[[Contract won the bid]

Hengshang Energy Saving (603137.SH): won the bid for the Pujiang Laboratory Permanent Housing Project Façade Project

Hengshang Energy Saving (603137.SH) announced that it recently received a notice of winning the bid from China Construction Eighth Engineering Bureau Co., Ltd. Project name: The curtain wall project for the Pujiang Laboratory permanent housing project, with a bid amount of 128.5854 million yuan.

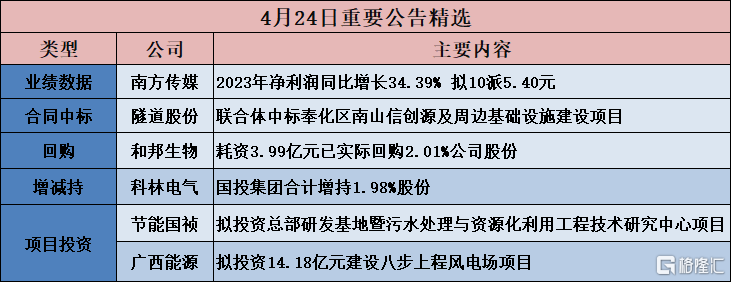

Tunnel Co., Ltd. (600820.SH): The consortium won the bid for the Nanshan Xinchuangyuan and surrounding infrastructure construction project in Fenghua District

Tunnel Co., Ltd. (600820.SH) announced that recently, Shanghai Infrastructure Construction and Development (Group) Co., Ltd., a wholly-owned subsidiary of Shanghai Tunnel Engineering Co., Ltd., and Zhejiang Chengkai Construction and Development (Group) Co., Ltd. formed a consortium to participate in the public tender for the “Nanshan Xinchuangyuan and Surrounding Infrastructure Construction Project Partners in Fenghua District”. According to the winning bid notice issued by the tenderer, Ningbo Fenghua District Transportation Investment and Development Group Co., Ltd., the sample project won by the consortium was determined. The main investment and construction of this project includes 7 sub-projects, including the Nanshan Xinchuangyuan Plant Renovation Project in Fenghua District, the Xiaowei Garden Project, the Smart Apartment Project, the Supporting Center Project, the Zhengting Road and Xipu South Road road projects, the Mile Avenue widening project, and the Fenghua West Ring Road (Baohua Road to East Ring Road section) highway project. The total investment of the project was 7.193 billion yuan. The cooperation period is 20 years, of which the construction period is 5 years and the operation period is 15 years.

[Performance data]

Lixun Precision (002475.SZ): Net profit of 2,471 billion yuan in the first quarter increased 22.45% year-on-year

Lixun Precision (002475.SZ) released its report for the first quarter of 2024. Operating revenue for the reporting period was 52.407 billion yuan, up 4.93% year on year; net profit attributable to shareholders of listed companies was 2,471 billion yuan, up 22.45% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 2.183 billion yuan, up 23.23% year on year; basic earnings per share were 0.35 yuan.

Kibing Group (601636.SH): Net profit of 1,751 billion yuan in 2023, plans to distribute 10 to 3.30 yuan

Kibing Group (601636.SH) released its 2023 annual report. The company achieved revenue of 15.683 billion yuan in 2023, up 17.8% year on year; net profit to mother of 1,751 billion yuan, up 32.98% year on year; net profit after deducting non-net profit of 1,662 billion yuan, up 39.41% year on year; and basic earnings per share of 0.6552 yuan. The company plans to pay a cash dividend of RMB 3.30 (tax included) for every 10 shares.

Zhongke Flying Test (688361.SH): Net profit of 140 million yuan in 2023, plans to distribute 10 to 1.40 yuan

Zhongke Flying Test (688361.SH) released its 2023 annual report. During the reporting period, it achieved operating income of 891 million yuan, an increase of 74.95%; net profit attributable to shareholders of listed companies of 140 million yuan, an increase of 1,07.2.38% over the previous year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of RMB 3.693 million; and basic earnings per share of 0.49 yuan. The company plans to pay a cash dividend of 1.40 yuan (tax included) for every 10 shares.

Deye Co., Ltd. (605117.SH): Net profit increased 18.03% year-on-year in 2023, and plans to transfer 10 to 4 of 21 yuan

Deye Co., Ltd. (605117.SH) announced its 2023 annual report. During the reporting period, it achieved operating income of 7.48 billion yuan, an increase of 25.59%; net profit attributable to shareholders of listed companies of 1,791 billion yuan, an increase of 18.03%; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 1,853 billion yuan, an increase of 20.72% year on year; and basic earnings per share of 4.17 yuan. The company plans to distribute a cash dividend of 21.00 yuan (tax included) for every 10 shares to all shareholders. It is proposed to transfer the share capital to all shareholders using the capital reserve fund. For every 10 shares, 4 shares will be added, and no bonus shares will be given.

Southern Media (601900.SH): Net profit increased by 34.39% year-on-year in 2023, and plans to distribute 10 to 5.40 yuan

Southern Media (601900.SH) released its 2023 annual report. During the reporting period, it achieved operating income of 9.365 billion yuan, an increase of 3.35%; net profit attributable to shareholders of listed companies of 1,284 million yuan, an increase of 34.39%; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 891 million yuan, an increase of 0.31% year on year; and basic earnings per share of 1.46 yuan. It is proposed to distribute cash dividends of 5.40 yuan (tax included) for every 10 shares to all shareholders.

Ousheng Electric (301187.SZ): Net profit of 42.7830 million yuan for the first quarter increased by 126.69% year-on-year

Ousheng Electric (301187.SZ) released its report for the first quarter of 2024. Operating revenue for the reporting period was 326 million yuan, up 33.80% year on year; net profit attributable to shareholders of listed companies was 42.783 million yuan, up 126.69% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 39.981 million yuan, up 144.80% year on year; basic earnings per share were 0.2491 yuan.

Great Wall Motor (601633.SH): Net profit of 3.28 billion yuan in the first quarter increased by 1752.55% year-on-year

Great Wall Motor (601633.SH) released its first quarter report. Total operating revenue was 42.86 billion yuan, up 47.60% year on year, net profit of 3.228 billion yuan, up 175 2.55% year on year, after deducting non-net profit of 2,024 billion yuan, and basic earnings per share of 0.38 yuan.

Oupai Home (603833.SH): Net profit in 2023 increased 12.92% year-on-year, and plans to pay 10 to 27.6 yuan

Oupai Home (603833.SH) released its 2023 annual report. During the reporting period, it achieved operating income of 22.782 billion yuan, an increase of 1.35%; net profit attributable to shareholders of listed companies of 3,036 billion yuan, an increase of 12.92% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 2,746 billion yuan, an increase of 5.91% year on year; and basic earnings per share of 4.98 yuan. It is proposed to distribute a cash dividend of 2.76 yuan (tax included) per share to all shareholders.

Hisense Home Appliances (000921.SZ): Net profit of 981 million yuan in the first quarter increased 59.48% year over year

Hisense Home Appliances (000921.SZ) released its report for the first quarter of 2024, with operating income of 23.486 billion yuan, up 20.87% year on year; net profit attributable to shareholders of listed companies of 981 million yuan, up 59.48% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 838 million yuan, up 60.89% year on year; basic earnings per share of 0.72 yuan.

Linglong Tire (601966.SH): Net profit in 2023 increased 376.88% year-on-year, and plans to pay 10 2.86 yuan

Linglong Tire (601966.SH) released its 2023 annual report. During the reporting period, it achieved operating income of 20.065 billion yuan, an increase of 18.58%; net profit attributable to shareholders of listed companies of 1,391 billion yuan, an increase of 376.88%; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 1,295 yuan, an increase of 622.52% year on year; and basic earnings per share of 0.95 yuan. It is proposed to distribute a cash dividend of 2.86 yuan (tax included) for every 10 shares to all shareholders.

[Repurchase]

Hebang Biotech (603077.SH): It has actually repurchased 2.01% of the company's shares at a cost of 399 million yuan

Hebang Biotech (603077.SH) announced that on April 23, 2024, the company completed this repurchase. It has actually repurchased 177,465,409 shares, accounting for 2.01% of the company's total share capital. The highest repurchase price is 2.46 yuan/share, the lowest repurchase price is 2.06 yuan/share, the average repurchase price is 2.25 yuan/share, and the total capital used is 399 million yuan.

[Increase or decrease holdings]

Babi Foods (605338.SH): Tianjin Huiping, Tianjin Drinks, and Tianjin Babi plan to reduce their holdings

Babi Foods (605338.SH) announced that Tianjin Huiping, Tianjin China Drink, and Tianjin Babi plan to reduce their holdings of the company's shares by no more than 796,909 shares (that is, no more than 0.32% of the company's current total share capital), no more than 1,065,399 shares (that is, no more than 0.43% of the company's current total share capital), and no more than 2,135,711 shares (that is, no more than 0.85% of the company's current total share capital) through centralized bidding and bulk transactions.

Colin Electric (603050.SH): SDIC Group increased its total shares by 1.98%

Colin Electric (603050.SH) announced that the company recently received a notification letter from shareholder Shijiazhuang State-owned Capital Investment and Operation Group Co., Ltd. (“SDIC Group”): China Investment Group increased its total holdings of the Company's shares by 4,499,960 shares through the Shanghai Stock Exchange centralized bidding system on April 23 and April 24, 2024, with a change ratio of 1.98%. As of April 24, the number of shares held by SDIC reached 22,190,708 shares, with a shareholding ratio of 9.77%.

[Project investment]

Guangxi Energy (600310.SH): Plans to invest 1,418 billion yuan to build an eight-step Shangcheng wind farm project

Guangxi Energy (600310.SH) announced that in order to seize the country's development opportunities to achieve the dual carbon target and vigorously develop the new energy industry, actively explore and develop the new energy business, develop and expand the company's main power supply business, and cultivate new power points and profit growth points, the company plans to invest 1417.95.28 million yuan (total dynamic investment) to build an eight-step Shangcheng wind farm project.

Energy Saving Guozhen (300388.SZ): Proposed investment in the headquarters R&D base and sewage treatment and resource utilization engineering technology research center project

Energy Saving Guozhen (300388.SZ) announced that on April 24, 2024, the company held the 30th meeting of the 7th board of directors to review and pass the “Proposal on Investment Headquarters R&D Base and Sewage Treatment and Resource Utilization Engineering Technology Research Center Project”. Through the establishment of an engineering technology research center for sewage treatment and resource utilization, we will strengthen engineering research on common core technologies in the field of environmental protection for the environmental protection industry, continuously provide core technology and engineering results for the company's innovation and development, promote the application of innovative products in the field of environmental protection, and promote the company's leapfrog development. The investment amount is approximately RMB 582 million (final total investment is based on actual investment).