The Sichuan Furong Technology Co., Ltd. (SHSE:603327) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 32%, which is great even in a bull market.

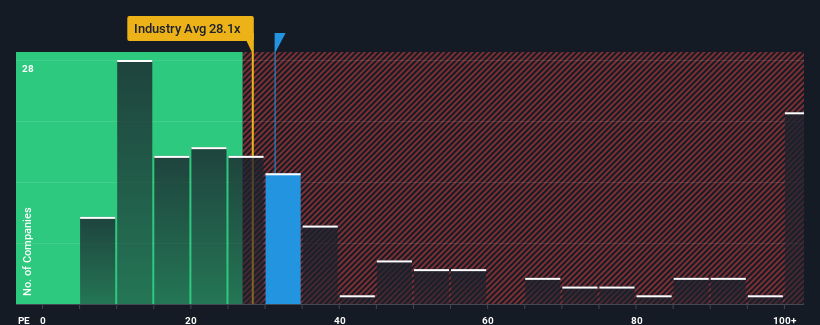

Even after such a large drop in price, it's still not a stretch to say that Sichuan Furong Technology's price-to-earnings (or "P/E") ratio of 31.2x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 29x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Sichuan Furong Technology could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

How Is Sichuan Furong Technology's Growth Trending?

Sichuan Furong Technology's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 23%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 32% as estimated by the dual analysts watching the company. That's shaping up to be similar to the 35% growth forecast for the broader market.

In light of this, it's understandable that Sichuan Furong Technology's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Sichuan Furong Technology's P/E?

With its share price falling into a hole, the P/E for Sichuan Furong Technology looks quite average now. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Sichuan Furong Technology maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Sichuan Furong Technology (including 2 which can't be ignored).

You might be able to find a better investment than Sichuan Furong Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.