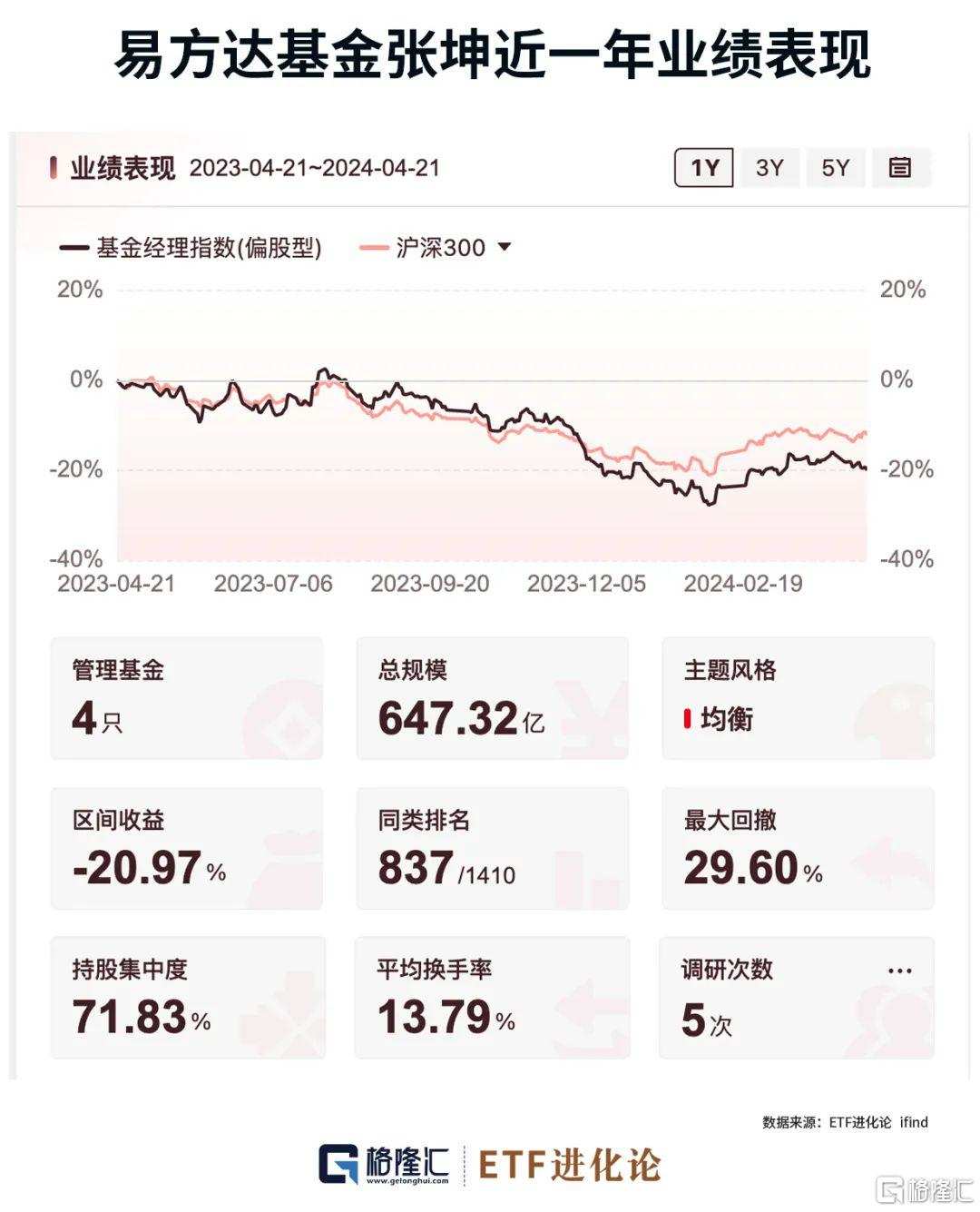

The latest trend of public equity firm Zhang Kun came to light. As of the end of the first quarter of 2024, Zhang Kun's management scale was about 64.732 billion yuan. Compared with 65.474 billion yuan at the end of 2023, his fund management scale was slightly reduced by 742 million yuan.

The 4 funds Zhang Kun manages are E-Fangda Blue Chip Select, E-Fangda Premium Select, E-Fangda Premium Enterprise Holdings for 3 years, and E-Fangda Asia Select. In terms of specific operations, the quarterly report shows that Zhang Kun's overall holdings remained stable, and the four funds he managed all had positions above 94% at the end of the first quarter. As stock prices changed, the ranking of the top ten heavy-held stocks was adjusted.

Zhang Kun's current largest product is E-Fangda Blue Chip Select. As of the end of the first quarter of 2024, the net asset value of the fund was 41,144 billion yuan, a slight decrease of 1.42% from 41,738 billion yuan at the end of 2023.

CNOOC promoted to the “number one heavy stock” selected by E-Fangda Blue Chips. CNOOC's stock price surged 39.38% in the first quarter. During the stock price increase, due to the limit that a single share position cannot exceed the 10% limit of the fund's net asset value, E-Fangda Blue Chips selected “passively” to reduce its holdings in CNOOC.

Asmack, Prada, and Samsonite entered the top ten largest positions in the first quarter of the first quarter.

Zhang Kun said in the quarterly report, “The Fund's stock position was basically stable in the first quarter, and the structure was adjusted to adjust the structure of the consumer and pharmaceutical industries. In terms of individual stocks, we still own high-quality companies with excellent business models, clear industry patterns, and strong competitiveness.”

Judging from the total holdings of Zhang Kun's products, Wuliangye, Luzhou Laojiao, Kweichow Moutai, China Merchants Bank, and Meituan were reduced in the first quarter. Among them, China Merchants Bank's holdings were greatly reduced; positions in Tencent Holdings and CNOOC were added; and Shanxi Fenjiu replaced Pharmaceutical and Biotech entered the top ten positions.

In the past two years, resource stocks represented by the coal, petroleum, and mining industries have risen, and high-dividend strategies have been sought after by the market. Funds have gained access to resource stocks all over the world, and high-performing funds have entered the resource sector. Zhang Kun put forward a different opinion on this. Zhang Kun stated:

1. Judging from the stock asset performance of long-term treasury bonds and bond-like bonds, the market's risk appetite has been reduced to a very low level. This is reflected in giving high weight to a static dividend rate level during pricing, and there are doubts about growth, especially the long-term growth of enterprises. Under the simplified model, between company A with 5% dividend rate +1% growth and company B with 3% dividend rate +8% growth, most of the market at this stage prefer to choose company A, and such companies have also attracted the allocation of a large number of fixed income funds.

2. If we review the long history of the capital market, an important reason why stocks have a higher long-term yield than bonds is that stocks have continuous growth, and the necessary condition for high-quality stocks is long-term continuous growth. Therefore, we believe that as stock investors, we should always give considerable weight to seek long-term growth.

3. Although in the period of high-quality development, the basic probability that the company will continue to grow rapidly is declining, we should never give up looking for moderate and continuous growth, and growth can also be obtained by searching in different segmented structures. However, growth must be of high quality; it must not be brought about by extensive management or burning of money; it should be obtained with a reasonable marginal return on investment. We will pay close attention to the company's ability to control costs and expenses, the ability to control working capital, the ability to generate free cash flow, the ability to allocate capital, and the will to return shareholders.

4. Furthermore, from a valuation perspective, in the past three years, due to continuous revisions in the market's long-term growth expectations, the valuation of Company A has increased, while the valuation of Company B has declined. We believe that judging from the absolute and relative levels of various valuation latitudes (price-earnings ratio, market capitalization/free cash flow), the current stage of market pricing makes Company B attractive for long-term high-quality growth.