Whales with a lot of money to spend have taken a noticeably bullish stance on Snowflake.

Looking at options history for Snowflake (NYSE:SNOW) we detected 27 trades.

If we consider the specifics of each trade, it is accurate to state that 51% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $803,054 and 18, calls, for a total amount of $849,834.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $200.0 for Snowflake over the recent three months.

Insights into Volume & Open Interest

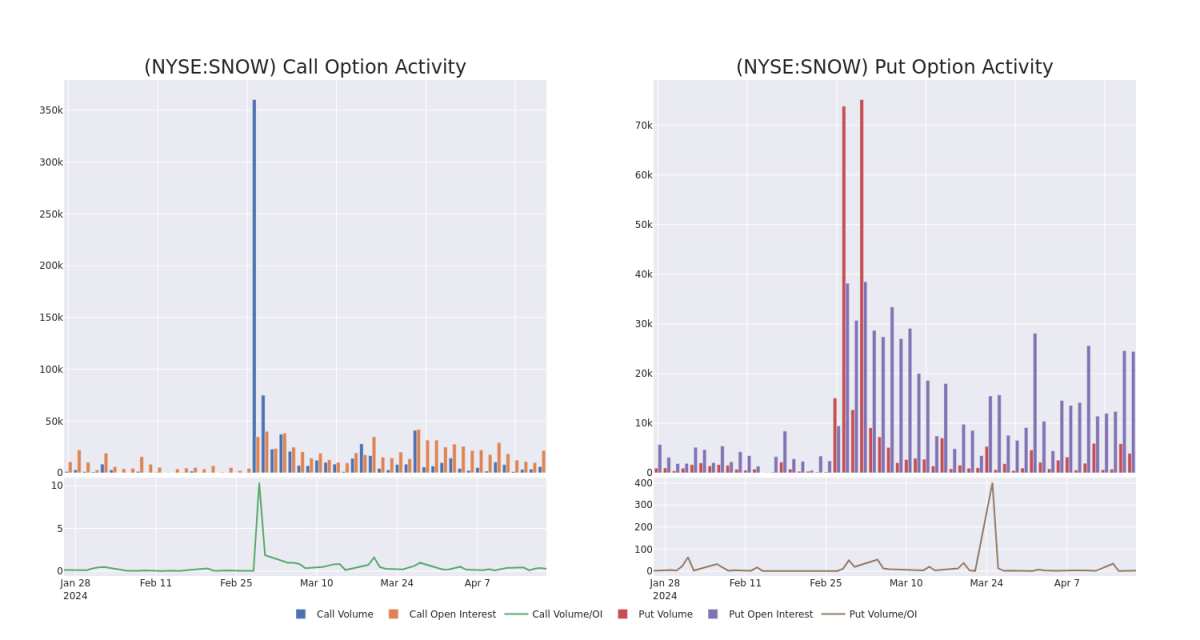

In terms of liquidity and interest, the mean open interest for Snowflake options trades today is 1128.0 with a total volume of 11,799.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Snowflake's big money trades within a strike price range of $100.0 to $200.0 over the last 30 days.

Snowflake Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | PUT | TRADE | BULLISH | 01/16/26 | $28.8 | $28.1 | $28.25 | $145.00 | $423.7K | 270 | 150 |

| SNOW | PUT | SWEEP | BEARISH | 05/17/24 | $4.9 | $4.75 | $4.8 | $150.00 | $101.2K | 2.4K | 440 |

| SNOW | CALL | SWEEP | BULLISH | 05/17/24 | $4.25 | $4.15 | $4.19 | $160.00 | $75.1K | 2.9K | 1.2K |

| SNOW | CALL | TRADE | BULLISH | 05/03/24 | $2.72 | $2.71 | $2.72 | $160.00 | $73.4K | 1.1K | 779 |

| SNOW | PUT | SWEEP | BEARISH | 03/21/25 | $5.8 | $5.7 | $5.8 | $100.00 | $70.7K | 0 | 123 |

About Snowflake

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that came public in 2020. To date, the company has over 3,000 customers, including nearly 30% of the Fortune 500 as its customers. Snowflake's data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake's data sharing capability allows enterprises to easily buy and ingest data almost instantaneously compared with a traditionally months-long process. Overall, the company is known for the fact that all of its data solutions that can be hosted on various public clouds.

Following our analysis of the options activities associated with Snowflake, we pivot to a closer look at the company's own performance.

Present Market Standing of Snowflake

- Currently trading with a volume of 2,954,988, the SNOW's price is up by 2.19%, now at $154.47.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 28 days.

Professional Analyst Ratings for Snowflake

In the last month, 2 experts released ratings on this stock with an average target price of $185.0.

- An analyst from Rosenblatt has elevated its stance to Buy, setting a new price target at $185.

- An analyst from Keybanc has revised its rating downward to Overweight, adjusting the price target to $185.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Snowflake options trades with real-time alerts from Benzinga Pro.