The Dong Yi Ri Sheng Home Decoration Group Co.,Ltd. (SZSE:002713) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 41% in that time.

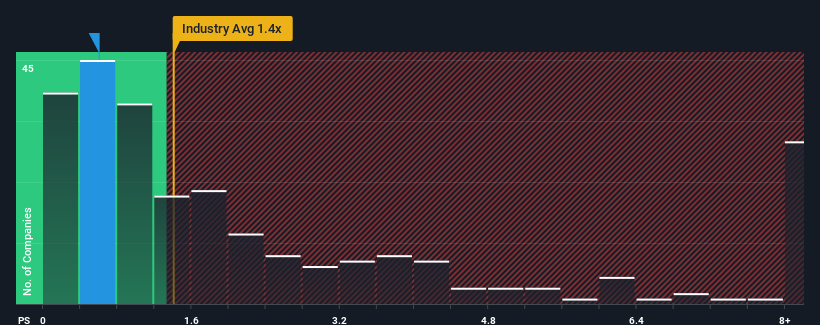

After such a large drop in price, Dong Yi Ri Sheng Home Decoration GroupLtd may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Consumer Services industry in China have P/S ratios greater than 3.5x and even P/S higher than 9x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

What Does Dong Yi Ri Sheng Home Decoration GroupLtd's P/S Mean For Shareholders?

Dong Yi Ri Sheng Home Decoration GroupLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Dong Yi Ri Sheng Home Decoration GroupLtd will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Dong Yi Ri Sheng Home Decoration GroupLtd?

The only time you'd be truly comfortable seeing a P/S as depressed as Dong Yi Ri Sheng Home Decoration GroupLtd's is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 46% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 24%, which is noticeably less attractive.

With this information, we find it odd that Dong Yi Ri Sheng Home Decoration GroupLtd is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Dong Yi Ri Sheng Home Decoration GroupLtd's P/S?

Having almost fallen off a cliff, Dong Yi Ri Sheng Home Decoration GroupLtd's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Dong Yi Ri Sheng Home Decoration GroupLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Dong Yi Ri Sheng Home Decoration GroupLtd with six simple checks.

If these risks are making you reconsider your opinion on Dong Yi Ri Sheng Home Decoration GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.