To the annoyance of some shareholders, Viva Biotech Holdings (HKG:1873) shares are down a considerable 34% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 74% loss during that time.

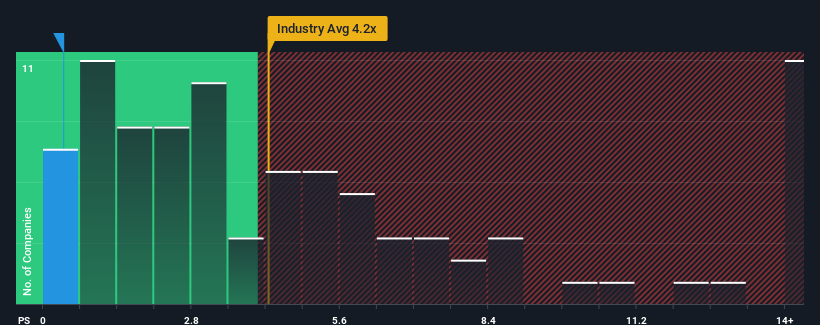

After such a large drop in price, Viva Biotech Holdings may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Life Sciences industry in Hong Kong have P/S ratios greater than 3x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

What Does Viva Biotech Holdings' P/S Mean For Shareholders?

For example, consider that Viva Biotech Holdings' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Viva Biotech Holdings will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Viva Biotech Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Viva Biotech Holdings' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.4%. Still, the latest three year period has seen an excellent 209% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 19% shows it's noticeably more attractive.

With this information, we find it odd that Viva Biotech Holdings is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Shares in Viva Biotech Holdings have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Viva Biotech Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Viva Biotech Holdings (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.