Financial giants have made a conspicuous bearish move on Wayfair. Our analysis of options history for Wayfair (NYSE:W) revealed 8 unusual trades.

Delving into the details, we found 12% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $127,350, and 6 were calls, valued at $238,353.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $25.0 to $65.0 for Wayfair over the last 3 months.

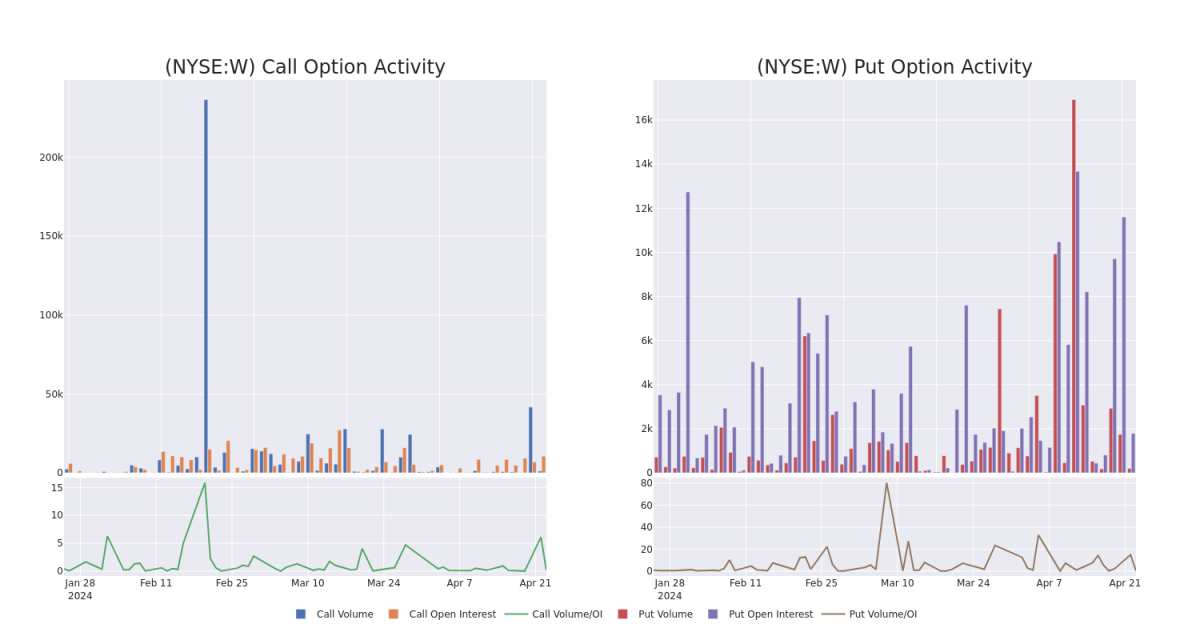

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Wayfair's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wayfair's whale trades within a strike price range from $25.0 to $65.0 in the last 30 days.

Wayfair 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| W | PUT | SWEEP | BEARISH | 06/21/24 | $4.95 | $4.8 | $4.95 | $55.00 | $98.9K | 830 | 200 |

| W | CALL | TRADE | NEUTRAL | 06/21/24 | $4.1 | $4.0 | $4.05 | $65.00 | $60.7K | 5.1K | 375 |

| W | CALL | TRADE | NEUTRAL | 06/21/24 | $3.95 | $3.85 | $3.9 | $65.00 | $52.6K | 5.1K | 351 |

| W | CALL | SWEEP | NEUTRAL | 01/17/25 | $35.9 | $32.75 | $34.6 | $25.00 | $34.6K | 724 | 0 |

| W | CALL | SWEEP | BEARISH | 05/17/24 | $4.15 | $4.1 | $4.1 | $60.00 | $32.8K | 4.0K | 350 |

About Wayfair

Wayfair engages in e-commerce in the United States (87% of 2023 sales), Canada, the United Kingdom, Germany, and Ireland. At the end of 2023, the firm offered more than 30 million products from more than 20,000 suppliers under the brands Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold. Its offerings include furniture, everyday and seasonal decor, decorative accents, housewares, and other home goods. Wayfair was founded in 2002 and began trading publicly in 2014.

Having examined the options trading patterns of Wayfair, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Wayfair Standing Right Now?

- With a trading volume of 673,539, the price of W is up by 5.87%, reaching $57.94.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 9 days from now.

What The Experts Say On Wayfair

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $75.8.

- An analyst from Wedbush downgraded its action to Outperform with a price target of $70.

- In a cautious move, an analyst from Morgan Stanley downgraded its rating to Overweight, setting a price target of $80.

- An analyst from Citigroup persists with their Buy rating on Wayfair, maintaining a target price of $85.

- Maintaining their stance, an analyst from Loop Capital continues to hold a Hold rating for Wayfair, targeting a price of $65.

- An analyst from Deutsche Bank has decided to maintain their Buy rating on Wayfair, which currently sits at a price target of $79.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.