Inmyshow Digital Technology(Group)Co.,Ltd. (SHSE:600556) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 46% in that time.

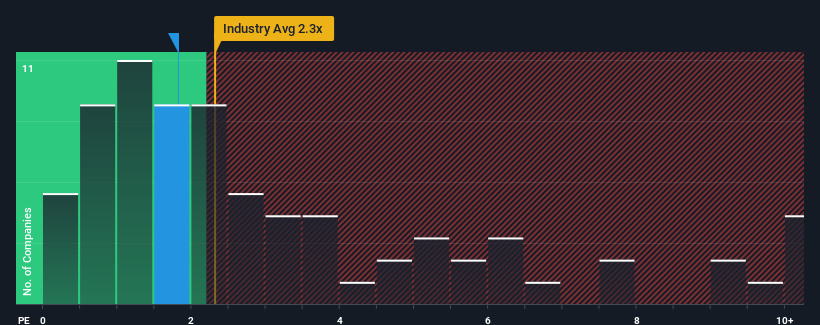

Although its price has dipped substantially, there still wouldn't be many who think Inmyshow Digital Technology(Group)Co.Ltd's price-to-sales (or "P/S") ratio of 1.8x is worth a mention when the median P/S in China's Media industry is similar at about 2.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Inmyshow Digital Technology(Group)Co.Ltd's P/S Mean For Shareholders?

Inmyshow Digital Technology(Group)Co.Ltd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Inmyshow Digital Technology(Group)Co.Ltd will help you uncover what's on the horizon.How Is Inmyshow Digital Technology(Group)Co.Ltd's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Inmyshow Digital Technology(Group)Co.Ltd's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 4.0% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 48% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 19% over the next year. Meanwhile, the rest of the industry is forecast to expand by 20%, which is not materially different.

With this information, we can see why Inmyshow Digital Technology(Group)Co.Ltd is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Inmyshow Digital Technology(Group)Co.Ltd's P/S?

Following Inmyshow Digital Technology(Group)Co.Ltd's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Inmyshow Digital Technology(Group)Co.Ltd maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Before you take the next step, you should know about the 2 warning signs for Inmyshow Digital Technology(Group)Co.Ltd that we have uncovered.

If these risks are making you reconsider your opinion on Inmyshow Digital Technology(Group)Co.Ltd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.