Shenzhen Mason Technologies Co.,Ltd (SZSE:002654) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 42% in the last year.

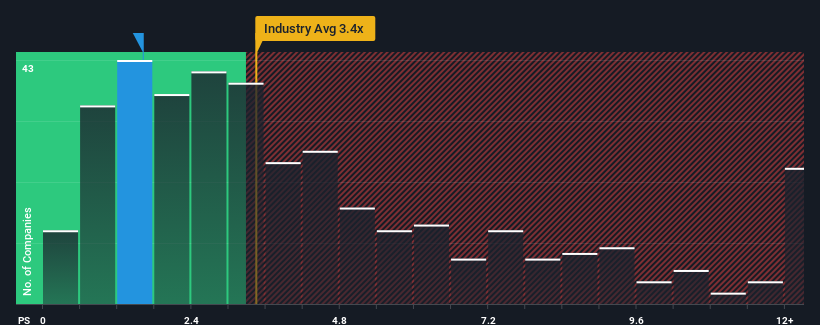

After such a large drop in price, Shenzhen Mason TechnologiesLtd may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.6x, considering almost half of all companies in the Electronic industry in China have P/S ratios greater than 3.4x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Shenzhen Mason TechnologiesLtd's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Shenzhen Mason TechnologiesLtd has been doing very well. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shenzhen Mason TechnologiesLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shenzhen Mason TechnologiesLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 44%. Revenue has also lifted 19% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 23% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Shenzhen Mason TechnologiesLtd's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Shenzhen Mason TechnologiesLtd's P/S

Shenzhen Mason TechnologiesLtd's recently weak share price has pulled its P/S back below other Electronic companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

In line with expectations, Shenzhen Mason TechnologiesLtd maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Shenzhen Mason TechnologiesLtd with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Shenzhen Mason TechnologiesLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.