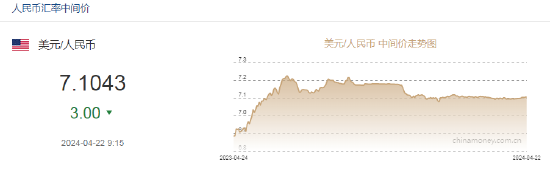

On April 22, the central price of RMB was 7.1043, an increase of 3 points. The median price for the previous trading day was 7.1046.

This week's highlights: The inflation index that the Federal Reserve is most concerned about will be released, and the Bank of Japan will discuss interest rates

This week, the US and Europe will release important economic data. The development of the situation in the Middle East is still a matter of concern for the market. The Bank of Japan will hold an interest rate meeting.

There are many highlights this week. The European and American Purchasing Managers' Index (PMI) for April will be released. The latest US gross domestic product (GDP) and personal consumption expenditure monthly rate (PCE) data may affect the outlook for monetary policy.

Meanwhile, the Bank of Japan will hold an interest rate meeting. After ending the negative interest rate cycle last month, the market currently expects July to be the time window for the next rate hike. However, the yen continued to fall. USD/JPY was once close to the level of 155.00, triggering strong intervention warnings from Japanese officials. On the eve of the policy meeting, Tokyo's March CPI will be announced, which may have some impact on future policy expectations.

China Gold: There is still a risk that the US dollar index will rise further in the short term

This week, the Federal Reserve will enter a quiet period before the May FOMC meeting. The situation in the Middle East, the US PMI, and PCE inflation data will be the focus of market attention. Since current US economic data still indicates that the Federal Reserve will cut interest rates later and interest rates on US bonds will rise, and the decline in risk assets such as the geographical situation and US stocks are also conducive to the continuation of the impact of risk aversion, we believe there is still a risk that the US dollar index will rise further in the short term.