Motorcomm Electronic Technology Co., Ltd. (SHSE:688515) shares have had a horrible month, losing 32% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 66% loss during that time.

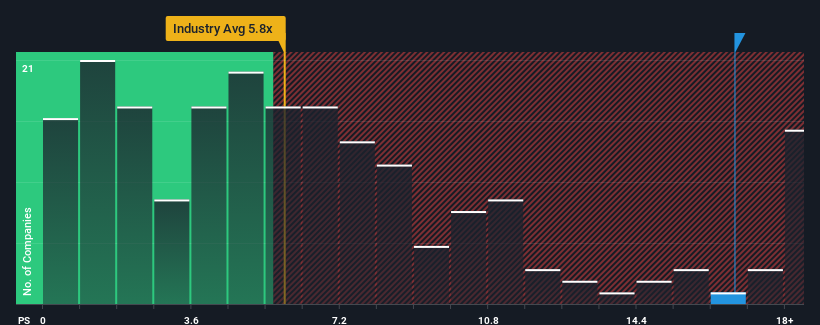

Although its price has dipped substantially, Motorcomm Electronic Technology may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 16.8x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 5.8x and even P/S lower than 2x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Motorcomm Electronic Technology's Recent Performance Look Like?

Motorcomm Electronic Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Motorcomm Electronic Technology.Is There Enough Revenue Growth Forecasted For Motorcomm Electronic Technology?

The only time you'd be truly comfortable seeing a P/S as steep as Motorcomm Electronic Technology's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 32%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Turning to the outlook, the next year should generate growth of 87% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 34% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Motorcomm Electronic Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Motorcomm Electronic Technology's shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Motorcomm Electronic Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Motorcomm Electronic Technology (of which 1 is concerning!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.