The International Genius Company (HKG:33) share price has fared very poorly over the last month, falling by a substantial 52%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 35% share price drop.

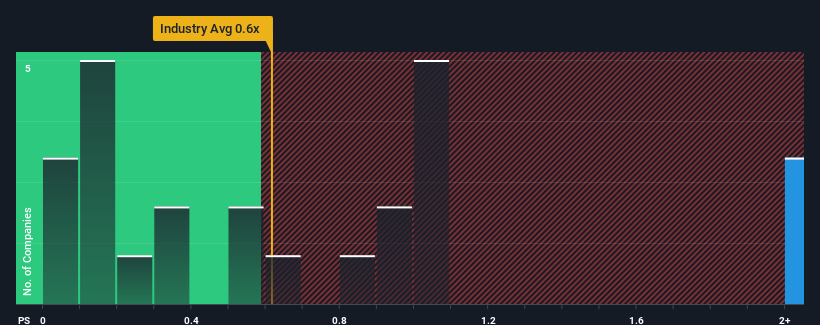

In spite of the heavy fall in price, given around half the companies in Hong Kong's Retail Distributors industry have price-to-sales ratios (or "P/S") below 0.6x, you may still consider International Genius as a stock to avoid entirely with its 8.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does International Genius' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at International Genius over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for International Genius, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is International Genius' Revenue Growth Trending?

International Genius' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. Even so, admirably revenue has lifted 240% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is only predicted to deliver 23% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why International Genius is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

Even after such a strong price drop, International Genius' P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that International Genius maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for International Genius (1 is concerning!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.