The Skyverse Technology Co., Ltd. (SHSE:688361) share price has fared very poorly over the last month, falling by a substantial 26%. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

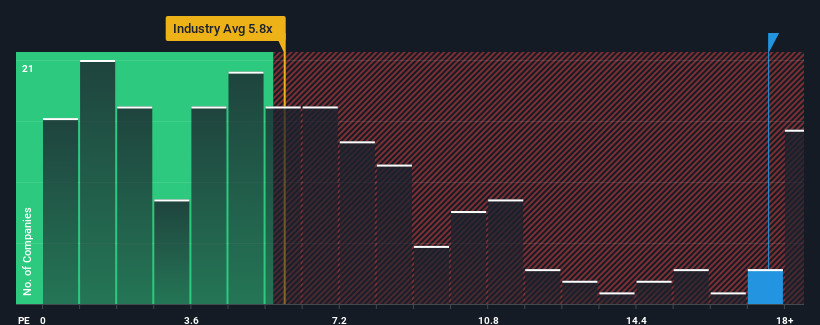

In spite of the heavy fall in price, Skyverse Technology's price-to-sales (or "P/S") ratio of 17.6x might still make it look like a strong sell right now compared to other companies in the Semiconductor industry in China, where around half of the companies have P/S ratios below 5.8x and even P/S below 2x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Skyverse Technology's Recent Performance Look Like?

Recent times have been advantageous for Skyverse Technology as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Skyverse Technology.How Is Skyverse Technology's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Skyverse Technology's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 75% gain to the company's top line. Pleasingly, revenue has also lifted 275% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 47% over the next year. That's shaping up to be materially higher than the 34% growth forecast for the broader industry.

In light of this, it's understandable that Skyverse Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Skyverse Technology's P/S?

A significant share price dive has done very little to deflate Skyverse Technology's very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Skyverse Technology shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Skyverse Technology with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.