To the annoyance of some shareholders, Chongqing Sansheng Industrial Co.,Ltd. (SZSE:002742) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

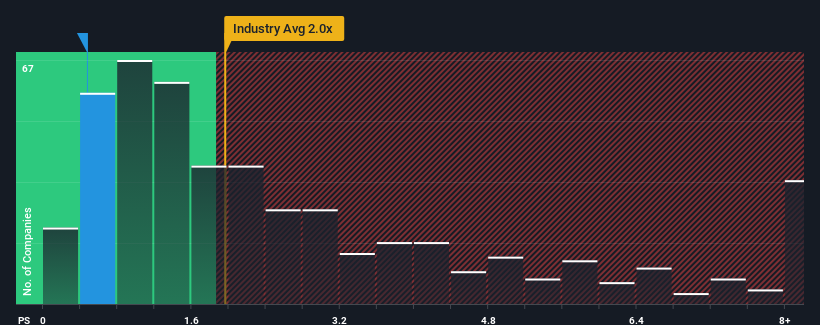

After such a large drop in price, Chongqing Sansheng IndustrialLtd may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Chemicals industry in China have P/S ratios greater than 2x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Chongqing Sansheng IndustrialLtd Performed Recently?

Revenue has risen at a steady rate over the last year for Chongqing Sansheng IndustrialLtd, which is generally not a bad outcome. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Chongqing Sansheng IndustrialLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Chongqing Sansheng IndustrialLtd's Revenue Growth Trending?

Chongqing Sansheng IndustrialLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 2.7% gain to the company's revenues. Still, lamentably revenue has fallen 21% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 21% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why Chongqing Sansheng IndustrialLtd's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Chongqing Sansheng IndustrialLtd's recently weak share price has pulled its P/S back below other Chemicals companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Chongqing Sansheng IndustrialLtd revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 2 warning signs we've spotted with Chongqing Sansheng IndustrialLtd.

If these risks are making you reconsider your opinion on Chongqing Sansheng IndustrialLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.