Recently, 37 Mutual Entertainment released its 2023 annual report and performance forecast for the first quarter of 2024. According to the announcement, the company achieved operating income of 16.547 billion yuan and net profit to mother of 2,659 billion yuan in 2023; revenue is expected to increase by more than 25% year-on-year in the first quarter of 2024, and net profit to mother is estimated to be 600 million yuan to 650 million yuan, an increase of 30%-40% over the previous month.

It is particularly worth mentioning that37 Mutual Entertainment alsoIt said that it is proposed to increase the frequency of dividends from once every six months to once every quarter, with no more than 500 million yuan per instalment, and no more than 1.5 billion yuan in total dividends, becomeThe first A-share listed company to propose a continuous quarterly dividend plan.

With quarterly distribution and dividends four times a year, this move immediately attracted great attention and discussion in the market. For investors, does the background portend some new opportunities?

1. High dividends+executivesIncrease holdings+Company buyback, real money shows long-term confidence

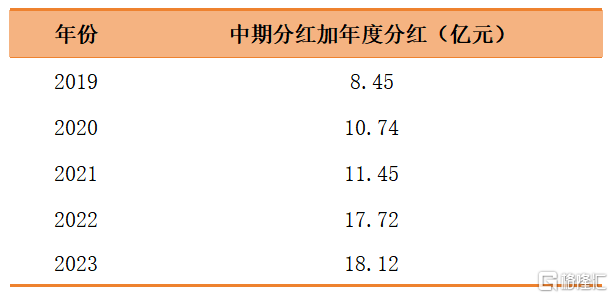

Judging from historical data,37 Mutual Entertainment has been stable for many yearsMaintains dividends twice a year,The dividend ratio showed a clear upward trendIt shows the sustainability and growth of the company's profitability.

According to the 2023 profit distribution plan, the company plans to distribute cash dividends of 3.70 yuan (tax included) to all shareholders for every 10 shares. The estimated 2023 dividend plan amount is 820 million yuan. In addition to the previous dividend amount of 992 million yuan for the first half year of 2023, total dividends for the full year of 2023 account for 68% of net profit for the full year. The cumulative dividend amount for the past five fiscal years is estimated to reach 6.648 billion yuan.

According to Choice data, the current dividend rate of 37 Entertainment (in the past 12 months) is about 5.4%, ranking third in the gaming sector (CITIC Level 3 Industry Index classification), which is higher than the industry average.

The stable dividend mechanism for many years is not only a promise to shareholders, but also a reflection of 37 Entertainment's profitability and financial soundness. This kindAn active shareholder return strategy helps strengthen the capital market's confidence in the company and enhance the company's market stability.

Furthermore,Institutional investors generally attach importance to the company's dividend policy.The continuous quarterly dividend plan proposed by 37 Mutual Entertainment this time will further attract the attention of long-term capital and enhance the market's recognition of the company, thereby providing strong support for the company's valuation increase and long-term development.

Through this dividend policy, 37 Mutual Entertainment not only demonstrated its respect for shareholders' interests, but also conveyed to the market its sense of responsibility as a leading enterprise in the industry and firm confidence in future development. As the company continues to expand its market share and enhance its profitability, it can be expected that 37 Mutual Entertainment will adopt a high-frequency dividend policy to create greater value for shareholders.

Furthermore, since the end of December last year, 37 Mutual Entertainment's executives have begun to increase their holdings. The actual controller, controlling shareholder, chairman Li Weiwei, general manager Xu Zhigao, and vice chairman Zeng Kaitian have successively completed share increases with their own funds, and the total transaction amount has exceeded 85 million yuan.

It is worth mentioning that at the end of 2023, the company also announced the use of 100 million yuan to 200 million yuan of its own capital to repurchase shares. The repurchase of shares will then be used to cancel and reduce registered capital, and on January 15, 2024, the shares were repurchased for the first time through a dedicated stock repurchase securities account through centralized bidding transactions. The number of shares repurchased was about 5.6266 million shares, accounting for 0.25% of the company's current total share capital, of which the highest transaction price was 18.13 yuan/share, and the total payment amount was about 101 million yuan.

ThisseriesThe initiative highlights executives' recognition of the company's valueversusConfidence in long-term healthy developmentwhileIt can also play a role in stabilizing the stock price and preventing the company's stock priceToo low anddeviating from actual value,Safeguarding shareholders' rights.

2. The trend of industry recovery is gradually showing, and we are ready to start enriching new travel reserves

As an investor, to judge the investment value of 37 Mutual Entertainment, the most fundamental thing is to return to industry trends, company fundamentals, and subsequent growth points. The reasons why 37 Mutual Entertainment proposed continuous quarterly dividends, a reduction in registered capital by company buybacks and cancellations, and large repurchases by many executives to increase their holdings are also based on these two points.

As game version distribution returned to normal in 2023, the total number of new game versions released throughout the year was 1,075, an increase of 109.96% over the previous year, doubling. This is also because after 5 years of continuous decline, the number of editions distributed once again showed an upward trend.

Various signs indicate that the game industry is gradually picking up and is expected to enterProfit recovery cycle,2024orwillcanResume a good growth rate of performance.

firmsAdhere to the long-term operation of existing gamesThrough strategies such as IP linkage, the vitality of various games such as “Contra Continent: Soul Master Showdown”, “Puzzles & Survival”, “Call Me the Treasurer”, and “Little Ant Country” has been extended.

lengthen the perspective,37 Mutual EntertainmentCurrently, there are more products in stock than40 modelsIt provided a strong impetus for the company's subsequent performance growth.In order to explore user needs and market growth points, 37 Mutual Entertainment continues to break through the operating game category. On the basis of the four cornerstone categories of MMORPG, SLG, cards, and simulated management, it has pioneered lightweight game types such as RPG, casual puzzle, etc., and has built the company's continuous and rich product matrix thanks to the successful practice of the company's “self-development+agent” model.

3. Summary

Overall, a series of actions such as continuous high dividends, increased dividend frequency, increased executive holdings, and company buybacks all showed 37 Mutual Entertainment's firm confidence in its continued growth in the future, and sent a positive signal to the market.

Against the backdrop of increasing certainty in the development of the game industry, 37 Mutual Entertainment has outlined a clear growth path with its rich game product reserves.

In particular, under Xianfa's leading edge in exploring AI applications, 37 Mutual Entertainment has successfully applied AI technology to the company's various businesses, creating a digital intelligence product matrix that runs through the entire R&D process, including “Zeus,” “Athena,” “Ares,” and “Cupid” on the R&D side, and promotes nine major mid-stage products such as “Turing,” “Quantum,” “Tianji,” and “Easy View” on the operating side. At the same time, 37 Mutual Entertainment has developed an internal AI agent platform that upgrades autonomous decision-making functions for various digital intelligent products and enhances collaborative office efficiency, significantly improving the level of industrialization of the game R&D pipeline and the overall operation efficiency of the enterprise.

Currently, 37 Interactive Entertainment's generative AI technology has been maturely applied to modules such as 2D drawing, intelligent customer service, localized translation, copywriting production, and collaborative office, greatly improving human efficiency. For example, in terms of art design, the company's R&D and distribution business lines together produce more than 280,000 AI-2D drawings per month; in the process of creating original characters, the company can save an average of 60% to 80% of man-hours by implementing the new process of AI to produce 2D art.

These innovative practices also indicate the potential for 377 Mutual Entertainment's technology-driven development. As the company continues to deepen the application of technology and optimize its game product line, it may be expected to usher in a new round of valuation and reshaping opportunities.