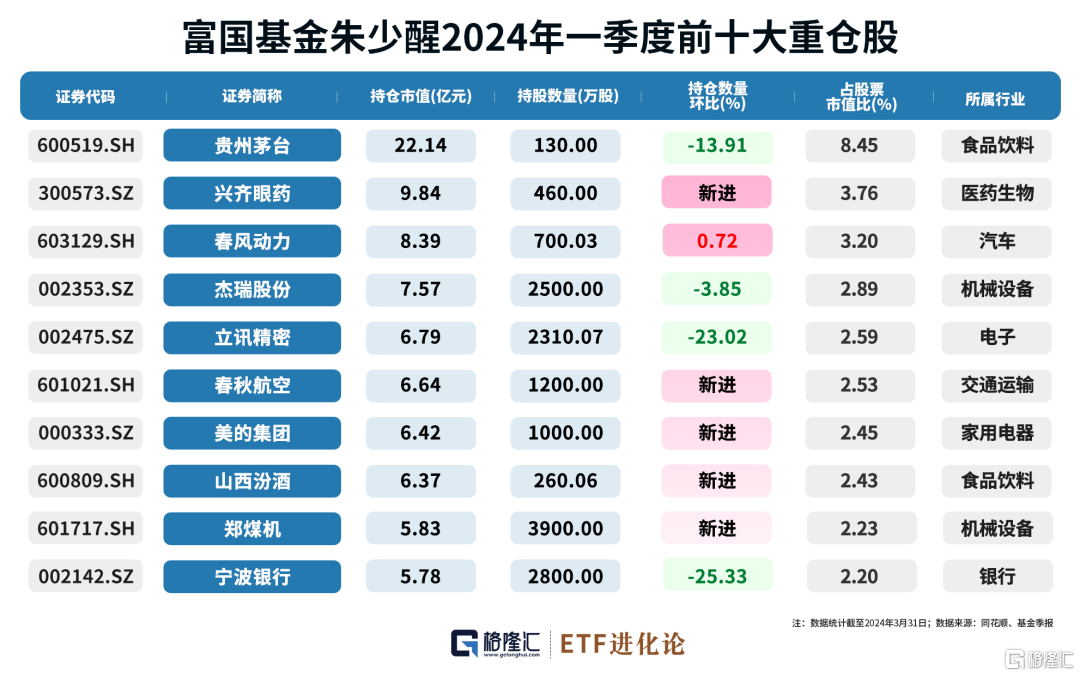

Zhu Shaoxing's latest management scale of Wells Fargo Foundation is 27.7 billion yuan, a slight decrease from 28.3 billion yuan at the end of last year.

Zhu Shaoxing made major adjustments to heavy stocks in the first quarter, replacing 5 of the top ten heavy-held stocks. Xingqi Pharmaceutical, Spring Airlines, Midea Group, Shanxi Fenjiu, and Zheng Meiji entered the top ten major stocks; Sinocera Materials, Hualu Hengsheng, Ruifeng New Materials, Mindray Healthcare, and Jinyu Medical withdrew from the top ten.

1. The Shanghai and Shenzhen 300 Index rose 3.10% in the first quarter, and the GEM Index fell 3.87%. The real economy continued its recovery trend in the first quarter. Combined with leap month factors, the GDP growth rate exceeded market expectations in terms of data. Monetary policy remains relaxed, fiscal policy shows more positive signs, and there are no obvious signs of a recovery in corporate investment confidence. Investors' risk appetite rebounded slightly. The new real estate data has yet to stabilize, but there are signs of a recovery in second-hand housing transactions. The dividend value style performed well in the first quarter. Investors' risk appetite remains very low.

2. Judging from microscopic research, the recovery in consumption and real estate in the first quarter was still not very strong, requiring more patience and observation. But we believe the positive elements will eventually come into play, even if there are repetitions in the middle. We hope that we will not be too limited to short-term interpretations of all kinds of unfavorable data. Currently, the overall valuation of the market is in a very attractive position over a long period of time, and the equity market is in a good risk-return range. In terms of a longer period of time, we believe that the many difficulties we are currently facing will eventually find a way to resolve them. It is quite appropriate for investors to currently choose the expected level of return corresponding to market fluctuations. In the future, we will continue to work to find value in high-quality stocks.

3. Under the current valuation, the dividend value style can still find better investment opportunities, but the quality growth style also has many investment opportunities.We do not have the reliable ability to accurately predict short-term trends in the market. Instead, we focus our energy on patiently collecting outstanding companies with great prospects and waiting for the value created by the company itself to be realized and market sentiment periodically returns at some point in the future. At the level of individual stock selection, the Fund prefers to invest in enterprises with good “corporate genes”, perfect corporate governance structures, and excellent management. We think such companies are more likely to create value for investors in the future. Sharing capital market benefits brought about by a company's own growth is the best way for growth funds to reap returns.

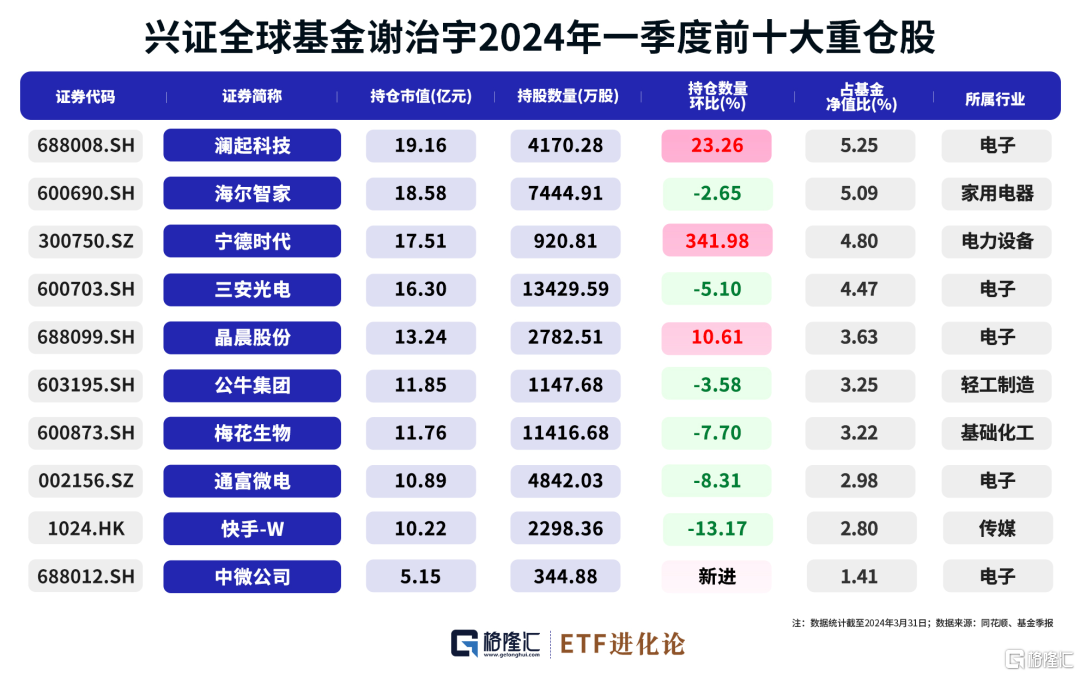

Xie Zhiyu of Xingzheng Global Fund's management scale at the end of the first quarter was about 36.9 billion yuan, down from 39.4 billion yuan at the end of last year.

Xie Zhiyu added Cang Lanqi Technology in the first quarter, Ningde Times and Jingchen shares, including significant increases in positions with Ningde Times; China and Micro entered the top ten new holdings; reduced holdings of Haier Smart Home and Sanan Optoelectronics, Bull Group, Meihua Biotech, and Tongfu Microelectronics.

Regarding the market's opinion, Xie Zhiyu said in a quarterly report:

1. The Shanghai Composite Index rose 2.23% in the first quarter of this year, and the GEM index fell 3.87%; the A-share index fluctuated greatly in the first quarter.

2. From a fundamental perspective, domestic real estate infrastructure is still sluggish, and export growth is picking up. Expectations of overseas Federal Reserve interest rate cuts are heating up, and the overall overseas economy continues to recover. Looking at various sectors: Resource products such as gold, copper and oil have risen, AI applications have continued to expand, intelligent driving has made significant phased progress both overseas and domestically, the low-altitude economy has begun to flourish in Shenzhen and other places, and trade-in continues to provide momentum for the economy.

3. Judging from the market style, attention to undervaluation and high dividends is still high, and developments in emerging fields are also worthy of attention.

4. The Fund maintained a high position during the reporting period, explored industrial chains related to artificial intelligence, intelligent driving, AI applications, pharmaceutical consumption, etc., and selected and arranged hardware and software companies with long-term competitiveness and broad application space. In the future, we will continue to explore the company's long-term growth value and continue to search for excellent companies with good investment and cost performance.