Financial giants have made a conspicuous bearish move on Occidental Petroleum. Our analysis of options history for Occidental Petroleum (NYSE:OXY) revealed 26 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 53% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $601,690, and 18 were calls, valued at $1,442,498.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $77.5 for Occidental Petroleum over the last 3 months.

Analyzing Volume & Open Interest

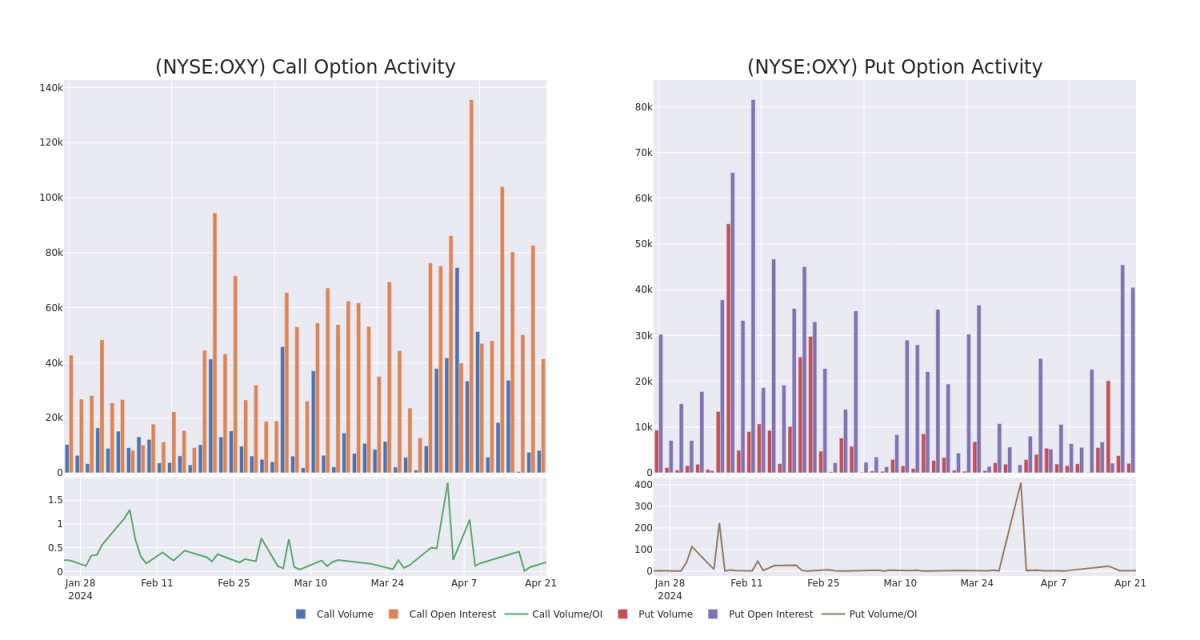

In today's trading context, the average open interest for options of Occidental Petroleum stands at 4822.59, with a total volume reaching 10,238.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Occidental Petroleum, situated within the strike price corridor from $55.0 to $77.5, throughout the last 30 days.

Occidental Petroleum 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | CALL | SWEEP | BEARISH | 01/17/25 | $13.2 | $13.1 | $13.11 | $57.50 | $302.7K | 1.0K | 231 |

| OXY | PUT | TRADE | BULLISH | 05/17/24 | $2.75 | $2.7 | $2.7 | $67.50 | $229.5K | 3.9K | 0 |

| OXY | CALL | SWEEP | BULLISH | 07/19/24 | $3.3 | $3.25 | $3.3 | $67.50 | $165.0K | 3.0K | 633 |

| OXY | CALL | TRADE | BULLISH | 06/21/24 | $1.63 | $1.61 | $1.63 | $70.00 | $161.6K | 9.9K | 2.4K |

| OXY | CALL | TRADE | NEUTRAL | 06/21/24 | $2.95 | $2.93 | $2.94 | $67.50 | $147.0K | 14.7K | 120 |

About Occidental Petroleum

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

In light of the recent options history for Occidental Petroleum, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Occidental Petroleum

- With a volume of 4,297,628, the price of OXY is up 1.35% at $67.53.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 15 days.

What Analysts Are Saying About Occidental Petroleum

In the last month, 5 experts released ratings on this stock with an average target price of $76.0.

- Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Occidental Petroleum with a target price of $84.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Occidental Petroleum with a target price of $72.

- Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for Occidental Petroleum, targeting a price of $70.

- Reflecting concerns, an analyst from Barclays lowers its rating to Equal-Weight with a new price target of $73.

- An analyst from Susquehanna persists with their Positive rating on Occidental Petroleum, maintaining a target price of $81.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Occidental Petroleum with Benzinga Pro for real-time alerts.