation asset portfolio includes 7 hydroelectric power plants and 3 wind power plants in Brazil, with a total installed capacity of 1,438 megawatts and an average actual generation capacity of 755 megawatts. The deal is in line with Vale's strategy to establish an energy matrix based on renewable energy in Brazil and will support the company's commitment to decarbonize operations at a competitive cost.

Focus on and strengthen core business

? Iron ore solutions business is gaining momentum:

? The US Department of Energy has selected Vale USA (Vale's wholly-owned subsidiary) to negotiate funding for the Bipartisan Infrastructure Act and the Inflation Reduction Act. Vale aims to raise $282.9 million to develop iron ore briquetting plants customized for direct reduction routes in the US, and plans to develop similar plants in Brazil and globally. Iron ore briquetting technology, developed by Vale in Brazil, will support the global steel industry. The world's first briquetting plant opened in Victoria, Brazil, in 2023.

? Build a unique energy transition metals business:

? Last week, the US Committee on Foreign Investment (CFIUS) passed the final regulatory approval for the energy transition metals cooperation project. The deal is expected to close in the coming weeks.

? In February 2024, a final agreement was signed on the divestment of PTVI in Indonesia. Under the agreement, Vale Canada Ltd (“VCL”) will receive $160 million 2 in cash upon completion of the transaction. The deal is expected to close before the end of 2024, after meeting customary closing conditions. After the transaction is completed, VCL will hold 33.9% of PTVI's shares.

Promoting sustainable mining

? Vale plans to achieve 100% renewable electricity supply in Brazil by 2025, and has now reached the target two years ahead of schedule. After reaching this goal, Vale has eliminated indirect carbon dioxide emissions (or “Scope 2” emissions) generated by the company in Brazil. The company is still facing the challenge of “achieving 100% renewable electricity globally by 2030,” which has now been achieved by 88.5%.

? In March 2024, the Peneirinha (Peneirinha) dam located in the Vargem Grande (Vargem Grande) integrated operation area was lifted from the emergency response level by Brazil's National Mining Authority. The building has obtained a Stability Condition Statement and its safety has been certified. This is Vale's 12th dam in the past two years to remove emergency response levels.

? In April 2024, Morningstar Sustainalytics downgraded Vale's ESG risk rating from 35.3 to 31.2, indicating further recognition of our efforts to build a safer and more sustainable company.

reparations

? Brumadinho's Comprehensive Reparation Agreement continues to advance, and 69 per cent of agreed commitments have been fulfilled in accordance with the settlement deadline.

? In terms of compensation, Mariana has paid about 36 billion reais for redress and compensation, and the resettlement program is about 85% complete.