With the disclosure of the fund's report for the first quarter of 2024, the trend of public fund position adjustments came to light.

According to China Merchants Securities data, there are roughly three ideas for active partial equity fund position adjustments in the first quarter:

The first is to lay out a stable dividend section. Add sectors with high dividends, low fluctuation and abundant free cash flow, such as coal mining, electricity, major state-owned banks, railways and highways.

The second is to lay out the offshore chain sector. With the gradual recovery of overseas demand, the export chain is relatively prosperous, and some overseas sectors such as white goods, light industry, and construction machinery have been boosted to varying degrees.

The third is the layout of the resource products sector, which is mainly catalyzed by the strengthening of global commodity prices. Supply is expected to shrink, and prices for industrial metals such as copper and aluminum with low inventory levels have risen. The intrinsic value of the US dollar continues to depreciate due to overspending of US debt. Demand for gold purchases by central banks is strong. Combined with geographical conflicts, the safe-haven value of precious metals is highlighted, and prices of precious metals such as gold have risen sharply.

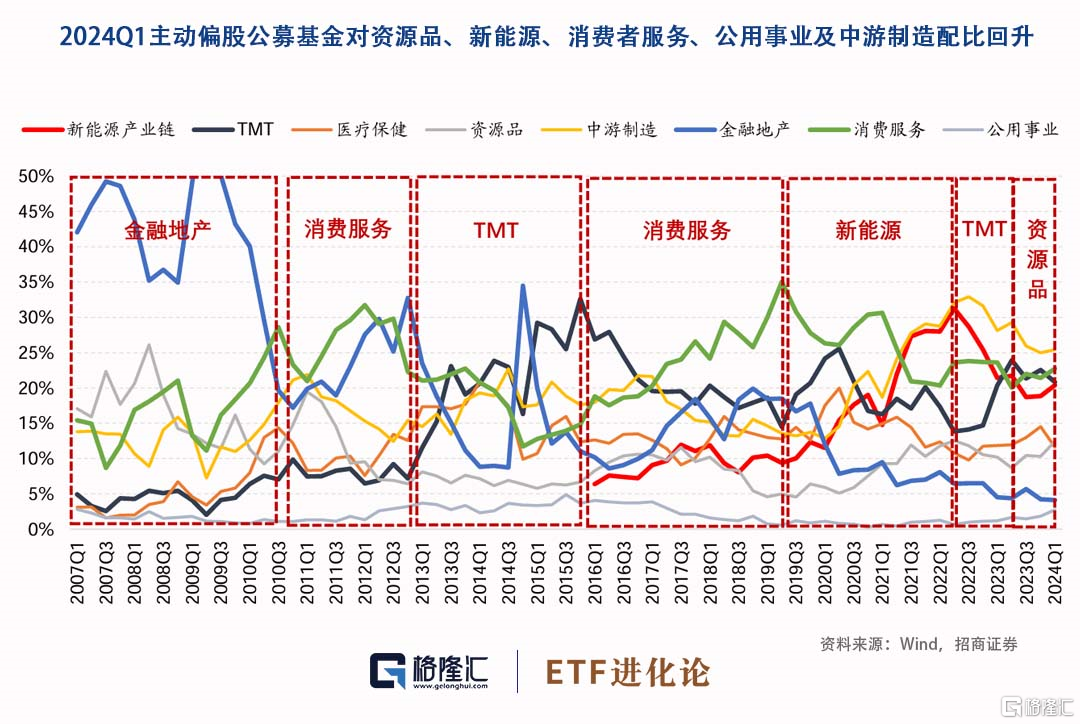

The ratio of active partial equity public funds to resources, new energy, consumer services, and utilities rebounded in 2024Q1, while the ratio of pharmaceuticals, TMT, and financial real estate declined.

Ratio recovery sector: The ratio of resource products was 12.4%, up 2.11% from the previous period, and was 97.7% in the past ten years. The ratio of new energy sources was 20.4%, up 1.53% from the previous period, and 71.9% in the past ten years. The consumer service ratio was 22.7%, up 1.31% from the previous period, and 50% in the past ten years. The utility ratio was 2.7%, up 0.88% from the previous period, to 63.6% in the past ten years. The midstream manufacturing ratio was 25.4%, up 0.45% from the previous period, or 79.5% in the past ten years.

Ratio decline sector: pharmaceutical ratio decreased by 11.6%, down 2.92% from the previous period, to 18.2% in the past ten years; TMT ratio of 20.8%, down 1.74% from the previous period, to the rank of 61.4% in the past ten years; financial real estate ratio of 4.1%, down 0.12% from the previous period.

According to the data, by the end of the first quarter of 2024, Kweichow Moutai and Ningde Times were the first and second largest stocks. The top three A-share holdings increased by Ningde Times, Zijin Mining, and Midea Group, which increased their market holdings by 29.256 billion yuan, 21.522 billion yuan, and 14.637 billion yuan, respectively.

Among them, private equity boss Deng Xiaofeng “has a good heart” and Zijin Mining, a star stock in the resources sector, entered the top ten public fund holdings in the first quarter of 2024.

As early as 2019, products managed by Deng Xiaofeng first appeared in the top ten tradable stocks, and since then they have been heavily invested in this company.

Regarding the trend of industrial metals, Deng Xiaofeng once made a wonderful statement. In his review and outlook for 2022, he said, “Some upstream industrial metal varieties face a completely different supply and demand structural environment from the past, and their downward price elasticity will shrink and upward elasticity will increase. However, considering the uncertainty of economic growth in overseas developed countries in 2023, and that domestic economic growth is still in the early stages of recovery, short-term demand for these products is under pressure within 1-2 years. However, in the medium to long term, fluctuations caused by short-term uncertainty provide a better investment window.”

By the end of the third quarter of 2023, the two products managed by Deng Xiaofeng held 709 million shares in Zijin Mining. In the first quarter of 2024, the number of shares held by Deng Xiaofeng's two products was reduced to 611 million shares.

Private equity boss Deng Xiaofeng has continued to reduce his holdings in Zijin Mining for 5 quarters since the first quarter of last year. From the third quarter of last year to the first quarter of this year, there are obvious signs that public funds have increased their positions. The number of fund products in the top ten holding positions in Zijin Mining has increased dramatically from more than 500 to more than 1,000.

Zijin Mining achieved operating income of 74.777 billion yuan in 2024Q1, down 0.22% year on year and 9.33% month on month; realized net profit of 6.261 billion yuan, up 15.05% year on year, up 26.37% month on month; realized net profit without return to mother of 6.224 billion yuan, up 15.92% year on year and 2.89% month on month. In 2024 Q1, the company's mineral gold production was 16.8 tons, up 5.35% year on year, down 4.71% month on month; mineral copper production was 262,600 tons, up 5.19% year on year, up 3.80% month on month; mineral zinc production was 98,500 tons, down 8.53% year on year, down 0.17% month on month. Increased production expansion of the company's core copper mines such as the Kamoa Copper Mine in the Democratic Republic of the Congo (DRC), the Tibet Julong Copper Mine, and the Serbian Pegi Copper and Gold Mine will provide strong support for the annual production target. In terms of gold, the 2024 Q1 Rosbell gold mine will produce 2 tons of gold, and the annual gold production will be 10 tons after technical transformation; Buritika gold mine will produce 2.2 tons of gold, and the planned mineral gold will be 8.6 tons for the whole year.

Regarding the resource sector, China-Europe fund manager Lan Xiaokang believes that the high prosperity and profits of the upstream resource sector may be maintained for a long time, and he is optimistic about the investment value of upstream resources products in the long term. First, global physical demand and recovery are still resilient, while supply constraints and uncertainties are high; second, the valuation of upstream assets (such as traditional industrial metal resources and energy and chemical products) is still low. Third, in an environment where the economy is recovering weakly, compared to other industries, the return on investment and dividends in the resource and energy industry will be more certain, and such assets will not lack flexibility. They have both offense and defense, and grasp of the pace of investment will be the winner or loser.

From the demand side, there are three main factors behind the rise in global physical demand: first, in the context of anti-globalization, regionalization is accelerating, and the gaps in energy resources and infrastructure in the Belt and Road countries are still large, which is expected to drive investment demand for infrastructure and physical assets; second, in the context of green transformation, the consumption intensity of new energy production capacity for non-ferrous metals far exceeds that of traditional energy; third, the role of fiscal policy is increasing, which is expected to further boost demand and benefit the physical sector. From the supply-side perspective, the supply growth of upstream resources is limited by various factors, including environmental protection policies and energy consumption restrictions, industrial chain restructuring, and tight labor supply.