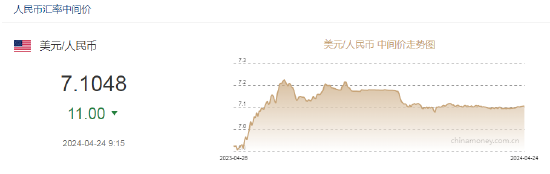

On April 24, the central price of RMB was 7.1048, up 11 points, and the median price for the previous trading day was 7.1059.

Citigroup economists think the Fed is likely to cut interest rates in June or July

It is still unclear whether the Federal Reserve will cut interest rates during 2024, causing many Wall Street analysts to adjust their market forecasts to accept the reality of revised interest rates. However, Citigroup strategists are still convinced that interest rates will be cut as early as June or July.

Citibank economist Veronica Clark (Veronica Clark) joined Market Domination to discuss why Citibank's US Federal Reserve predictions have not wavered. Clark stated bluntly: “We still have a basic forecast for June or July. But I think the fundamental difference for us is that we do think the Fed has a more dovish response. But that's not to say we're seeing some miraculous deceleration in inflation data; if so, we still think inflation is very sticky. And we think the Federal Reserve is studying some labor market data, even our survey data and PMI service employment data this morning, and are worried that we may be entering a weak labor market, and we really want to prevent this from happening.”

Oak Capital Max: The Federal Reserve will not cut interest rates to ultra-low levels

While the market is anxious for the Federal Reserve to start cutting interest rates as soon as possible, Oak Capital co-founder Howard Marks (Howard Marks) said that the Federal Reserve will not lower interest rates to ultra-low levels, but he thinks this is a good thing.

Investors have been expecting the Federal Reserve to cut interest rates since last year, but they have been continuously hit by reality. America's continued hot economy and unusually stubborn inflation have almost surprised everyone. The market's bet on how many times the Federal Reserve will cut interest rates this year has been reduced from six at the beginning of the year to only one or two. Some pessimists even think that there will probably be no interest rate cuts this year.