Citi raised the target price of Xiaomi from HK$19.6 to HK$21.9 and maintained a “buy” rating, increasing the adjusted EPS in 2024 by 25%. J.P. Morgan also continued to maintain Xiaomi's “overrated” rating and set the target price at HK$21.0.

On April 23, Lei Jun shared the latest progress of the Xiaomi SU7 at the Xiaomi Investors Conference: the number of locked orders has exceeded 70,000 units, and the delivery target is 100,000 units this year.

Lei Jun said that Xiaomi will also invest 11 billion to 12 billion dollars in new businesses, including automobiles, to focus 100% on the domestic market within three years, with the goal of becoming the top five global car manufacturers in the next 15 to 20 years.

After Investor Day ended, Wall Street banks Citi and J.P. Morgan immediately released review reports, expressing their optimism about Xiaomi.

Citi raised its target price for Xiaomi from HK$19.6 to HK$21.9 and maintained a “buy” rating. J.P. Morgan also continued to maintain Xiaomi's “overrated” rating and set the target price at HK$21.0.

As of press release, the Hong Kong stock price of Xiaomi was reported at HK$16.52, an increase of more than 11% over the past month.

J.P. Morgan Chase and Citi are both optimistic about Xiaomi cars

As Lei Jun summed it up, Xiaomi is already at the table in the automotive field, but it is too early to talk about success. It still has to go through the three hurdles of quality, delivery, and service before it can truly succeed.

Regarding the electric vehicle business, Xiaomi Investor Day conveyed a number of positive messages: sales exceeded expectations, gross margin is expected to be corrected in 2024, a gross profit margin of 5-10% is expected in 2025, and operating expenses are also controlled.

- Xiaomi has already secured orders for 70,000 electric vehicles, and is expected to ship 100,000 units in 2024, far exceeding initial estimates.

- Demand is biased towards the high-end market. SU7 Max accounts for more than 40% of orders, and the average order price exceeds expectations. The current focus is on increasing production capacity, and the goal is to produce 10,000 vehicles per month in June.

- Xiaomi plans to invest an additional 11 billion to 12 billion dollars in new businesses, including automobiles, while further increasing investment in several key areas such as the underlying operating system.

- Lei Jun said that Xiaomi will focus 100% on the domestic market in the next three years, and getting the Chinese market ready is the first step.

- Xiaomi's goal is not a low level of profit, but rather to become one of the top five car manufacturers in the world in the next 15 to 20 years, and become a new generation of global hard-core technology leaders.

- Xiaomi anticipates that the gross margin of the electric vehicle business is expected to improve in 2024 and achieve a gross profit margin of 5-10% in 2025. J.P. Morgan believes that next year's gross margin expectations are entirely likely to be realized. A break-even balance can be achieved when the annual sales volume of Xiaomi vehicles reaches 30-400,000 units.

- According to Lei Jun's statement on Investor Day, J.P. Morgan predicts that Xiaomi will launch an SUV model in 2025, or drive continued growth in car sales.

Citi raised Xiaomi's electric vehicle shipment forecast for 2024 to 2026 to 100,000 units, 200,000 units, and 280,000 units (previously 60,000 units, 131,000 units, and 252,000 units), and raised the gross margin forecast to 6%, 9%, and 12% (previously -10%, -2%, and 11%).

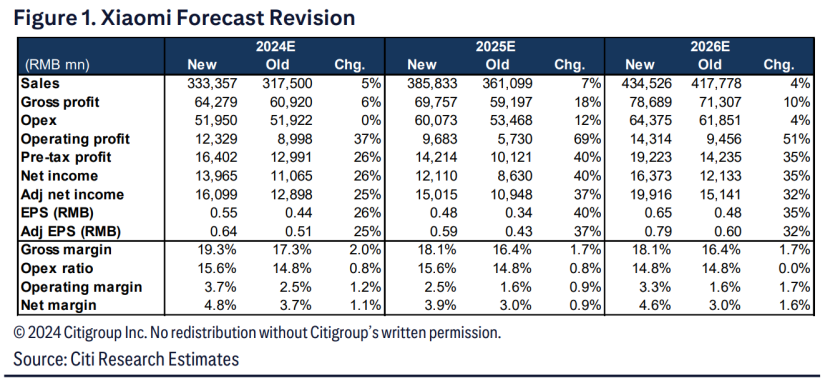

Based on the electric vehicle business's guidelines for exceeding expectations, Citi raised Xiaomi's adjusted earnings per share (EPS) forecast for 2024 to 2026 by 25%, 37%, and 32%, respectively, to 0.64 yuan, 0.59 yuan, and 0.79 yuan.

However, J.P. Morgan believes that the electric vehicle business may drag down Xiaomi's profitability before it is scaled up, lowering the adjusted EPS forecast for 2024 by 3% to 0.71 yuan and the 2025 forecast by 26% to 0.85 yuan.

Smartphone gross margin declined only slightly, and the core hardware business is back on a growth trajectory

Other perspectives, and key messages from Investor Day include:

- Smartphone shipments increased by 15 million to 20 million units this year, and R&D expenses were 24 billion yuan; gross margin may decline due to pressure on raw material costs, but the margin is manageable.

- Xiaomi aims to become the world's number one smartphone shipment by 2028; top three tablet shipments by 2025; smartphone shipments over $600 will increase 50% year-on-year in 2024; air conditioning sales will exceed 6 million units in 2024; and double the number of high-end Internet users in the next three years.

- Currently, Xiaomi is focusing most on the three businesses of automobiles, Surge OS, and AI.

- By 2025, the number of engineers on the intelligent driving team will increase from the current 1,000 to 2,000.

J.P. Morgan said that Xiaomi's core hardware business has finally returned to a growth trajectory and should continue to grow in 2024 with the help of the following factors:

- The position in China's high-end market has been further consolidated, driving a strong rise in average sales prices;

- Most of the loss of share in the Indian market has come to an end, and re-growth is expected in EMEA (Europe, Middle East and Africa) and Latin America;

- The AIoT (Artificial Intelligence+Internet of Things) business turned losses into profits. The product line is richer, the market share of new products (such as air conditioners, etc.) has increased, and overseas market business has grown.